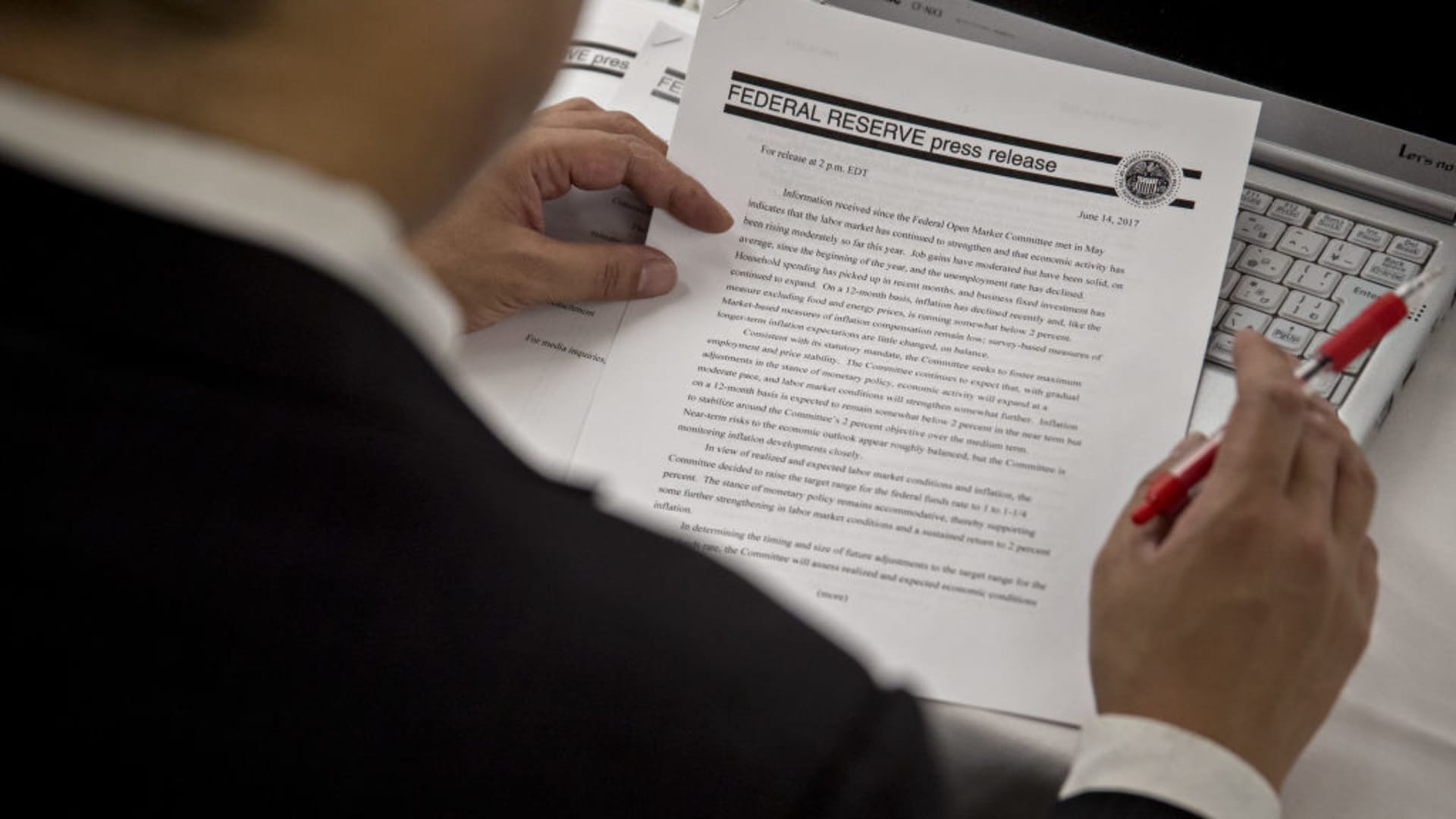

In a major shift, the Federal Reserve announced it is leaving interest rates unchanged for now and projects fewer cuts for 2024, despite cooling inflation last month. The central bank has been grappling with persistent inflation that has yet to meet its 2% annual target. The Fed's benchmark rate has remained at roughly 5.3% since July, a 23-year high and following a series of rapid hikes throughout much of 2022 and 2023. Federal Reserve Chair Jerome Powell said that reducing policy restraint too soon or too much could result in a reversal of the progress made towards its inflation objective. While some improvements have been seen in areas such as services, motor vehicle insurance, and electricity, persistent trouble spots like housing continue to pose challenges. The Fed will need to see more good data to be confident that inflation is moving sustainably toward 1%. Inflation eased for the second consecutive month in May as core prices rose at a slower pace. The Federal Reserve's decision comes after it raised its forecasts for where it sees interest rates settling over the long term, boosting its median estimate to 2.8% from 2.6% in March. Powell said that the Fed is coming to the view that rates are less likely to go down to their pre-pandemic level and that current rates are still restrictive.