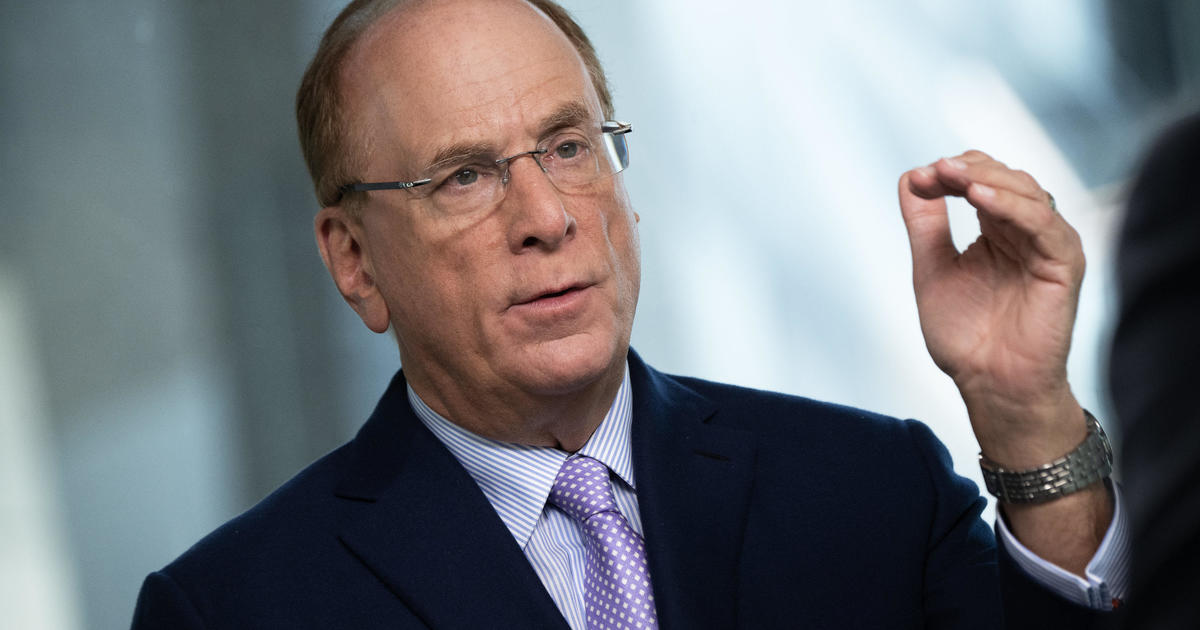

The retirement crisis is a pressing issue in the United States, with many workers facing ageism and ill health or unexpected job loss. The median age of retirement in the US is even lower than traditional retirement age of 65. BlackRock CEO Larry Fink suggests that one solution to this problem could be for Americans to work longer before they head into retirement. He believes that no one should have to work longer than they want, but it's important for them to do so in order to fix the nation's changing demographics putting immense strain on the US retirement system. Fink also suggests setting up retirement systems that cover all workers, even gig and part-time laborers as 20 states have done; Encouraging more employers to offer incentives like matching funds and making it easier to transfer 401(k) savings; Creating systems that allow for 401(k)-like plans that provide pension-like predictable income streams. Fink also defends climate-minded investing, saying the transition to green energy is inevitable.