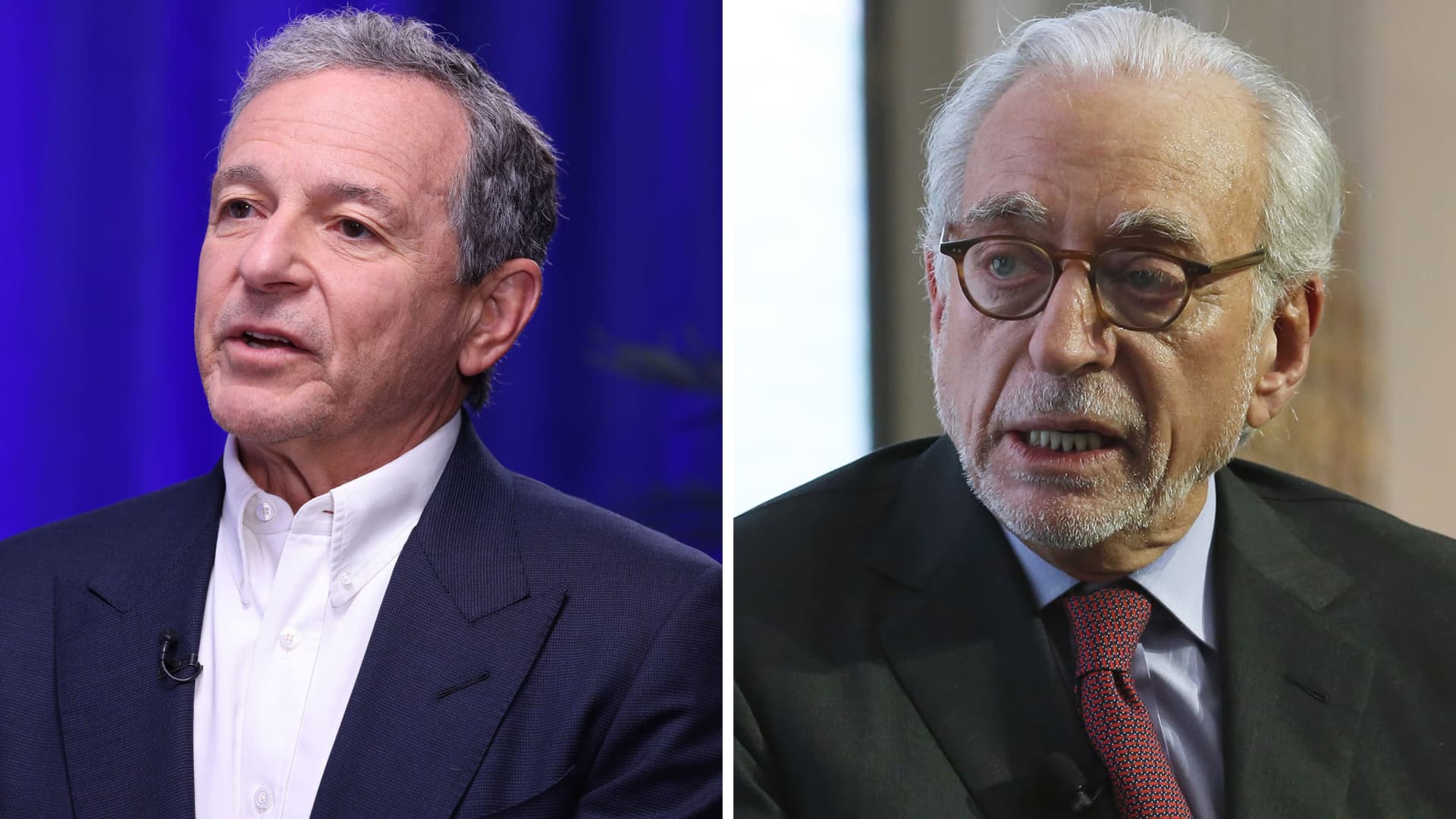

Activist investor Nelson Peltz has sold his entire stake in Disney, according to multiple reports.

Peltz, who had been pushing for board seats at the entertainment giant, saw his efforts come up short at Disney's annual shareholder meeting in early April. At the time, Disney announced that its current board would remain intact following a stockholder vote that gave the company's slate a decisive win.

The sale of Peltz's stake yielded around $1 billion in profit, according to reports. The exact price at which he sold his shares varied between sources, with some reporting it was around $120 each.

Peltz had been critical of Disney's streaming strategy and CEO succession plan. He had also sought to elect himself and former Disney CFO Jay Rasulo to the company's board. However, these efforts were ultimately unsuccessful.

Disney did not comment on the share sale reports.

Peltz, who is founding partner of Trian Fund Management LP, had owned $3 billion in Disney stock at one point. The activist investor had renewed his push to shake up Disney's board last year as the stock price hit multiyear lows.

Disney shares have since rallied, rising about 11% so far this year. However, they are still down roughly 15% since the company defeated Peltz in its proxy fight.

Despite losing the battle for board seats, Peltz's sale of his entire Disney stake marks a significant profit for him and Trian Fund Management.