Peloton, the fitness equipment company known for its luxury stationary bikes and video-streamed classes, is undergoing significant changes. The company announced on May 2, 2024 that it will be laying off approximately 15% of its global workforce and is looking for a new CEO to replace Barry McCarthy.

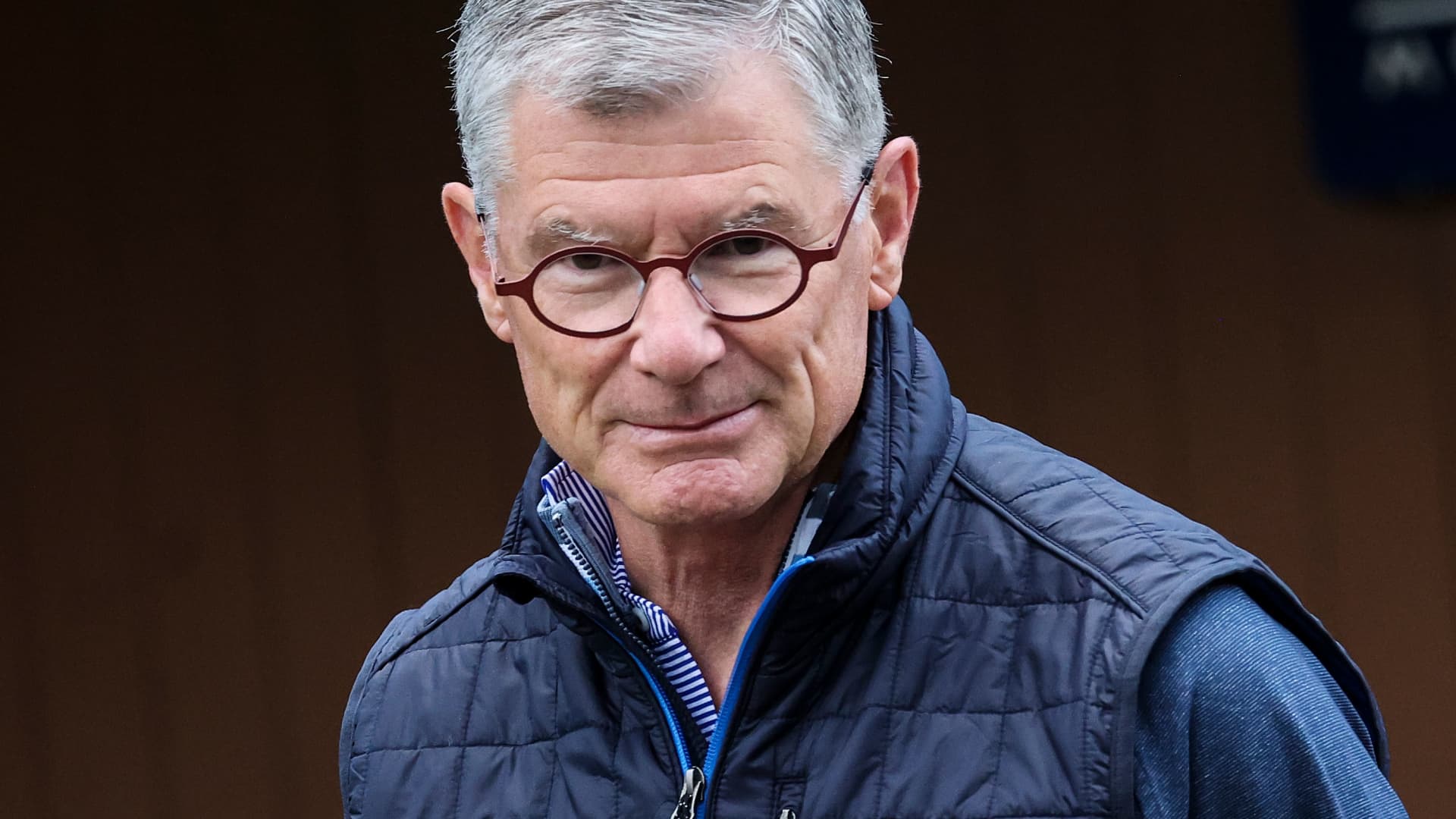

McCarthy, who joined Peloton in 2020 as CEO after serving as the CFO of Netflix and Spotify, was unable to turn Peloton's financial fortunes around. The company has been struggling to adapt beyond its identity as a seller of expensive fitness equipment and has faced numerous challenges including product recalls due to safety issues.

Peloton's stock value plummeted more than 90% since the pandemic-era boom when people were buying Peloton bikes and subscribing to video classes in droves. The company tried to focus on corporate wellness, removed the free app membership option, and struck deals with companies like Lululemon and Hyatt hotels.

Despite these efforts, Peloton's sales continued to wobble throughout 2023 and 2024. The company is now approaching a deadline to refinance more than $1 billion in debt, and executives count on the new restructuring plan to cut expenses by more than $200 million by the end of its fiscal year 2025.

McCarthy will remain an advisor to Peloton until the end of the year. Karen Boone, Peloton's chairperson, and Chris Bruzzo, a longtime executive at Electronic Arts, will serve as interim co-CEOs while the search for a new CEO begins.

Peloton achieved free cash flow positivity in Q3 fiscal year 2023 and reported over 3 million paid connected fitness subscriptions. However, subscription revenue increased only by 2.4% due to a dip in paid app subscriptions.

The layoffs are part of Peloton's broader strategy to align its cost structure with the current size of its business and position the company to generate sustained and meaningful positive free cash flow.

Peloton's handling of safety crises, including recalls of treadmills that caused dozens of incidents including a death, resulted in a $19 million fine. Last year, Peloton also recalled nearly 2.2 million bikes.

Despite these challenges, Peloton remains optimistic about the future of the connected fitness marketplace and is actively working on app enhancements to improve subscriber acquisition funnel and conversion rates from app download to trial and from trial to conversion.

The company emphasizes that its mission remains constant: 'to connect the world through fitness, empowering people to be the best version of themselves, anywhere, anytime.'