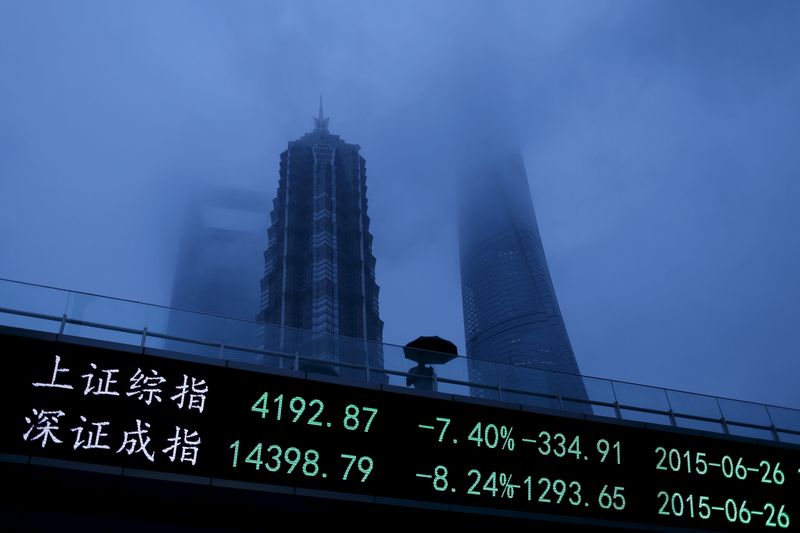

Asian stocks experienced mixed movements on Monday, May 13, 2024, as investors assessed economic data from China and awaited key U.S. inflation figures due later in the week. Chinese markets saw sharp swings following the release of April inflation data which showed a pickup in consumer spending but a continued contraction of the economy for the 19th consecutive month.

Chinese stocks were pressured by reports of potential U.S. trade tariffs against China, which could stymie economic growth and potentially spark renewed trade tensions with Washington.

Despite these concerns, Hong Kong's index rose 0.5% due to a rally in property stocks, while Japan's index shed 0.1%, South Korea's KOSPI fell 0.2%, and India's NSE Nifty futures pointed to a muted open amid increased volatility during the country's general elections.

Major Asian earnings were also on tap for the week, including SoftBank Group Corp., Sony Corp., SMC Corp., Resona Holdings, Inc., and Asahi Group Holdings, Ltd. in Japan; and Hindustan Aeronautics Ltd, Tata Steel Ltd, and Zomato Ltd in India.

Chinese inflation data showed that consumer prices rose 0.3% year-on-year in April, signaling some strength in spending despite the ongoing economic contraction. However, producer prices fell 2.5% year-on-year, indicating continued deflationary pressures.

Reports of potential U.S. trade tariffs against China could potentially stymie economic growth and spark renewed trade tensions with Washington.

Hong Kong's property sector received a boost as several major Chinese cities relaxed restrictions on home buying over the past week, leading to a rally in property stocks.

Regional markets were also bracing for earnings reports from several key companies this week, including China's biggest technology companies such as Baidu Inc., Alibaba Group Holding Ltd., and Tencent Holdings Ltd.

Investors will be closely watching U.S. inflation data due later in the week, which is expected to factor into U.S. interest rates.