Approximately 33.9 million shares were sold, leaving Berkshire with approximately 999 million shares remaining

Berkshire Hathaway sold $1.48 billion worth of Bank of America shares

Buffett began investing in Bank of America in 2011 and has shown faith in its future growth potential

Berkshire Hathaway, the multinational conglomerate led by Warren Buffett, sold approximately $1.48 billion worth of Bank of America shares in recent transactions, according to multiple reports. The exact number of shares sold varied slightly between sources but all agreed that Berkshire remains one of Bank of America's largest shareholders.

As per the filings with the Securities and Exchange Commission (SEC), Berkshire Hathaway sold around 33.9 million shares in total, leaving it with approximately 999 million shares remaining. Buffett began investing in Bank of America back in 2011 when he purchased $5 billion of preferred stock and warrants to buy an additional 700 million common shares.

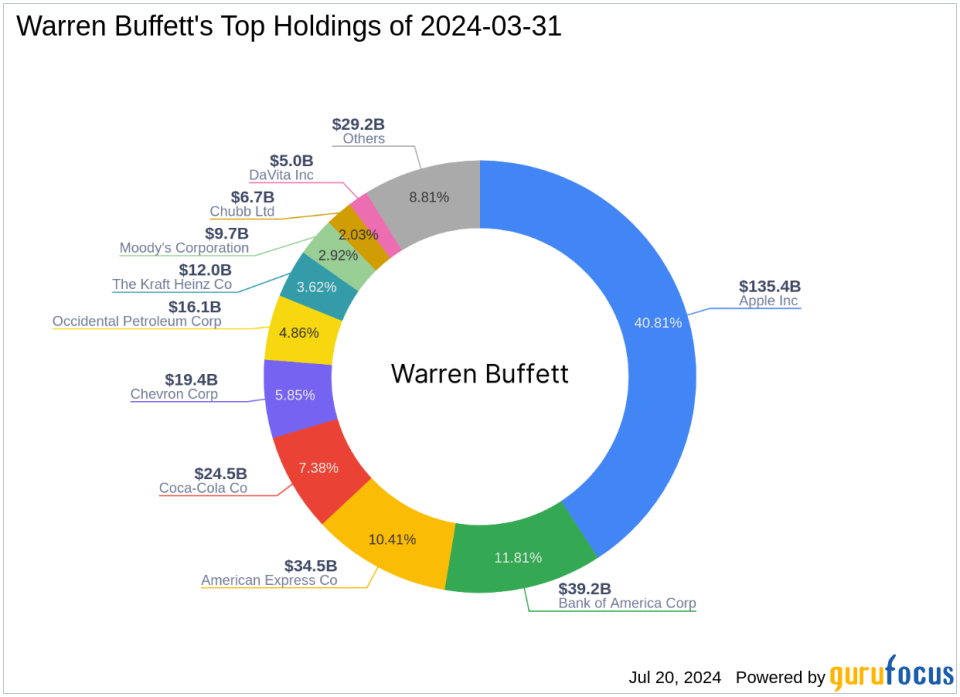

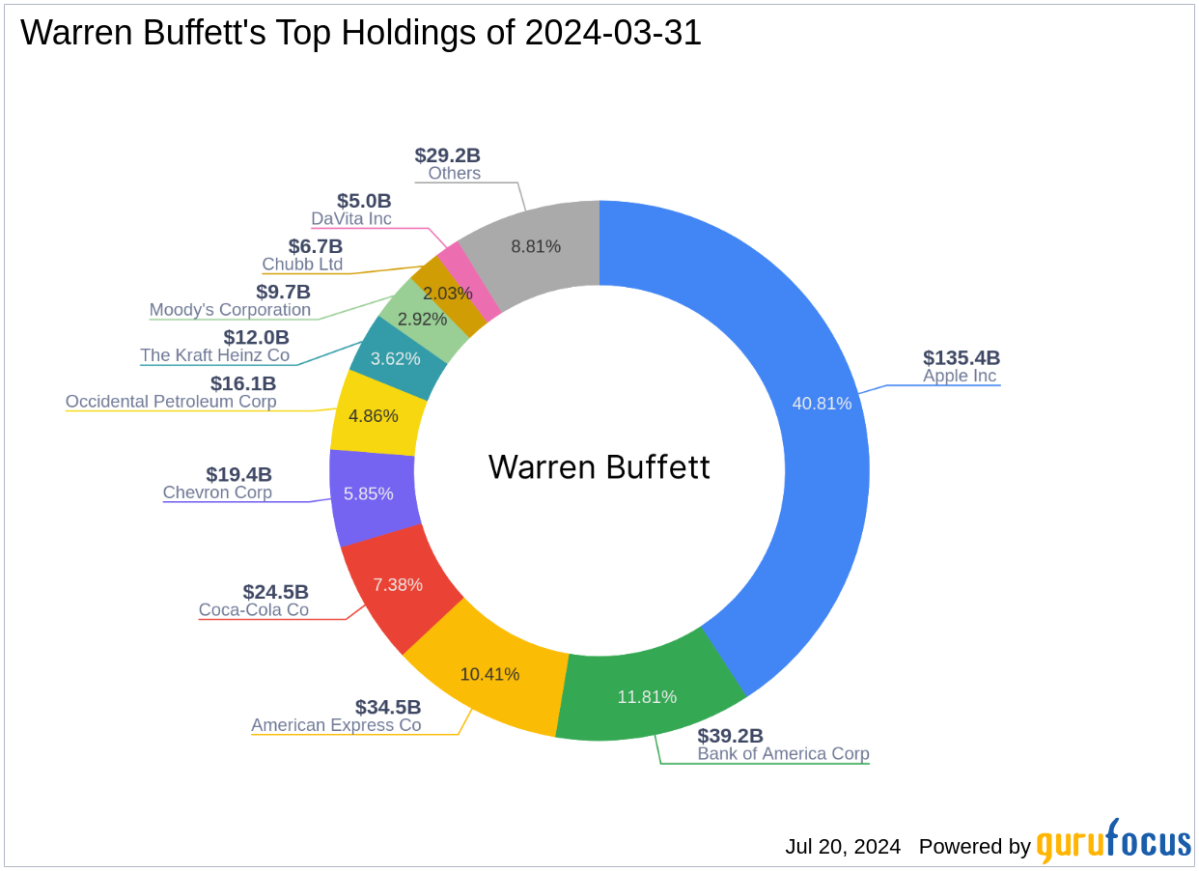

The reasons behind the sale are not clear but could be due to portfolio adjustments or Buffett's investment philosophy. The financial services sector, including consumer banking and global wealth management, has been a significant part of Berkshire Hathaway's holdings for years. With assets exceeding $3 trillion, the firm is known for its substantial insurance and other diverse business holdings.

Despite the sale, Buffett continues to show faith in Bank of America's fundamentals and future growth potential. The stock has risen 7.9% in the month to date, indicating a positive market sentiment towards the bank.

90%

Doubts

The reasons behind the sale are not clear

100%

What's This

The overall score is a weighted

number that takes

into

account conflict of interest, bias, deception and other practices that undermine

the

credibility of the source. It is calculated as:

(Site Conflicts Of Interest +

Author Conflicts Of Interest) / 2.0 * 0.2 +

ArticleBiasScore * 0.20 +

UniquePointsScore * 0.05 +

DeceptionScore * 0.20 +

ReadabilityScore * 0.05 +

FallacyScore * 0.20

Readability

95%

A score that takes into

consideration the content

for

flow,

interruptions with ads, and overt search engine optimization techniques that

makes

the

content hard to understand

Unique

Points

Warren Buffett's Berkshire Hathaway Inc. sold approximately 34 million shares of Bank of America Corp. Berkshire is one of the largest shareholders in Bank of America.

Accuracy Deception

(100%)

Fallacies

(100%)

Bias

(100%)

Site

Conflicts

Of

Interest (100%)

Author

Conflicts

Of

Interest (100%)

100%

What's This

The overall score is a weighted

number that takes

into

account conflict of interest, bias, deception and other practices that undermine

the

credibility of the source. It is calculated as:

(Site Conflicts Of Interest +

Author Conflicts Of Interest) / 2.0 * 0.2 +

ArticleBiasScore * 0.20 +

UniquePointsScore * 0.05 +

DeceptionScore * 0.20 +

ReadabilityScore * 0.05 +

FallacyScore * 0.20

Readability

95%

A score that takes into

consideration the content

for

flow,

interruptions with ads, and overt search engine optimization techniques that

makes

the

content hard to understand

Unique

Points

Warren Buffett's firm sold 33,890,927 shares of Bank of America on July 19, 2024. Buffett's reduction in Bank of America stake aligns with his investment philosophy and need for portfolio balance. Bank of America represents a substantial 12.85% of Buffett's total portfolio.

Accuracy Deception

(100%)

Fallacies

(100%)

Bias

(100%)

Site

Conflicts

Of

Interest (100%)

Author

Conflicts

Of

Interest (100%)

100%

What's This

The overall score is a weighted

number that takes

into

account conflict of interest, bias, deception and other practices that undermine

the

credibility of the source. It is calculated as:

(Site Conflicts Of Interest +

Author Conflicts Of Interest) / 2.0 * 0.2 +

ArticleBiasScore * 0.20 +

UniquePointsScore * 0.05 +

DeceptionScore * 0.20 +

ReadabilityScore * 0.05 +

FallacyScore * 0.20

Readability

100%

A score that takes into

consideration the content

for

flow,

interruptions with ads, and overt search engine optimization techniques that

makes

the

content hard to understand

Unique

Points

Berkshire sold approximately 33.9 million shares of Bank of America for around $1.48 billion After the sale, Berkshire owned about 999 million Bank of America shares Berkshire began investing in Bank of America in 2011 with a purchase of $5 billion preferred stock and warrants to buy 700 million common shares

Accuracy Deception

(100%)

Fallacies

(100%)

Bias

(100%)

Site

Conflicts

Of

Interest (100%)

Author

Conflicts

Of

Interest (100%)

96%

What's This

The overall score is a weighted

number that takes

into

account conflict of interest, bias, deception and other practices that undermine

the

credibility of the source. It is calculated as:

(Site Conflicts Of Interest +

Author Conflicts Of Interest) / 2.0 * 0.2 +

ArticleBiasScore * 0.20 +

UniquePointsScore * 0.05 +

DeceptionScore * 0.20 +

ReadabilityScore * 0.05 +

FallacyScore * 0.20

Readability

70%

A score that takes into

consideration the content

for

flow,

interruptions with ads, and overt search engine optimization techniques that

makes

the

content hard to understand

Unique

Points

Berkshire Hathaway and Warren Buffett reported insider transactions in Bank of America Corp. stock to the SEC The transactions reduced Berkshire Hathaway’s indirectly owned Bank of America shares to about 999 million

Accuracy Deception

(100%)

Fallacies

(100%)

Bias

(100%)

Site

Conflicts

Of

Interest (100%)

Author

Conflicts

Of

Interest (100%)