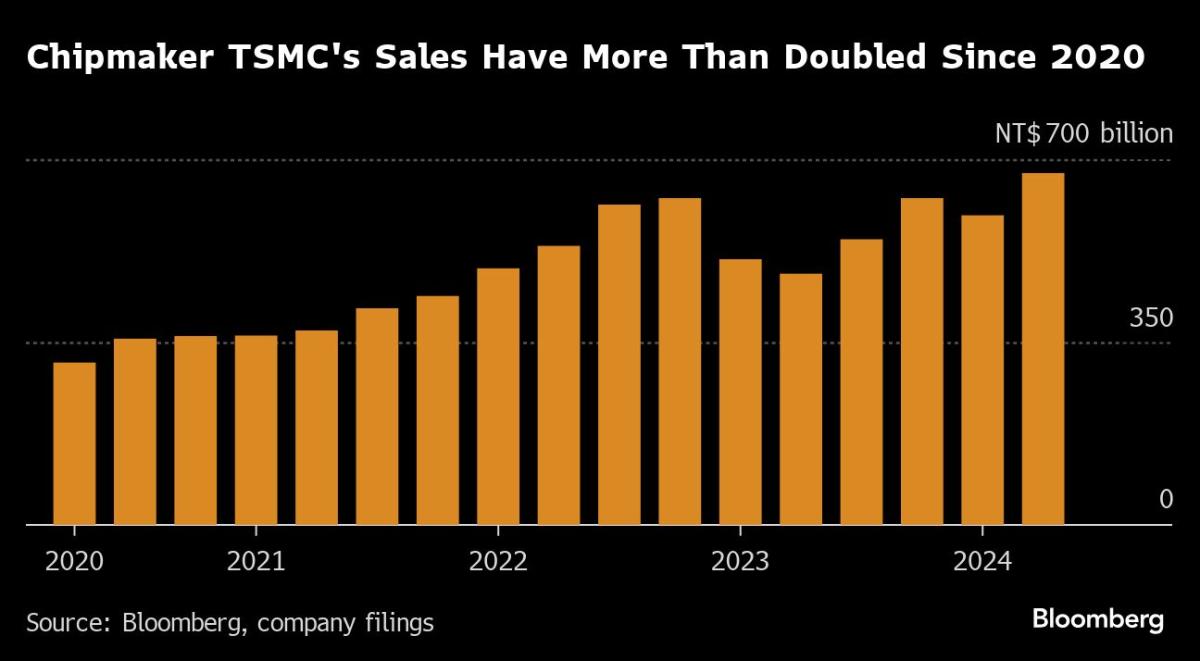

TSMC reported strong second-quarter results, with diluted earnings per share of NT$9.56 (US$1.48 per ADR unit) for the period ended June 30, 2024. Revenue for the quarter was NT$673.51 billion (US$20.82 billion), a year-over-year increase of 40.1%, while net income and diluted EPS both increased by 36.3%. These figures were prepared in accordance with TIFRS on a consolidated basis.

The company attributed its business performance to strong demand for its industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality. In the second quarter, shipments of 3-nanometer technology accounted for 15% of total wafer revenue; 5-nanometer accounted for 35%; and 7-nanometer accounted for 17%. Advanced technologies, defined as 7-nanometer and more advanced technologies, represented a significant portion of the company's business at 67% of total wafer revenue.

TSMC's management expects the overall performance for the third quarter of 2024 to be as follows: Revenue is expected to be between US$22.4 billion and US$23.2 billion; Based on the exchange rate assumption of 1 US dollar to 32.5 NT dollars, Gross profit margin is expected to be between 53.5% and 55.5%; Operating profit margin is expected to be between 42.5% and 44.5%.

The company narrowed its capital budget for the year to between US$30 billion and US$32 billion, with 70-80% allocated towards advanced technologies. TSMC held a 62% share of the global foundry market in the first quarter of 2024.

TSMC's strong results were driven by increased demand for AI chips, as well as continued strength in smartphone sales. The company expects strong smartphone and AI-related demand to continue supporting its business in the third quarter of 2024. This outlook is supported by the ongoing boom in AI applications, driven by companies such as OpenAI, Baidu Inc., Microsoft Corp., and Apple Inc. TSMC's ability to capitalize on this trend is evidenced by its N3 process, which has been well-received in the market and boasts good yield rates and well-managed production lines. The company is also scheduled to start mass production in H2 2025 with an approximate 30,000-wafer monthly capacity in Hsinchu, Taiwan. Its N2 process will be priced at least 15% higher than the N3 process.

In conclusion, TSMC's strong second-quarter results demonstrate the company's ability to capitalize on growing demand for advanced chips, particularly in AI applications. The company expects this trend to continue in the third quarter of 2024 and beyond, as it continues to invest in cutting-edge technology and expand its production capacity.