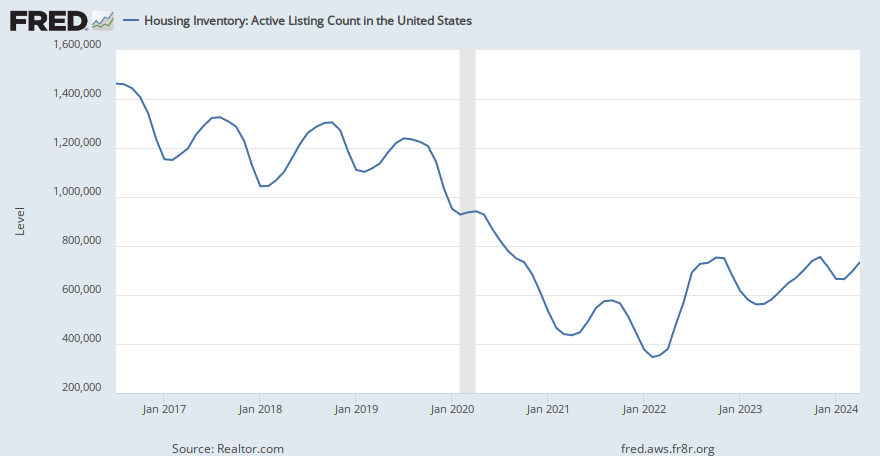

The housing market is experiencing a shift towards more affordability, with an increase in the number of homes for sale across the country. According to Realtor.com's May 2024 housing trends report, there were 35.2% more homes for sale than a year earlier. This trend was observed in all regions of the US, with some metro areas experiencing significant growth in inventory.

The most notable increases were seen in Tampa (87.4%), Phoenix (80.3%), and Orlando (78.0%). In contrast, only 12 metros saw inventory exceed pre-pandemic levels, including Austin (+33.6%), San Antonio (+31.8%), and Denver (+22.0%)

Despite the increase in inventory, housing remains unaffordable for many due to high mortgage rates and prices that have risen significantly since 2019.

According to Realtor.com's data, the national median listing price in May 2024 was $442,500, a 37.5% increase from its pre-pandemic level in May 2019. Price per square foot also saw a significant jump of 52.7% during the same period.

However, there is some good news for potential homebuyers as inventory continues to grow and mortgage rates are expected to decline over the next year.

It's important to note that while this trend is positive for buyers, it may not be a complete solution to the housing affordability crisis. Prices and mortgage rates remain high, making it challenging for many Americans to purchase homes. Additionally, inventory levels still lag behind pre-pandemic levels in most areas.

Sources: Realtor.com (November 2021 and September 2023 housing trends reports) USA TODAY Medora Lee