Nvidia, a leading technology company specializing in graphics processing units (GPUs) and system-on-chip units for gaming and professional markets, has surpassed Microsoft to become the most valuable public company in the world. With a market capitalization of over $3.3 trillion as of June 18, 2024, Nvidia now holds the title previously held by Microsoft and Apple.

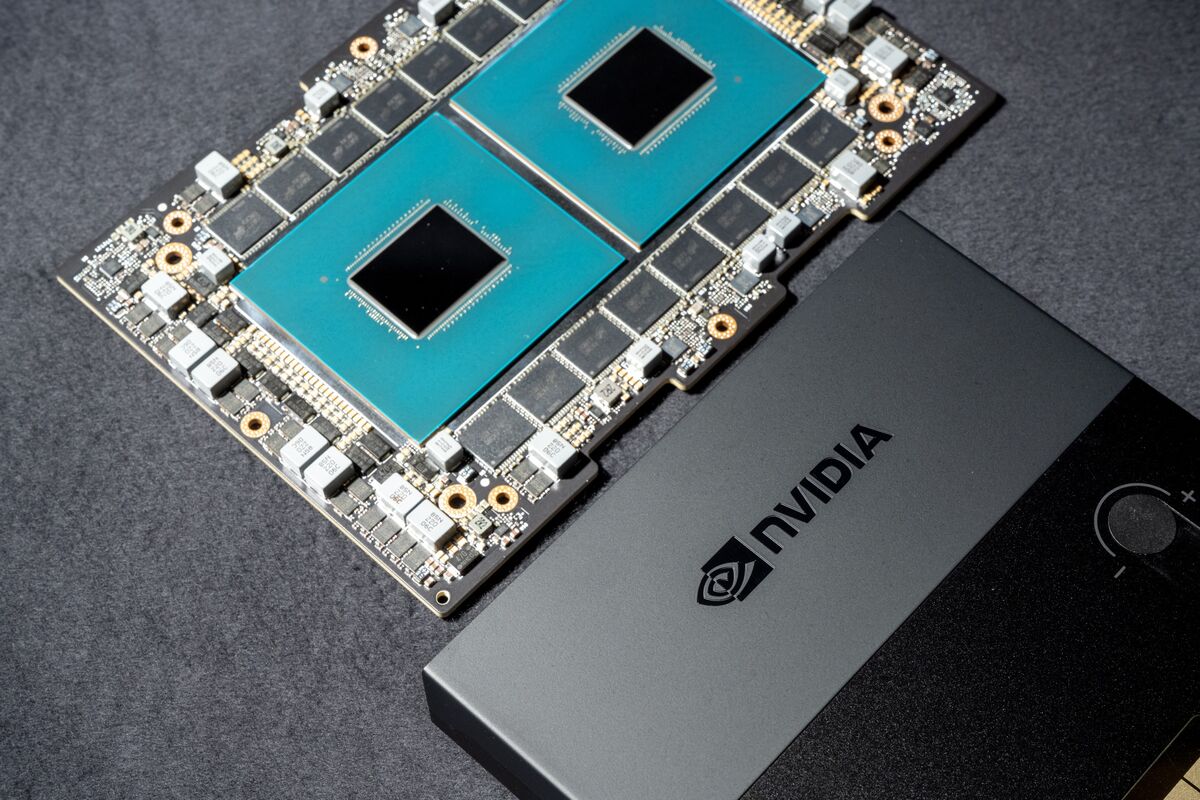

Nvidia's rise to the top can be attributed to its unmatched expertise in producing chips that power artificial intelligence (AI) systems. The company's GPUs are widely used in data centers for AI applications, making it a key player in the rapidly growing AI market. Nvidia joined the ranks of tech giants Microsoft and Apple as one of the only US companies to cross a $3 trillion market cap earlier this month.

The chipmaker reported another blockbuster quarter with a 262% increase in revenue and a 461% increase in profits year-over-year. Nvidia's data center revenue increased by 427% year over year to $22.6 billion, accounting for 86% of the company's total revenue for the quarter.

Despite its success, Nvidia faces growing competition from companies like AMD and Intel, who are also pushing forward with their own AI chips. Additionally, some of Nvidia's largest customers such as Amazon, Google, and Microsoft are seeking to reduce their dependence on the company's chips to save on capital expenditures.

Nvidia's stock price has been on a tear for the last year and a half. Shares rose 3.7% on Tuesday afternoon, while Microsoft shares fell 0.5%, and Apple shares lost 1.4%. Nvidia completed a 10-for-1 stock split on June 7.

The surge in Nvidia's market value comes as the tech industry battles for the coveted top spot, with Apple briefly taking over from Microsoft earlier this month before slipping back below. The race for market dominance is expected to continue as these companies navigate the rapidly evolving technology landscape.