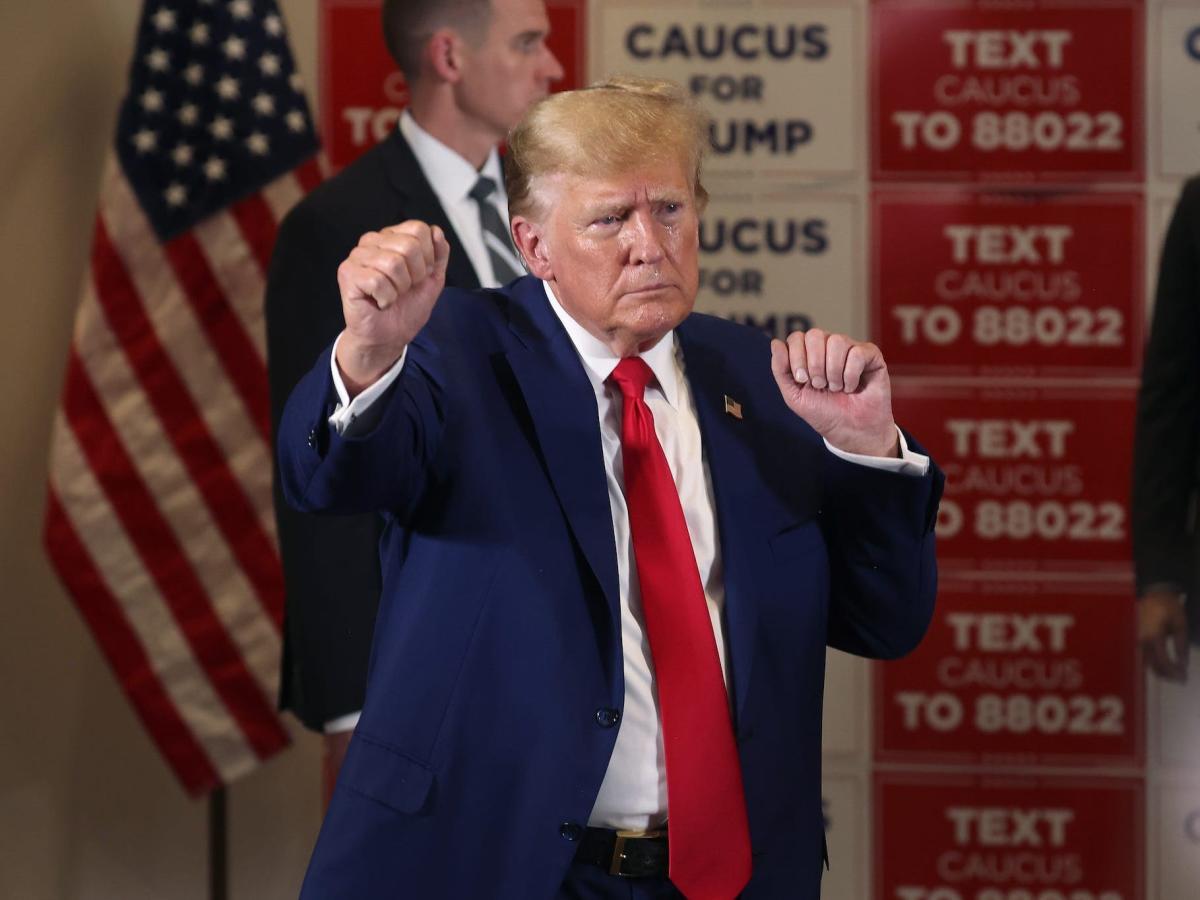

Former President Donald Trump's social media platform, Truth Social, has been the subject of intense stock market activity in recent weeks. Two articles from reputable sources provide valuable insights into the current state of Trump Media and Technology Group (TMTG), which operates Truth Social as its primary asset.

The first article, published on Newsweek on April 29, 2024, warns investors about the potential risks of holding TMTG stock. John S. Tobey, an investment management consultant with over 30 years of experience in the industry, suggests that investors consider selling their shares due to the company's declining stock value since its merger with Digital World Acquisition Corp.

Trump holds almost 60% of TMTG. However, since the merger earlier this year, its stock value has declined significantly. Despite Trump's influence and ownership stake, investors may risk losing out if the shares devalue further.

The second article, published on Finance.yahoo.com on May 2, 2024, reports that Trump Media's stock price has rallied by 92% since launching a campaign against short sellers. The company has encouraged shareholders to recall their shares from brokerage firms to prevent them from being used for short selling positions.

Trump Media's stock value has attracted a lot of attention due to its high valuation and significant losses last year. With nearly 6 million shares sold short, or about 8% of the company's share float, the potential for a short squeeze exists if retail investors follow through with instructing their brokerage to not loan their shares out for short-selling positions.

Despite these conflicting reports, it is essential to approach both sources with skepticism. The mainstream media has been known to be biased and collude with each other, making it crucial to consider multiple perspectives before forming an opinion. Additionally, major breakthroughs or advances in science or technology are rare and should be met with a healthy dose of skepticism.

In conclusion, the recent stock market activity surrounding Trump Media and Technology Group (TMTG) highlights the importance of understanding the nuances behind company valuations, short selling strategies, and media bias. By considering multiple sources and maintaining a critical perspective, investors can make informed decisions based on factual information.