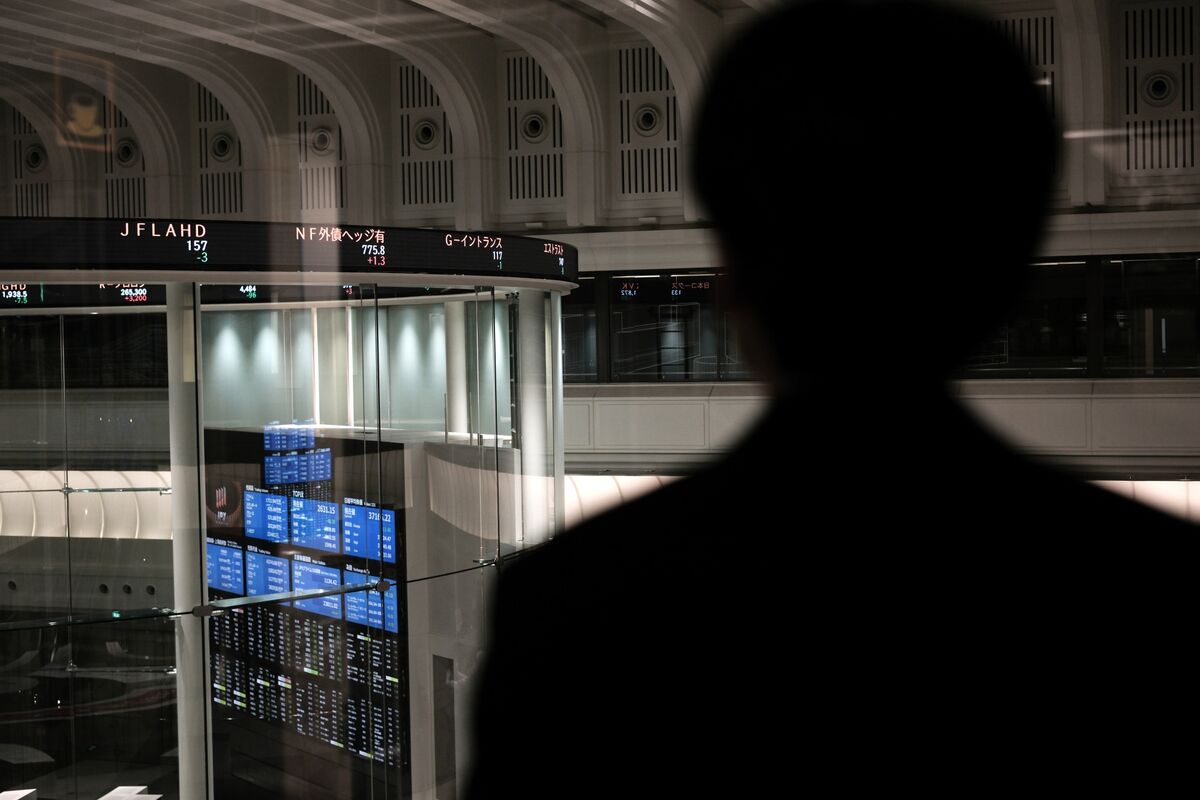

Asian stocks rose on Monday, May 27, with the Japanese Nikkei 225 and Shanghai Composite index setting new records, as investors hoped for interest rate cuts from major central banks to ease inflation pressures. The S&P 500 rebounded after a two-day slide and the Nasdaq 100 hit a fresh all-time high, led by gains in Nvidia Corp. and Apple Inc.

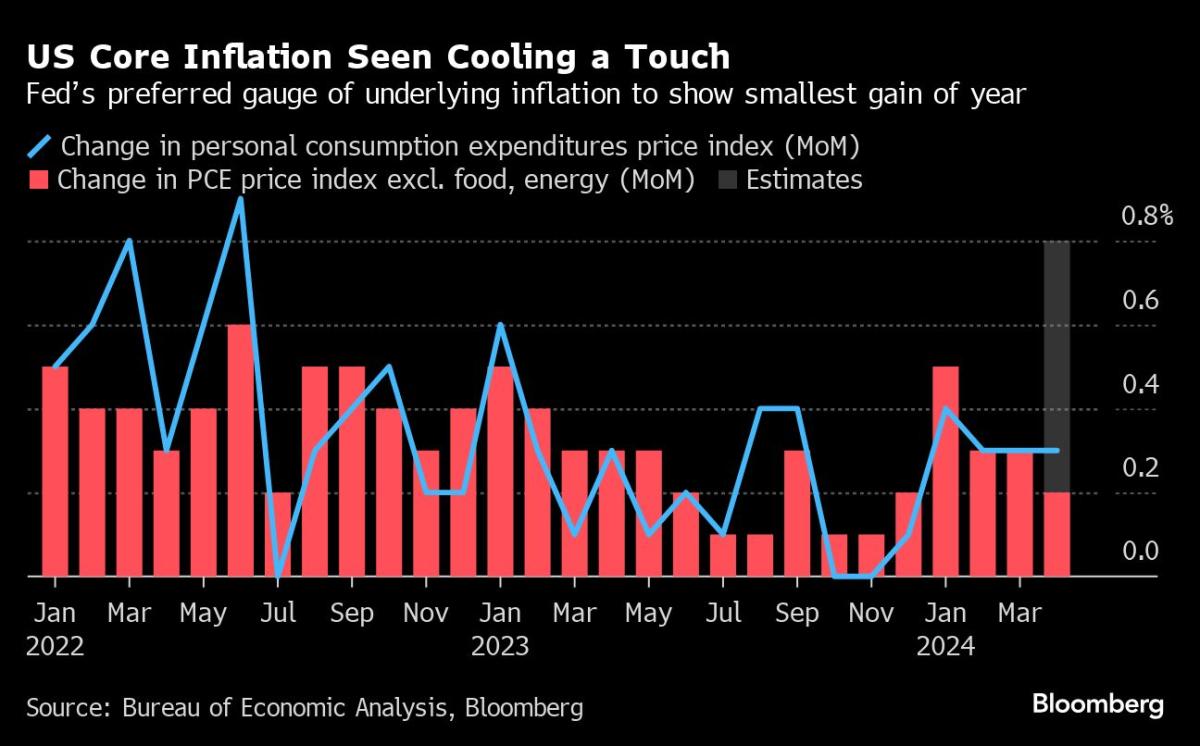

Bank of Japan Deputy Governor Shinichi Uchida stated that the end of deflation was in sight, boosting investor sentiment towards Asian markets. The Federal Reserve is widely expected to cut interest rates this year due to cooling inflation, with US inflation data due this week likely indicating easing price pressure.

The Australian dollar, euro, and yen strengthened against the greenback as investors sought safer assets amid global economic uncertainty. In Hong Kong, Hang Seng slipped slightly.

MediaTek, a semiconductor company based in Taiwan, jumped 8.4% after reporting strong earnings.

Global investors are also keeping an eye on developments in the European Central Bank and other central banks for signs of rate cuts to support their economies. The IMF is holding discussions with Ukrainian authorities to review economic policies as the country seeks to unlock the next tranche of $2.2 billion in aid.

Investors are also monitoring company earnings reports, US officials' statements, and geopolitical developments for further market direction.