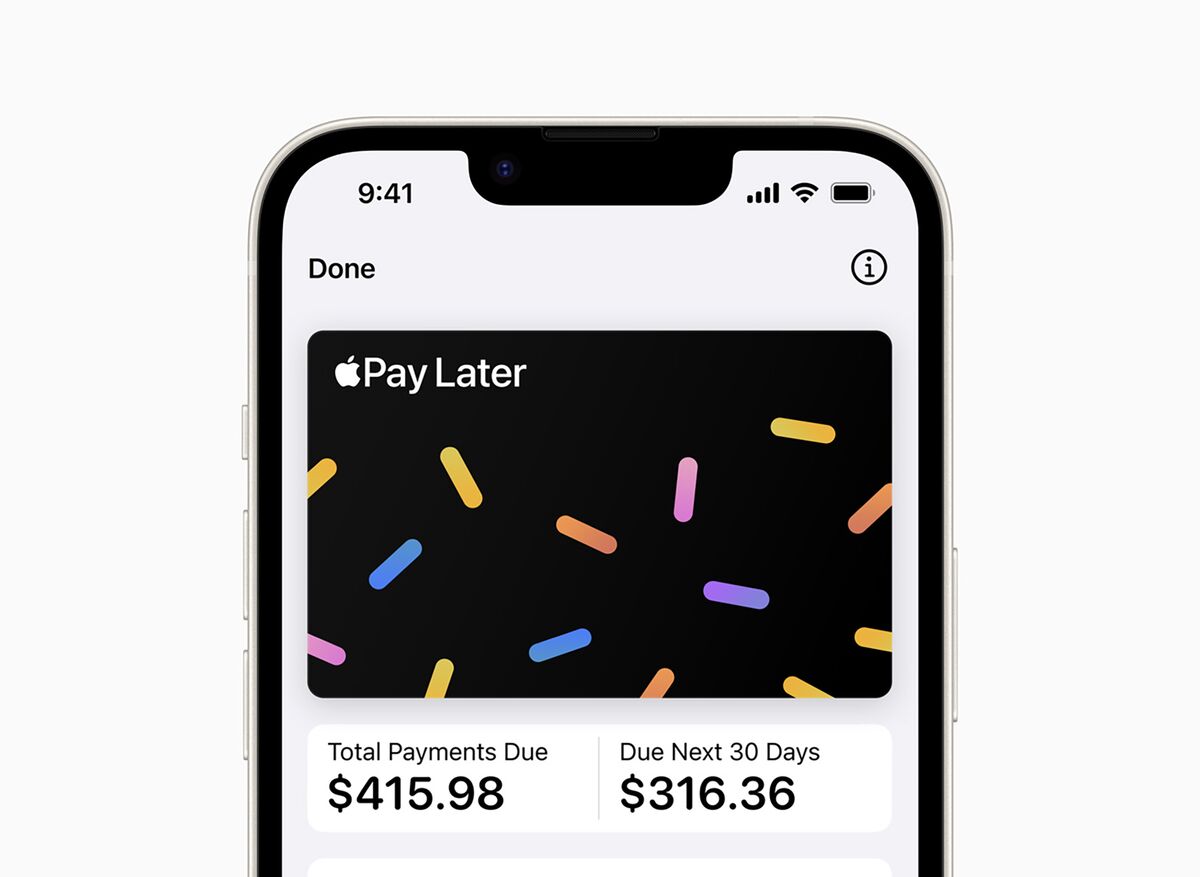

Apple Pay Later, a buy-now-pay-later service offered by Apple, is being discontinued. The service, which allowed users to split purchases into four equal payments over six weeks with no fees or interest, was only available in the United States. According to multiple reports, Apple will instead be offering installment loans through credit and debit cards and third-party lenders like Affirm when checking out with Apple Pay later this year. Users in the U.S. will also be able to apply for loans directly through Affirm during checkout.

Apple introduced Apple Pay Later at its Worldwide Developers Conference (WWDC) in 2022, and it became available to everyone in the U.S. in October 2023. The service was backed by Apple itself, while Goldman Sachs issued the Mastercard payment credential used to complete purchases with Apple Pay Later.

The reason for discontinuing Apple Pay Later is unclear, but it may be due to competition from other buy-now-pay-later services like Affirm and Klarna. These companies have been gaining popularity in recent years, offering similar services that allow users to pay for purchases over time without incurring interest charges.

Apple's focus now appears to be on expanding the availability of installment loans through Apple Pay. This will enable users to access flexible payment options when making purchases online or in-app with their iPhone or iPad, regardless of where they are located in the world. The new feature is expected to roll out later this year and will be available for any Apple Pay-enabled bank or issuer to integrate.

It's important to note that while installment loans can be a convenient way to manage expenses, they should be used responsibly. It's essential to consider your ability to repay the loan in full before applying, as failure to do so can result in additional fees and negative impacts on your credit score.