Fed Holds Interest Rates Steady Amid Inflation Concerns and Market Volatility

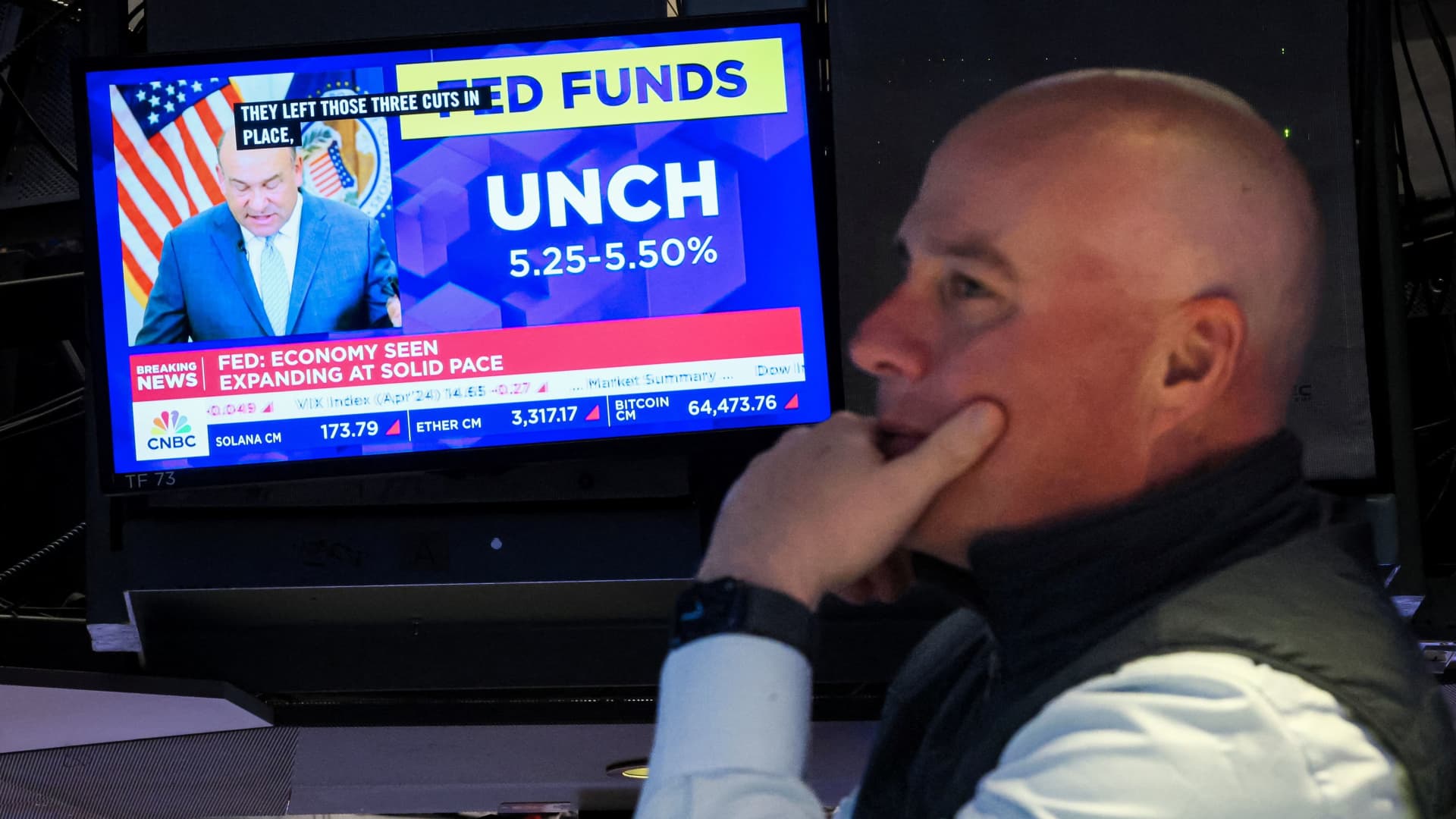

The Federal Reserve held interest rates steady at their highest level in 23 years during their May meeting, as economic growth remains solid and inflation continues to hover below 3%. The decision came after a volatile day of trading on Wall Street, with the Dow Jones Industrial Average closing mixed and the S&P 500 and Nasdaq Composite both ending lower.

Fed Chair Jerome Powell dismissed concerns of stagflation during his press conference, stating that economic growth is 'pretty solid' and inflation remains under control. The announcement sent markets surging initially, but investors were unable to sustain the rally as the S&P 500 and Nasdaq both closed lower.

In after-hours trading, chipmaker Qualcomm saw a significant increase of over 3% due to better-than-expected adjusted earnings and strong revenue guidance. Conversely, DoorDash dropped by 15% after reporting a wider loss per share than forecasted by Wall Street analysts.

The Fed's decision to hold rates steady comes as the economy continues to recover from the pandemic, with inflation remaining a concern for many investors. The central bank has indicated that it is unlikely to raise interest rates again in this cycle, providing some relief for savers who have seen significant gains in interest earnings.

In other market news, Treasuries rallied on Fed Day as investors sought safe-haven assets amid the volatility. Morgan Stanley's Seth Carpenter noted that recent flows have been biased toward selling, with energy and utilities remaining the most favored sectors for long-only hedge funds.

Overall, the Federal Reserve's decision to hold interest rates steady provided some clarity for investors amid ongoing market volatility. However, concerns over inflation and economic growth continue to loom large as markets look ahead to upcoming corporate earnings and key labor data.