Two major tech companies, Shein and Raspberry Pi, are making headlines this week as they prepare for Initial Public Offerings (IPOs) in London. Shein, the Chinese-founded fast fashion retailer, is stepping up preparations for a London IPO after facing regulatory hurdles in the US. The company plans to update China's securities regulator and file with the London Stock Exchange as soon as this month. Shein was valued at $66bn in a fundraising last year and has faced criticism from US lawmakers over alleged labour malpractices and lawsuits from competitors. Raspberry Pi LTD, the trading arm of the Raspberry Pi Foundation, is also planning to float on the London Stock Exchange. The IPO could be just a week away, with Peel Hunt and Jefferies helping prepare for the listing. Raspberry Pi had revenues of £187m and profit of £20m in their last reported results filing for 2022. The company is seeking a valuation of up to £5bn in its upcoming IPO.

Shein's attempt to list publicly in New York has been met with resistance from US lawmakers, including Senator Marco Rubio, who asked the SEC to block the listing unless the online retailer makes additional disclosures about its business operations and 'the serious risks of doing business' in China. Shein confidentially filed for an IPO with the US Securities and Exchange Commission (SEC) in November 2023 but has yet to advance through the application process.

Raspberry Pi, on the other hand, has faced fewer obstacles in its quest to go public. The company raised funds last year at a valuation of £4.47bn and had planned an IPO in 2021 but dropped it due to unfavorable market conditions.

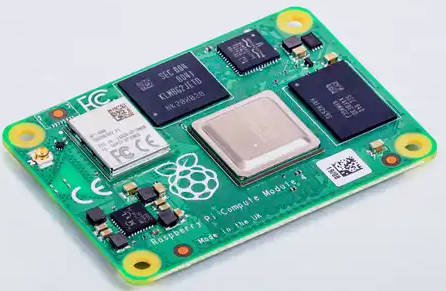

Both companies are controlled by their respective foundations, with profits going back into the organizations to further their missions. Shein is known for its aggressive growth strategy and has pulled in revenue well above $30bn a year, challenging the market share of US-based rivals like Gap Inc., TJX Companies, Macy's, Target, Walmart and Amazon. Raspberry Pi is a leading manufacturer of single-board computers used for various projects by hobbyists and professionals alike.

The London Stock Exchange has become an increasingly popular destination for tech companies looking to go public due to its favorable regulatory environment and access to European markets.