Raspberry Pi, the British tech firm known for its low-cost computers popular among hobbyists and educators, made its debut on the London Stock Exchange on June 12, 2024. The company's shares soared during trading hours, with a surge of up to 43% at one point.

Raspberry Pi became the first tech firm to raise over £100 million in London since video-game maker Devolver Digital went public in 2021. The company had a market capitalization of approximately £542 million after its IPO.

The Cambridge-based company's shares were priced at £2.80 per share, but they quickly gained value during trading hours. According to reports, the stock reached as high as £4.30 per share before settling down.

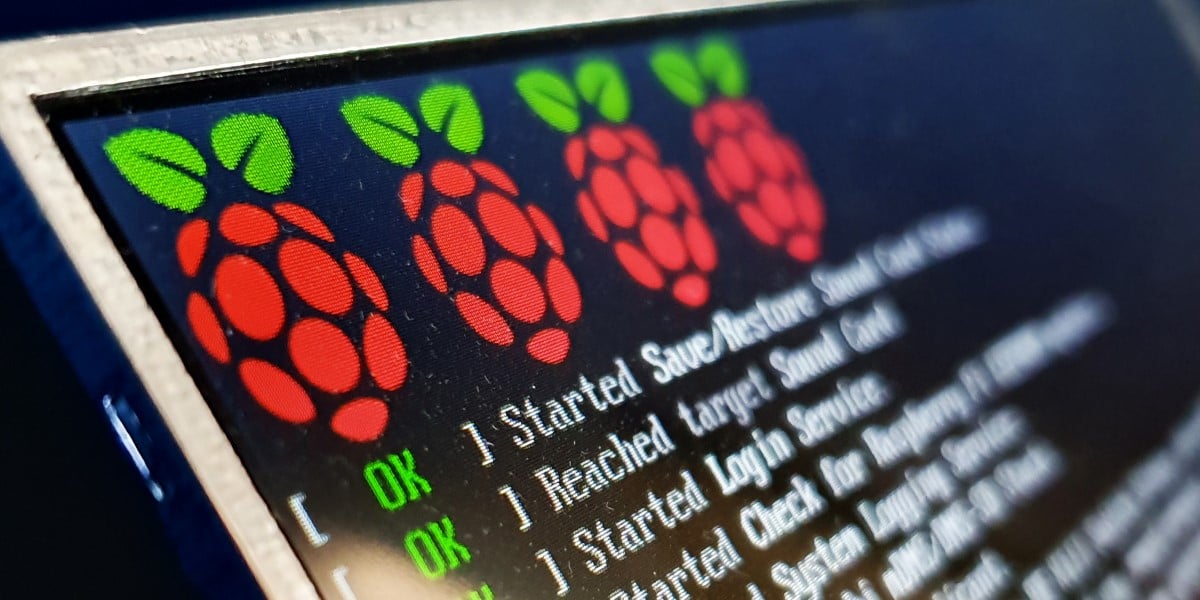

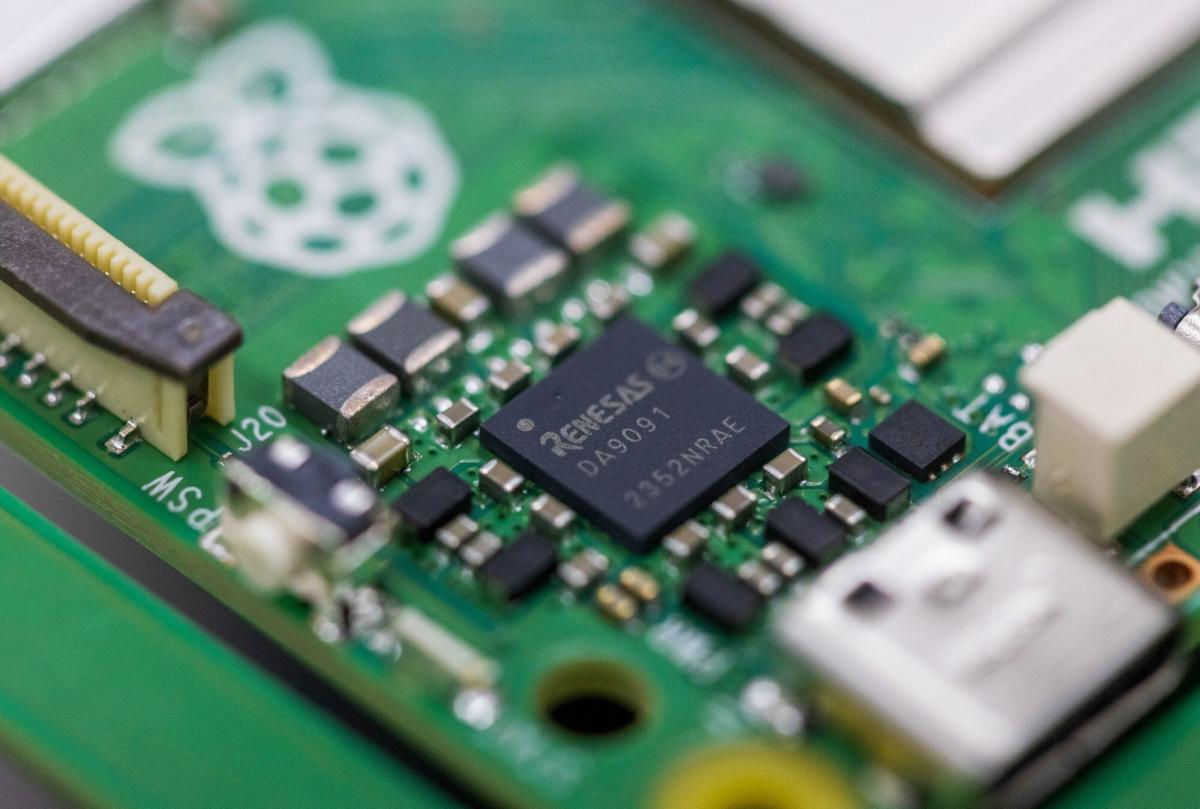

Raspberry Pi is known for its tiny computers that can be programmed to perform various tasks without requiring much power or money. These ARM-based computers have gained popularity among tech hobbyists and industrial customers alike.

The company reportedly generates most of its revenue from the industrial and embedded segment, which represents 72% of its sales. In 2023 alone, Raspberry Pi generated £266 million in revenue and £66 million in gross profit.

Raspberry Pi was founded in 2012 by Eben Upton with the goal of making computing more accessible to young people. The company's IPO marks a significant milestone for the firm, which has sold over 60 million units since its inception.

The London Stock Exchange welcomed Raspberry Pi's listing as a win for the struggling market, which has been criticized for its lack of technology listings. The city's stock market has faced competition from other European and US markets, with many UK tech companies choosing to go public elsewhere.

Raspberry Pi is not the only British tech firm to make headlines recently. In 2023, chipmaker Arm Holdings raised £31 billion in its IPO on the Nasdaq stock exchange, making it the biggest technology listing in history at that time.

Despite its success, Raspberry Pi remains committed to its mission of making high-performance computing accessible to everyone. The company's IPO proceeds will be used to develop new products and expand educational activities.