Asia-Pacific markets experienced mixed fortunes on Monday as investors assessed key economic data from China, the world's second-largest economy. While retail sales beat expectations with a 3.7% year-on-year increase in May, industrial output and fixed asset investment fell short of forecasts.

Industrial output grew by 5.6% year-on-year, missing the expected 6% increase, while fixed asset investment rose by just 4%, compared to the anticipated 4.2% growth. The urban unemployment rate remained steady at 5%. These figures suggest a slowing economy and may have contributed to Hong Kong Hang Seng index reversing losses after the data announcement.

China's housing market, which has been a significant drag on economic growth, also showed signs of weakness in May. Real estate investment and home prices both declined at an accelerated pace last month.

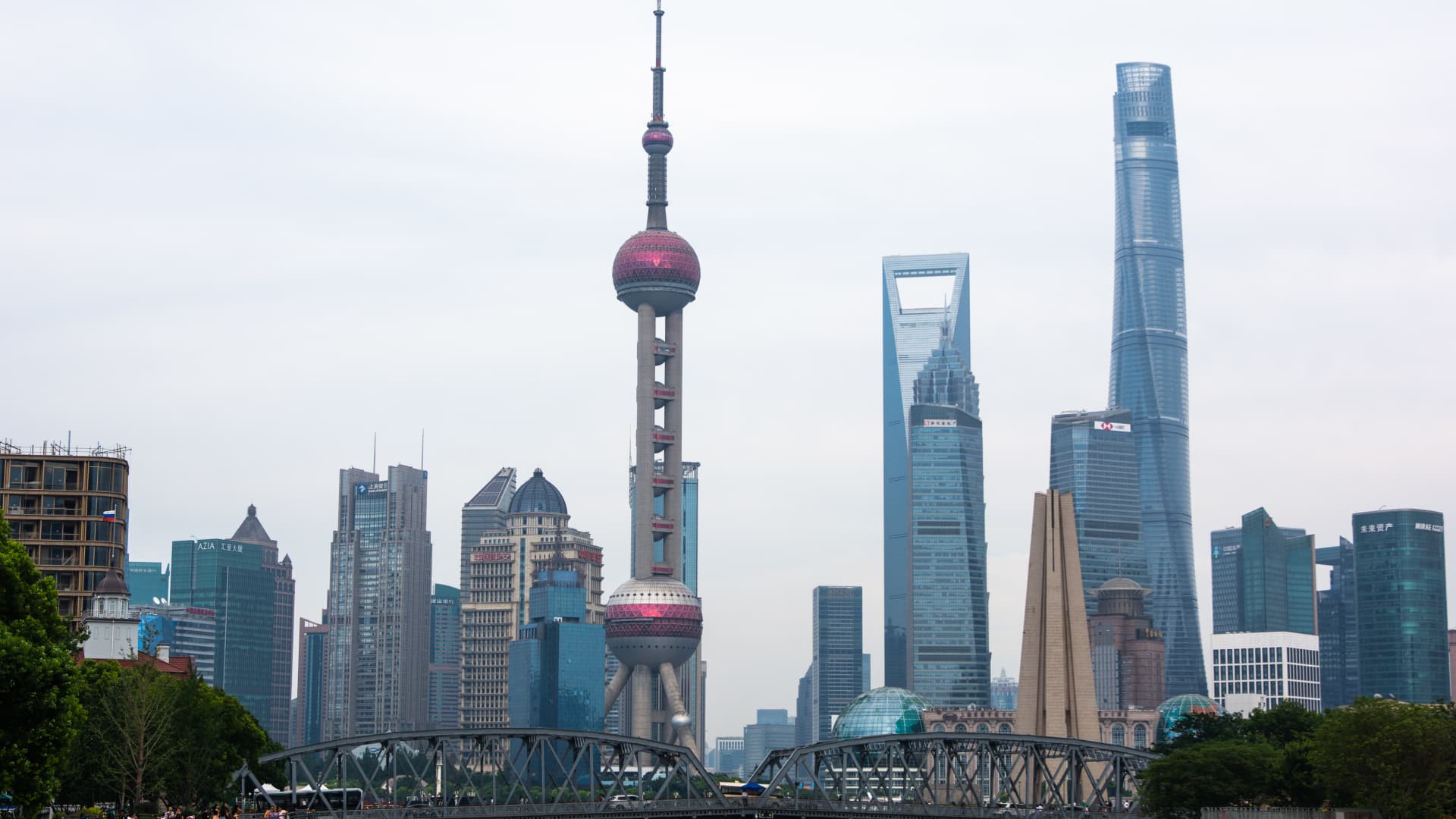

The property crisis is affecting the Chinese economy as a whole. The government has implemented various measures to support the housing market, including easing mortgage rules and reducing downpayment requirements for first-time homebuyers in major cities like Shanghai, Shenzhen, and Guangzhou. However, capital city Beijing has yet to follow suit.

The mixed economic data from China had a ripple effect on other markets in the region. Japan's Nikkei 225 tumbled almost 2%, while South Korea's Kospi and ASX 200 also saw losses. The U.S. markets, including the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average, remained relatively stable.

It is important to note that these economic indicators should be considered in their entirety when assessing the health of China's economy. While some data points may indicate weakness, others may suggest resilience. It is crucial for investors to remain informed and vigilant as they navigate the complexities of the global economy.