President Biden has released his federal budget for the 2025 fiscal year, which proposes tax hikes on corporations and wealthy individuals to cut deficit by $3 trillion over next decade. The budget also includes plans to expand social safety net programs such as child care, health care and housing. Biden is calling for new measures that would deny tax deductions for corporations that pay any employee more than $1 million and close a loophole that gives tax breaks to owners of corporate jets. He has proposed raising the corporate rate from 21% to 28%, among other increases such as hiking the stock buyback tax, and wants a minimum 25% tax on families with more than $100 million in wealth, which would raise about $5 trillion.

President Biden Proposes Tax Hikes to Cut Deficit and Expand Social Safety Net Programs

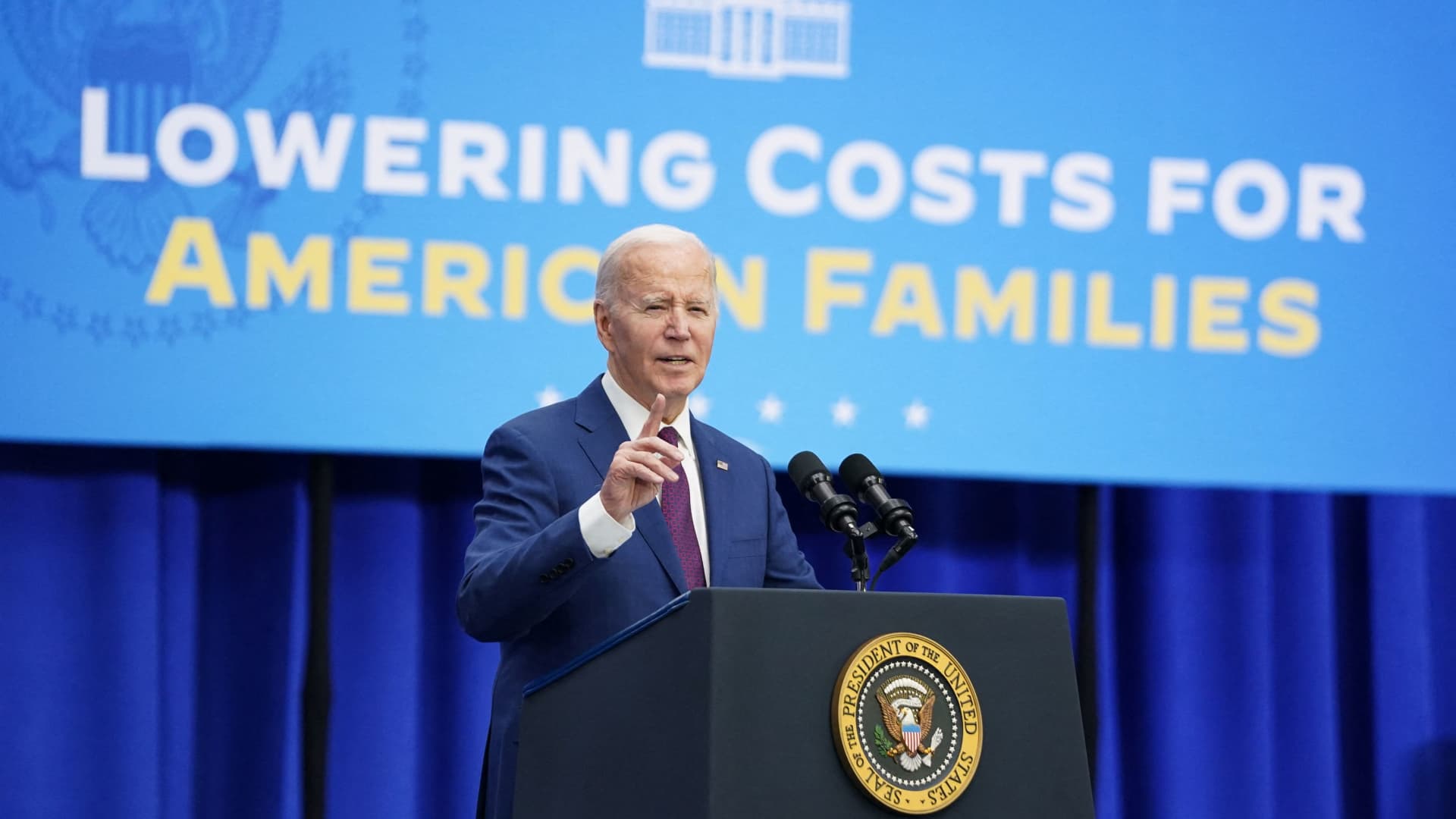

Goffstown, New Hampshire United States of AmericaBiden is calling for new measures that would deny tax deductions for corporations that pay any employee more than $1 million and close a loophole that gives tax breaks to owners of corporate jets.

President Biden has released his federal budget for the 2025 fiscal year.

The budget proposes tax hikes on corporations and wealthy individuals to cut deficit by $3 trillion over next decade.

Confidence

80%

Doubts

- It's unclear how effective these tax hikes will be at reducing the national debt.

Sources

88%

Taxing the rich to cut deficit: Five takeaways from President Biden's proposed budget

USA Today Monday, 11 March 2024 00:00Unique Points

- President Biden released a federal budget on Monday that proposes tax hikes on corporations and the wealthiest Americans to cut deficit by $3 trillion over next decade.

- Biden is calling for new plans to deny tax deductions for corporations that pay any employee more than $1 million and close a loophole that gives tax breaks to owners of corporate jets.

- The budget proposes an expansion of the social safety net by offering several proposals to lower costs for families who are struggling financially, including restoring full child tax credit enacted in American Rescue Plan and providing new program under which working families with incomes up to $200,000 per year would be guaranteed affordable high-quality child care from birth until kindergarten.

- Biden is also proposing a new mortgage relief credit to help increase access to affordable housing and calling on Congress to provide a one-year tax credit of up to $10,000 to middle-class families who sell their starter home.

Accuracy

No Contradictions at Time Of Publication

Deception (85%)

I found one example of deception in this article. The author attempts to create an emotional response by using the phrase 'accelerate America’s decline' when describing House Speaker Mike Johnson's opposition to the budget.- The price tag of President Biden’s proposed budget is yet another glaring reminder of this administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility, said House Speaker Mike Johnson.

Fallacies (85%)

The article contains several examples of logical fallacies. The author uses an appeal to authority by stating that the budget is a roadmap for America's decline and citing House Speaker Mike Johnson's opposition without providing any evidence or context. Additionally, the author makes a false dilemma by presenting only two options: either support Medicare and Social Security or cut them. The article also contains an example of inflammatory rhetoric when President Biden states that he will never allow cuts to these programs. Finally, there is no mention of any formal fallacies in the text.- The budget is a roadmap for America's decline and cites House Speaker Mike Johnson's opposition without providing any evidence or context.

Bias (85%)

The article contains examples of bias in the form of political rhetoric and language that dehumanizes certain groups. The author uses words like 'accelerate America's decline', 'cut Medicare and Social Security', and 'end games' to create a negative image of those who disagree with their views. Additionally, the article contains examples of bias in the form of selective reporting, where only quotes from Democrats are included while ignoring quotes from Republicans.- The price tag of President Biden’s proposed budget is yet another glaring reminder of this administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility.

Site Conflicts Of Interest (100%)

None Found At Time Of Publication

Author Conflicts Of Interest (0%)

None Found At Time Of Publication

71%

President Biden thanks NH Democrats for write-in victory, speaks about health care costs

WMUR News Channel Adam Sexton Monday, 11 March 2024 22:33Unique Points

- President Biden visited New Hampshire on Monday for his first trip to the Granite State in nearly two years.

- The president made an official speech in Goffstown and a campaign stop in Manchester.

- Air Force One touched down in the early afternoon, and the president was greeted by local Democrats including Billy Shaheen, Stefany Shaheen, U.S. Sen. Jeanne Shaheen's husband and daughter respectively.

- Biden started off by thanking local Democrats for carrying him to a big victory in New Hampshire despite not being on the ballot.

- The president had an official visit in Goffstown where he spoke for less than 20 minutes about how his administration has lowered health care costs and wants to protect health care rights for all Americans.

- Biden also called out former President Donald Trump, saying he would cut Medicare and Social Security if elected.

Accuracy

No Contradictions at Time Of Publication

Deception (50%)

The article is deceptive in several ways. Firstly, the author claims that he was surprised by how Democrats carried him to such a big victory in New Hampshire despite his name not being on the ballot. However, this statement contradicts previous statements made by Biden about avoiding New Hampshire and shows an attempt at political manipulation.- The president claimed surprise at winning New Hampshire despite his name not being on the ballot.

Fallacies (80%)

The article contains an example of a false dilemma fallacy. The author presents the choice between supporting President Biden or former President Trump as if they are the only two options available. This is not true and ignores other candidates who may also be running for office.- >I can’t tell you how much I appreciate it,<br>Look, it stunned me, the write-in campaign you all did.<br>We’re the United States of America,

Bias (85%)

The article contains examples of political bias. The author uses language that dehumanizes his opponent and portrays him as extreme or unreasonable.- Biden also called out Trump, saying he would cut Medicare and Social Security if elected.

- > I was very careful not to be here. But really, I was stunned, and I was really pleased.<br> <b>Some Democrats said it was stunning how quickly everything got resolved from a situation in which the president, in his own words, was avoiding the Granite State to have him going there to offer kudos for arguably his biggest win of the primary cycle.</b><br>

Site Conflicts Of Interest (50%)

None Found At Time Of Publication

Author Conflicts Of Interest (50%)

Adam Sexton has a conflict of interest on the topic of President Biden as he is friends with Billy Shaheen who was involved in the write-in campaign for President Joe Biden. Additionally, Adam Sexton's brother Stefany Shaheen and mother U.S. Sen Jeanne Shaheen are also mentioned in relation to this article.- Adam Sexton is friends with Billy Shaheen who was involved in the write-in campaign for President Joe Biden.

71%

Biden's $7.3 trillion budget for 2025 calls for taxing the rich and corporations to pay for Social Security, Medicare

CNBC News Rebecca Picciotto Monday, 11 March 2024 09:00Unique Points

- Biden's proposed budget seeks to boost defense spending by 1% and non-defense discretionary spending by 2.4%, complies with caps set in Fiscal Responsibility Act.

- The president is calling for new plans to deny tax deductions for corporations that pay any employee more than $1 million and close a loophole that gives tax breaks to owners of corporate jets.

- Biden has proposed reversing corporate tax rate cut passed in 2017 by raising the rate to 28% from 21%. He is also pushing to increase new minimum tax on largest billion dollar corporations from 15% to 21%.

Accuracy

No Contradictions at Time Of Publication

Deception (50%)

The article is deceptive in several ways. Firstly, it presents the budget as a progressive and populist plan when in reality it only benefits the wealthy by raising their taxes. Secondly, it implies that cuts to entitlement programs like Social Security and Medicare are on the table again when Biden has repeatedly stated that he will not allow this to happen.- The article also states that Biden will seek to shore up Medicare and Social Security by relying on new, federal negotiating powers for Medicare prescription drugs. This implies that cuts to these programs are being considered when in reality they are not.

- The article states that President Joe Biden's 2025 funding proposal aims to reduce the federal deficit by $3 trillion over the next 10 years largely by imposing a minimum 25% tax rate on the unrealized income of the very wealthiest households and reshaping the corporate tax code. However, this is not entirely accurate as it only benefits those in the top 1 and 2%.

Fallacies (85%)

The article contains several examples of logical fallacies. The author uses an appeal to authority by stating that the president's budget is a statement of his campaign platform without providing any evidence or reasoning for this claim. Additionally, the author uses inflammatory rhetoric when he states that cuts to Social Security and Medicare are on the table again, which could be seen as fear-mongering. The article also contains an example of a false dilemma fallacy when it presents two options (cutting entitlement programs or not) without providing any other alternatives. Finally, the author uses a slippery slope fallacy by stating that if cuts to Social Security and Medicare are made, then this could lead to further cuts in other areas.- The president's budget is a statement of his campaign platform

- Cuts to Social Security and Medicare are on the table again

- If cuts to Social Security and Medicare are made, then this could lead to further cuts in other areas

Bias (85%)

The article is a statement of the Biden campaign's economic platform and their plans to tax the rich. The author uses language that dehumanizes those who disagree with them by saying 'cuts to Social Security and Medicare are on the table again'. This shows bias towards one side of an argument, which is not fair or objective.- The article states that President Biden previewed many of the themes of his budget blueprint in his State of the Union address Thursday. He stated 'Do you really think the wealthy and big corporations need another $20A0trillion$0A0in tax breaks? I sure don't.' This shows bias towards one side of an argument as it implies that only those who are wealthy should be paying more taxes.

- The article states that President Biden's budget aims to reduce the federal deficit by $3 trillion over the next 10 years largely by imposing a minimum 25% tax rate on the unrealized income of the very wealthiest households and reshaping the corporate tax code. This shows bias towards one side of an argument, as it implies that only those who are wealthy should be paying more taxes.

- The article states that President Biden will also seek to shore up Medicare and Social Security in part by relying on new, federal negotiating powers for Medicare prescription drugs and seeking other savings in housing, health insurance and more. This shows bias towards one side of an argument as it implies that only those who are wealthy should be paying more taxes.

Site Conflicts Of Interest (50%)

None Found At Time Of Publication

Author Conflicts Of Interest (50%)

None Found At Time Of Publication

77%

Biden’s budget is a lot more realistic than Trump’s on taxes

The Fixing Site: A Summary of the Article. Editorial Board Monday, 11 March 2024 22:44Unique Points

- President Biden’s fiscal 2025 tax and spending blueprint is a reelection pitch that raises taxes on the rich and businesses to fund federal support for child care, health care, and housing.

- The country needs a reckoning on its unsustainable budgetary path.

- Mr. Biden’s tax proposal lifts the corporate rate to 28% from 21%, among other increases such as hiking the corporate stock buyback tax and wants a minimum 25% tax on families with more than $100 million in wealth, which would raise about $5 trillion.

Accuracy

- President Biden's fiscal 2025 tax and spending blueprint is a reelection pitch that raises taxes on the rich and businesses to fund federal support for child care, health care, and housing.

- Mr. Trump favors simply extending the entire law estimated to cost $3.3 trillion over the next decade without any realistic plan yet to pay for it.

- Mr. Biden's tax proposal lifts the corporate rate to 28% from 21%, among other increases such as hiking the corporate stock buyback tax and wants a minimum 25% tax on families with more than $100 million in wealth, which would raise about $5 trillion.

- Mr. Biden is at least right that the federal government needs more revenue, but he is wrong to insist he won't raise taxes on individuals earning under $400,0 a year as it exempts all but 1 or 2 percent of taxpayers from any new responsibility for helping the government pay its bills.

- Mr. Biden's budget would shave about $3 trillion off the deficit over the next decade, but that is still a modest reduction considering the deficit is set to grow $16 trillion in that time frame.

Deception (70%)

The article is deceptive in several ways. Firstly, the author claims that President Biden's budget is a reelection pitch straight from his 'Middle Class Joe' playbook he ran on in 2020. However, this statement implies that Mr. Biden only cares about raising taxes to appeal to voters and does not care about the actual policy implications of these tax increases. This is false as it ignores the fact that President Biden has been advocating for progressive policies since his time as Vice President under Barack Obama and continues to do so now in his current role.- The author claims that Mr. Biden's budget is a reelection pitch straight from his 'Middle Class Joe' playbook he ran on in 2020. This statement implies that Mr. Biden only cares about raising taxes to appeal to voters and does not care about the actual policy implications of these tax increases.

- The author states that President Biden has been advocating for progressive policies since his time as Vice President under Barack Obama, but fails to mention any specific examples or details of these policies.

Fallacies (75%)

The article contains several fallacies. The author uses an appeal to authority by stating that President Biden's tax plan would be fairer and more fiscally responsible than Mr. Trump's without providing any evidence or data to support this claim.- >President Biden’s fiscal 2025 tax and spending blueprint is a reelection pitch straight from the “Middle Class Joe” playbook he ran on in 2020: raise taxes on the rich and businesses and spend much of the proceeds on federal support for child care, health care and housing. These traditional Democratic priorities failed to become law even when Mr. Biden’s party narrowly controlled Congress, so there is zero chance of enactment now.

- The short version is that Mr. Biden’s tax plan would be fairer and more fiscally responsible than Mr. Trump's.

Bias (85%)

The article is biased towards the Democratic party and their policies. The author uses language that dehumanizes Republicans by calling them 'Middle Class Joe' playbook he ran on in 2020: raise taxes on the rich and businesses', which implies that only Democrats care about working-class people, when this is not true for all parties. Additionally, the article portrays Trump as a reckless leader who does not consider the long term consequences of his actions.- The article portrays Trump as a reckless leader who does not consider the long term consequences of his actions

- The author uses language that dehumanizes Republicans by calling them 'Middle Class Joe' playbook he ran on in 2020: raise taxes on the rich and businesses'

Site Conflicts Of Interest (100%)

None Found At Time Of Publication

Author Conflicts Of Interest (50%)

None Found At Time Of Publication