The Chinese government has announced that the economy is stable and will continue to grow at a rate of 4.5% this year, despite concerns about the property sector and lackluster consumer spending. The Finance Ministry denied a report by Fitch Ratings that downgraded China's sovereign debt rating outlook, stating that deficits are under control and risks are manageable. However, Fitch forecasted that China's economy will expand at a 4.5% annual rate this year due to the downturn in the property sector and lackluster consumer spending.

China's Economy Stable Despite Concerns About Property Sector and Consumer Spending

Boston, Massachusetts United States of AmericaThe Chinese government has announced that the economy is stable and will continue to grow at a rate of 4.5% this year, despite concerns about the property sector and lackluster consumer spending.

The Finance Ministry denied a report by Fitch Ratings that downgraded China's sovereign debt rating outlook, stating that deficits are under control and risks are manageable.

Confidence

80%

Doubts

- It is not clear if there are any other factors that could affect the stability of the Chinese economy.

- The accuracy of Fitch Ratings' report on China's sovereign debt rating outlook should be verified.

Sources

67%

Hot inflation likely to delay interest rate cuts. Here's what to expect

ABC NEWS SITE NAMES Name: ABC News Site Names URL: https://abcnews.go.com/Politics/us-officially-blames-iran_106834435 ABC News Friday, 12 April 2024 00:06Unique Points

None Found At Time Of Publication

Accuracy

- The Federal Reserve had promised long-awaited interest rate cuts, but the economy has refused to cooperate and cast that financial relief into doubt.

- Fresh price data released on Wednesday marked the third consecutive month of firmer-than-expected inflation; while a blockbuster jobs report last week revealed that employers are hiring with gusto.

- Price increases have cooled dramatically from a peak of about 9%, but inflation has stalled in recent months, hovering more than a percentage point higher than the Federal Reserve's target rate of 2%.

- The Fed Funds rate remains between 5.25% and 5.5%, matching its highest level since 2001.

- Interest rate cuts would lower borrowing costs for consumers and businesses, potentially triggering a burst of economic activity through greater household spending and company investment.

Deception (30%)

The article is deceptive in several ways. Firstly, it presents the Federal Reserve's interest rate cuts as a source of solace for consumers when they are not happening due to high inflation rates. Secondly, it quotes economists who predict multiple rate cuts but also acknowledge that there is uncertainty about whether any will happen this year or at all.- The article quotes economists who predict multiple rate cuts but also acknowledge that there is uncertainty about whether any will happen this year or at all. This is deceptive because it presents the possibility of interest rate cuts as a certainty when in reality, there is no guarantee they will occur.

- The article presents the Federal Reserve's interest rate cuts as a source of solace for consumers when they are not happening due to high inflation rates. This is deceptive because it implies that the Fed has already made its decision and that interest rate cuts will happen soon, but in reality, there is uncertainty about whether any will happen this year or at all.

Fallacies (85%)

The article contains several fallacies. The author uses an appeal to authority by citing the Federal Reserve's plans for interest rate cuts and quotes from economists who are experts in their field. However, this does not necessarily mean that the Fed will follow through with its plans or that these experts have any insight into what is best for society as a whole. The author also uses inflammatory rhetoric by describing inflation as- The future is uncertain -- I wouldn't bet the farm,

Bias (85%)

The article discusses the possibility of interest rate cuts and how inflation is affecting this decision. The author quotes experts who suggest that multiple rate cuts are still possible but also acknowledges that there is uncertainty about whether they will happen. The language used in the article suggests a bias towards keeping rates high due to concerns about inflation, which could be seen as an attempt to downplay the potential benefits of lowering interest rates for consumers and businesses.- Fresh price data released on Wednesday marked the third consecutive month of firmer-than-expected inflation; while a blockbuster jobs report last week revealed that employers are hiring with gusto.

- Given the strength of the economy and progress on inflation so far, we have time to let the incoming data guide our decisions on policy

- That combination of elevated inflation and economic fortitude offers the Fed an opportunity to hold rates steady at highly elevated levels, since the central bank runs little immediate risk of triggering a downturn

- The economy has refused to cooperate

Site Conflicts Of Interest (100%)

None Found At Time Of Publication

Author Conflicts Of Interest (50%)

The author of the article has a conflict of interest on several topics related to the Federal Reserve and its policies. The Peterson Institute for International Economics is mentioned as having published research by Joseph Gagnon that supports lowering interest rates, which could benefit consumers who are struggling with high credit card and mortgage rates. However, this relationship between the author's employer and a policy position is not disclosed in the article.- The Peterson Institute for International Economics published research by Joseph Gagnon that supports lowering interest rates.

69%

The 'supercore' inflation measure shows Fed may have a real problem on its hands

CNBC News Brian Evans Wednesday, 10 April 2024 19:29Unique Points

None Found At Time Of Publication

Accuracy

- The supercore inflation reading is useful for the Federal Reserve as it excludes elevated housing inflation and not as good a measure of underlying prices.

- Fresh price data released on Wednesday marked the third consecutive month of firmer-than-expected inflation; while a blockbuster jobs report last week revealed that employers are hiring with gusto.

- The future is uncertain -- I wouldn't bet the farm, Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics and a former Federal Reserve official told ABC News.

- Some economists have retained expectations of a rate this summer citing progress made in the Fed's inflation fight over the past two years.

- The US election will begin to intrude with Fed decision making and some observers have retained expectations of a rate this summer, said Seema Shah, chief global strategist for principal asset management at investment firm Edelman Smithfield.

- China's deficit is at a moderate and reasonable level and risks are under control.

- The median for countries with an A+ rating is 3%, but China's average deficit-to-GDP ratio averaged at around 8.6% in the past year due to COVID-19 pandemic and tax relief measures, weaker property investments which eroded government capacity to collect revenue.

- The general government deficit is forecast to rise this year to 7.1% of its GDP, up from 5.8% in 2023.

Deception (80%)

The article is deceptive in several ways. Firstly, it presents the supercore inflation measure as a more accurate gauge of underlying prices than the overall CPI and core CPI measures. However, this is not true as all three measures are used to track different aspects of price changes within an economy. Secondly, the article quotes economists stating that elevated housing inflation is temporary and should be excluded from measuring underlying prices. This contradicts the fact that supercore inflation includes shelter and rent costs in its services reading, making it a more comprehensive measure than core CPI or overall CPI measures which exclude these costs. Thirdly, the article presents an ongoing problem with rising consumer price index (CPI) as evidence of a real problem for the Federal Reserve. However, this is not true as rising prices are often temporary and do not necessarily indicate long-term inflationary pressures.- Fed officials say it is useful in the current climate as they see elevated housing inflation as a temporary problem and not as good a measure of underlying prices.

- The supercore inflation measure shows Fed may have a real problem on its hands

Fallacies (75%)

The article contains several fallacies. The first is an appeal to authority when it quotes Fed officials stating that the supercore inflation reading is useful in the current climate as they see elevated housing inflation as a temporary problem and not as good a measure of underlying prices. This statement implies that these experts are infallible, which is false. Additionally, there are several instances where inflammatory rhetoric is used to describe the situation with supercore inflation, such as- Fed officials say it is useful in the current climate as they see elevated housing inflation as a temporary problem and not as good a measure of underlying prices.

- An ongoing problem CPI increased 3.5% year over year last month, above the Dow Jones estimate that called for 3.4%.

Bias (80%)

The article contains several examples of bias. Firstly, the author uses language that dehumanizes and demonizes those who hold a different view on inflation than him. For example, he says 'Fed officials say it is useful in the current climate as they see elevated housing inflation as a temporary problem'. This implies that anyone who disagrees with them is wrong or misguided. Secondly, the author uses language that portrays those holding a different view on inflation than him as extreme or unreasonable. For example, he says 'Fitzpatrick said if you take the readings of the last three months and annualize them, you're looking at a supercore inflation rate of more than 8%, far from the Federal Reserve's 2% goal'. This implies that anyone who disagrees with him is irrational or unrealistic. Thirdly, the author uses language that portrays those holding a different view on inflation than him as being in an open question for months to come. For example, he says 'At this point we're not seeing it'. This implies that anyone who disagrees with him is uncertain and unsure of what will happen next. Finally, the author uses language that portrays those holding a different view on inflation than him as being in an open question for months to come. For example, he says 'At this point we're not seeing it'. This implies that anyone who disagrees with him is uncertain and unsure of what will happen next.- At this point we're not seeing it

- Fed officials say it is useful in the current climate as they see elevated housing inflation as a temporary problem

- Fitzpatrick said if you take the readings of the last three months and annualize them, you're looking at a supercore inflation rate of more than 8%, far from the Federal Reserve's 2% goal.

Site Conflicts Of Interest (50%)

None Found At Time Of Publication

Author Conflicts Of Interest (50%)

None Found At Time Of Publication

61%

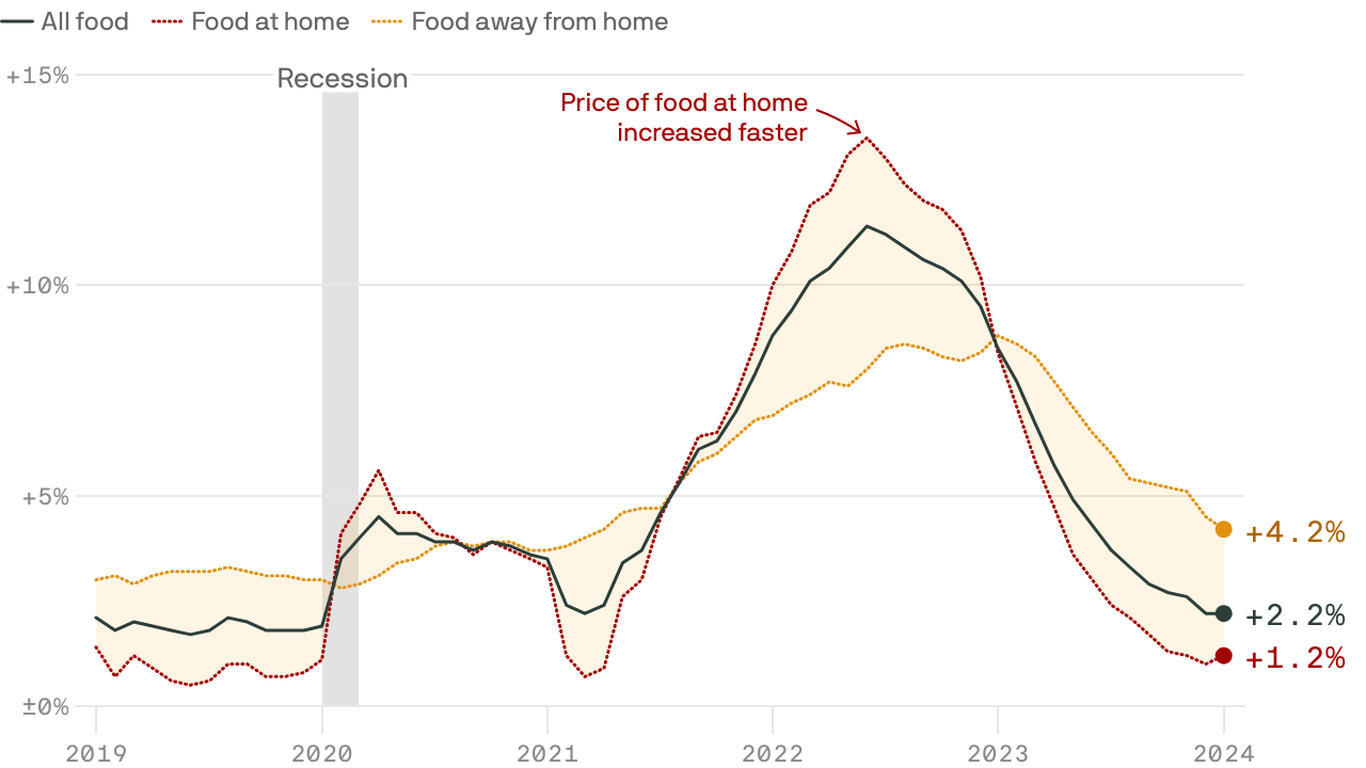

March's inflation data had good and bad news about food

Axios News Site: https://www.axios.com/2024/01-30/prior-authorization-gap-insurer-drug-decisions Deena Zaidi Wednesday, 10 April 2024 17:01Unique Points

- The consumer price index (CPI) index jumped by a faster-than-expected 3.5% last month, data showed on Wednesday.

- Food prices rose marginally, with the 'at home' category flat from the previous month.

- Three of the six major grocery store food group indexes dipped over the month, while three saw rising prices.

Accuracy

- The CPI index jumped by a faster-than-expected 3.5% last month, data showed on Wednesday.

Deception (30%)

The article is deceptive in several ways. Firstly, the author claims that eating at home is getting increasingly cheaper despite evidence to the contrary. Secondly, the author uses misleading language when describing food prices as 'moderating' when they are still rising year over year and only slightly lower than expected for March. Thirdly, the article presents a false dichotomy between grocery stores and restaurants by stating that opportunities at grocery stores are improving while there is high inflation in restaurants.- The author uses misleading language when describing food prices as 'moderating' when they are still rising year over year and only slightly lower than expected for March.

- The author claims that eating at home is getting increasingly cheaper despite evidence to the contrary.

Fallacies (75%)

The article contains several fallacies. Firstly, the author uses a dichotomous depiction of eating out and at home by stating that it is getting increasingly cheaper to eat at home while eating out is not. This statement oversimplifies the situation and ignores other factors such as income levels or availability of certain foods in different locations. Secondly, there are appeals to authority when Agriculture Secretary Tom Vilsack states that opportunities at grocery stores are improving significantly but restaurants still have high inflation. Lastly, inflammatory rhetoric is used by stating that egg prices after a bird flu outbreak will be watched.- Eating out and at home

- Opportunities at grocery stores

- Restaurants with high inflation

Bias (75%)

The article contains examples of both monetary and religious bias. The author uses language that depicts one side as extreme or unreasonable by stating that the consumer price index (CPI) jumped by a faster-than-expected 3.5% last month, data showed on Wednesday, which is portrayed as bad news despite being within expectations.- data showed on Wednesday.

- The CPI index jumped by a faster-than-expected 3.5% last month

Site Conflicts Of Interest (50%)

Deena Zaidi has a conflict of interest with the Bureau of Labor Statistics (BLS) as she is reporting on their March inflation data and specifically mentions that they reported at home category flat from the previous month. Additionally, Deena Zaidi reports on food prices which are also related to BLS's CPI index.- Deena Zaidi has a conflict of interest with the Bureau of Labor Statistics (BLS) as she is reporting on their March inflation data and specifically mentions that they reported at home category flat from the previous month. Additionally, Deena Zaidi reports on food prices which are also related to BLS's CPI index.

- Deena Zaidi has a financial tie with Axios Visuals as she is an author for their website.

Author Conflicts Of Interest (50%)

None Found At Time Of Publication

72%

China says economy 'stable,' rejects Fitch Ratings downgrade of its fiscal outlook

The Associated Press News Wednesday, 10 April 2024 08:43Unique Points

- China's Finance Ministry denounced a report by Fitch Ratings that kept its sovereign debt rated at A+ but downgraded its outlook to negative.

- Fitch forecasts that China's economy will expand at a 4.5% annual rate this year, down from 5.2% last year, due to downturn in the property sector and lackluster consumer spending.

Accuracy

- The Finance Ministry faulted Fitch's methods as it failed to take into account Beijing's moves toward appropriately intensifying and improving quality of government spending.

- Fresh price data released on Wednesday marked the third consecutive month of firmer-than-expected inflation; while a blockbuster jobs report last week revealed that employers are hiring with gusto.

- The supercore accelerated to a 4.8% pace year over year in March, the highest in 11 months.

- Shelter costs accounted for more than 60% of the increase in the core index and were responsible for pushing up rents.

Deception (30%)

The article is deceptive in several ways. Firstly, the Finance Ministry denounces Fitch Ratings' downgrade of China's fiscal outlook while simultaneously acknowledging that risks to public finances are rising and Beijing is working to resolve mounting local and regional government debts. This contradicts their claim that the deficit is at a moderate and reasonable level. Secondly, the Finance Ministry faults Fitch Ratings for failing to take into account Beijing's moves towards improving quality and efficiency of its government spending, but this does not explain why they kept China's A+ rating despite rising risks to public finances. Lastly, the article states that while slower growth is adding to the challenges of coping with heavy borrowing, Fitch kept China's A+ rating due to its large and diversified economy and vital role in global trade. However, this does not address why they downgraded their outlook for China's fiscal situation.- While slower growth is adding to the challenges of coping with heavy borrowing, Fitch kept China's A+ rating due to its large and diversified economy

- The Finance Ministry denounces a report by Fitch Ratings that kept its sovereign debt rated at A+ but downgraded its outlook to negative

- Fitch said risks are rising as Beijing works to resolve mounting local and regional government debts and shift away from heavy reliance on property industry

Fallacies (75%)

The article contains several fallacies. The first is an appeal to authority when the Finance Ministry denounces Fitch Ratings' report and faults its methods without providing any evidence or counterarguments. This is a form of ad hominem attack that does not address the substance of the argument. Additionally, there are multiple instances where inflammatory rhetoric is used, such as- The Finance Ministry said it was a 'pity' that Fitch had downgraded its sovereign debt.

- <br>Risks to China’s public finances are rising

- <br>Fitch forecasts that China’s economy will expand at a 4.5% annual rate this year, down from 5.2% last year

Bias (75%)

The article reports on Fitch Ratings downgrading China's fiscal outlook to negative. The Finance Ministry of China rejects this downgrade and argues that the deficit is at a moderate level and risks are under control. However, it also acknowledges that there are rising risks to public finances due to local government debt resolution work and shifting away from heavy reliance on property industry for economic growth. Fitch kept China's A+ rating due to its large and diversified economy, vital role in global trade, and huge foreign exchange reserves. The article also mentions that Moody's downgraded China's credit rating outlook in December 2021.- Fitch Ratings kept China’s A+ rating due to its large and diversified economy, vital role in global trade, and huge foreign exchange reserves.

Site Conflicts Of Interest (100%)

None Found At Time Of Publication

Author Conflicts Of Interest (0%)

None Found At Time Of Publication

70%

Fed rate cuts in doubt as rising housing costs stall progress on inflation

The Boston Globe Wednesday, 10 April 2024 00:00Unique Points

- The CPI increased at a 3.5 percent annual pace in March, up from 3.2 percent in the previous month.

- Shelter costs accounted for more than 60% of the increase in the core index and were responsible for pushing up rents.

Accuracy

No Contradictions at Time Of Publication

Deception (50%)

The article is deceptive in several ways. Firstly, it states that the inflation uptick has thrown into doubt widely held expectations that the Fed would roll back interest rates sharply this year. However, there are no quotes or references to any such expectations being widely held. Secondly, it claims that consumer and business borrowers will get little relief from lower interest rates if they do come about due to rising housing costs stalling progress on inflation. This is not true as the article itself acknowledges that a decline in the benchmark federal funds rate would keep the economy humming by making consumer mortgages, auto loans, and business loans cheaper. Lastly, it states that shelter accounts for more than 60% of the increase in core CPI but fails to mention that this is due to COVID-related supply constraints which have since been resolved. This misrepresents the situation.- The article claims that consumer and business borrowers will get little relief from lower interest rates if they do come about due to rising housing costs stalling progress on inflation. However, it fails to acknowledge that a decline in the benchmark federal funds rate would keep the economy humming by making consumer mortgages, auto loans, and business loans cheaper.

- The article states that shelter accounts for more than 60% of the increase in core CPI but fails to mention that this is due to COVID-related supply constraints which have since been resolved. This misrepresents the situation.

Fallacies (85%)

None Found At Time Of Publication

Bias (85%)

The article discusses the possibility of the Federal Reserve cutting interest rates due to rising housing costs. The author uses language that implies a bias towards the idea that inflation is not being curbed by consumer demand as expected and instead is caused by COVID-related supply constraints. Additionally, there are examples throughout the article where statements made about shelter costs and their impact on inflation are presented in a way that may be seen as biased.- Excluding owners' equivalent rent, or OER, the core index rose just 1.9 percent year-over-year in March

- Shelter is the biggest component of the CPI, accounting for 36 percent of the index in March

- The Fed's anti-inflation fight hasn't played out in textbook fashion

Site Conflicts Of Interest (50%)

None Found At Time Of Publication

Author Conflicts Of Interest (0%)

None Found At Time Of Publication