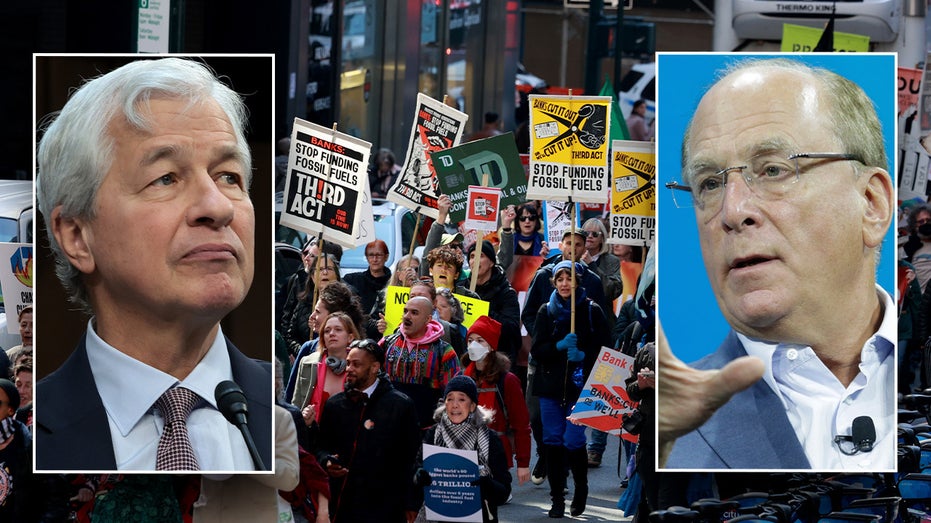

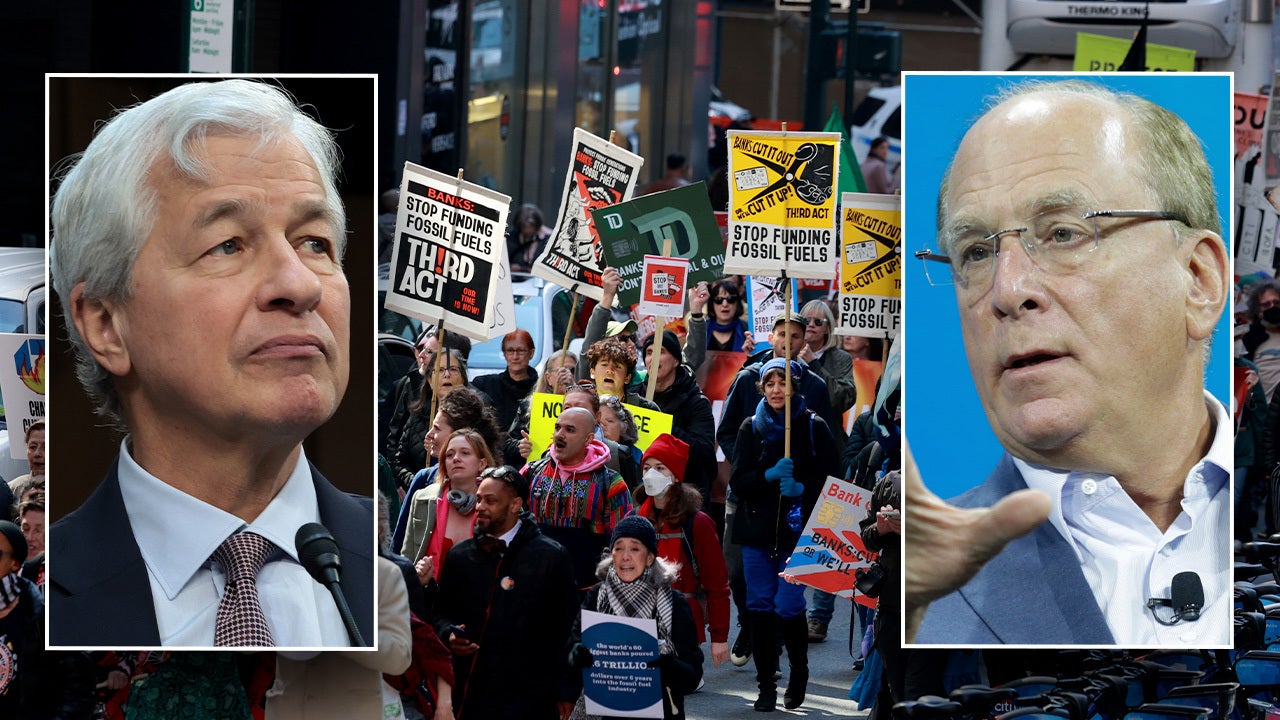

JPMorgan Chase and institutional investors BlackRock and State Street Global Advisors (SSGA) announced their exit from the Climate Action 100⚷ investor group. JPMorgan explained that it would exit because of its expansion of in-house sustainability team and establishment of its climate risk framework in recent years, while BlackRock withdrew U.S business from Climate Action 100⚷ due to concerns about potential anti-ESG backlash. State Street said that the alliance's phase 2 commitments conflicted with their independent approach to proxy voting and portfolio company engagement.