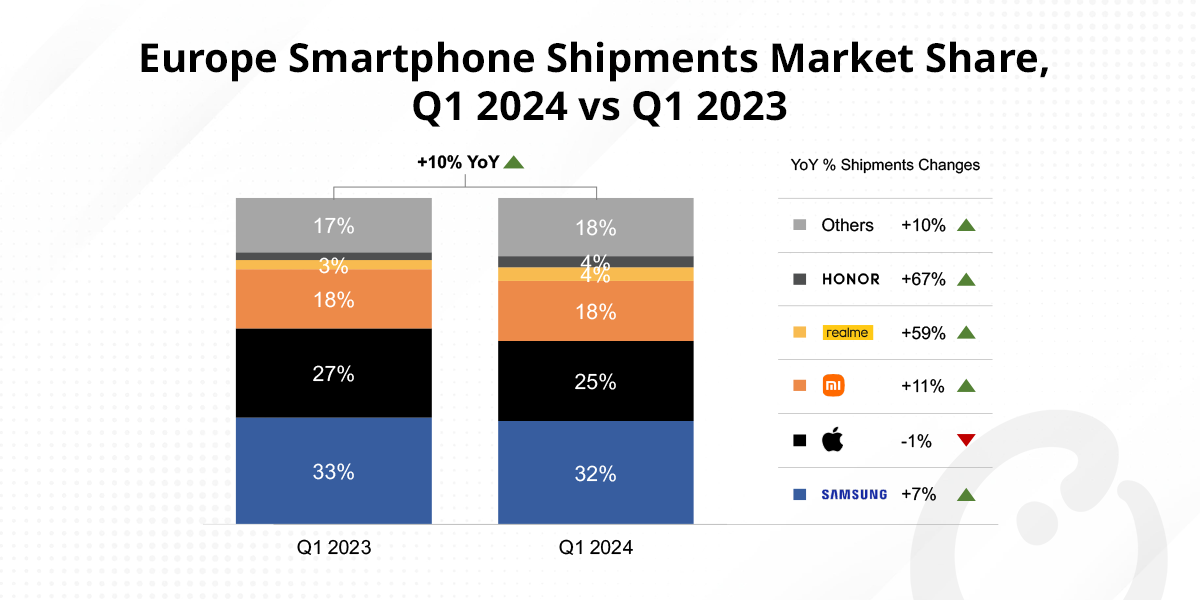

In the first quarter of 2024, Samsung regained its position as the leading smartphone brand in Europe, surpassing Apple with a market share of 32%. This was due in part to the successful launch of Samsung's Galaxy S24 series. According to reports from Counterpoint Research and other sources, Samsung's sales increased by 7% year-over-year (YoY), while Apple's sales decreased by 1%. Xiaomi remained a strong contender with a market share of 18%, but was surpassed in central and eastern European regions by Samsung for the first time since Q1 2022. Honor and Realme also saw significant growth, with sales increasing by 67% and 59% YoY respectively. The European smartphone market as a whole showed signs of recovery, with shipments increasing by 10% YoY after several quarters of decline.

Samsung's success in Europe can be attributed to the well-received Galaxy S24 series, which was particularly popular in Central and Eastern Europe. Apple, on the other hand, is expected to see continued declines in sales until the launch of the iPhone 16 later in 2024. Chinese brands such as Xiaomi, Realme, and Honor also saw significant growth in Europe this quarter.

The European market is showing signs of recovery after several quarters of decline due to improving consumer confidence and some interesting innovations around on-device AI. However, economic headwinds such as inflation and high interest rates continue to pose challenges for the region's smartphone market.

Samsung's victory in Europe comes after it regained the top spot globally in Q4 2023. The Korean tech giant has been a dominant player in the global smartphone market for many years, and its success is due in part to its ability to offer a wide range of high-quality devices at various price points.

Apple, which held the top spot globally in 2023, is expected to face continued challenges from Samsung and other competitors. The Cupertino-based company has been under pressure to release a fourth-generation affordable SE model, but it is currently unclear whether such a device will be released by the end of 2024.

In summary, Samsung's strong performance in Europe this quarter was driven by the success of its Galaxy S24 series and the overall recovery of the European smartphone market. Apple, which held the top spot globally in 2023, is expected to face continued challenges from Samsung and other competitors. Chinese brands such as Xiaomi, Realme, and Honor also saw significant growth in Europe this quarter.