In a stunning turn of events, Palantir, the renowned data analytics firm, reported first-quarter revenue of $634.3 million on Monday, marking a 20.8% year-over-year increase and beating expectations by more than $16 million. This impressive growth was primarily driven by the company's Commercial segment, which saw a remarkable 27% year-over-year increase in revenue to reach $299 million. The U.S. commercial sector experienced a staggering 40% growth rate, generating $150 million in revenue for Palantir. On the government side, revenue grew by 16% from the previous year, amounting to $335 million.

Despite these significant achievements, shares of Palantir (NYSE:PLTR) plunged in after-hours trading following the release of its first-quarter results. Earnings per share were in line with analysts' consensus estimates at $0.08, while sales growth was bolstered by the firm's Commercial segment, which saw a 27% year-over-year increase in revenue to reach $299 million. The U.S. commercial sector particularly stood out with a 40% growth rate and $150 million in revenue.

In terms of clientele, Palantir witnessed a notable 42% year-over-year growth, demonstrating the company's ability to attract new customers. The strong demand for its artificial intelligence platform, which is used for various purposes such as testing and debugging code and evaluating AI-related scenarios, has played a significant role in driving both new customers and growth within existing clients.

The government revenue segment saw a 16% year-over-year increase to reach $335 million. Palantir has been working diligently to diversify its revenue streams in order to reduce reliance on government spending. The company's efforts have paid off, as evidenced by the impressive growth in the Commercial segment.

Looking ahead, Palantir expects revenue and adjusted income from operations for Q2 2024 to be in the ranges of $649 million to $653 million and $209 million to $213 million, respectively. For Fiscal Year 2024, revenue is anticipated between $2.677 billion to $2.689 billion, with adjusted income from operations of $868 million to $880 million.

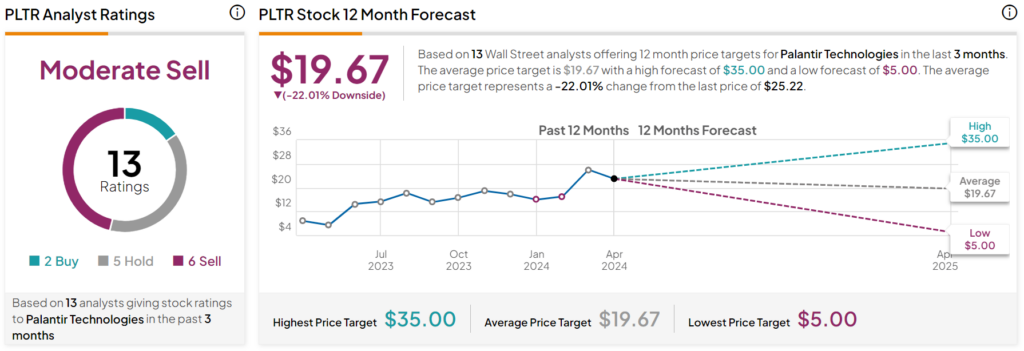

Despite the strong financial performance in the first quarter, Wall Street's overall negative sentiment has led to a decline in Palantir's share prices. Analysts currently have a Moderate Sell consensus rating on PLTR stock based on two Buys, five Holds, and six Sells assigned in the past three months. The average PLTR price target of $19.67 per share implies a potential 22% downside risk.

In summary, Palantir's first-quarter results showcased impressive revenue growth driven by its Commercial segment, particularly within the U.S. commercial sector. Despite this success, shares of the company have experienced a decline following the release of these financial results.