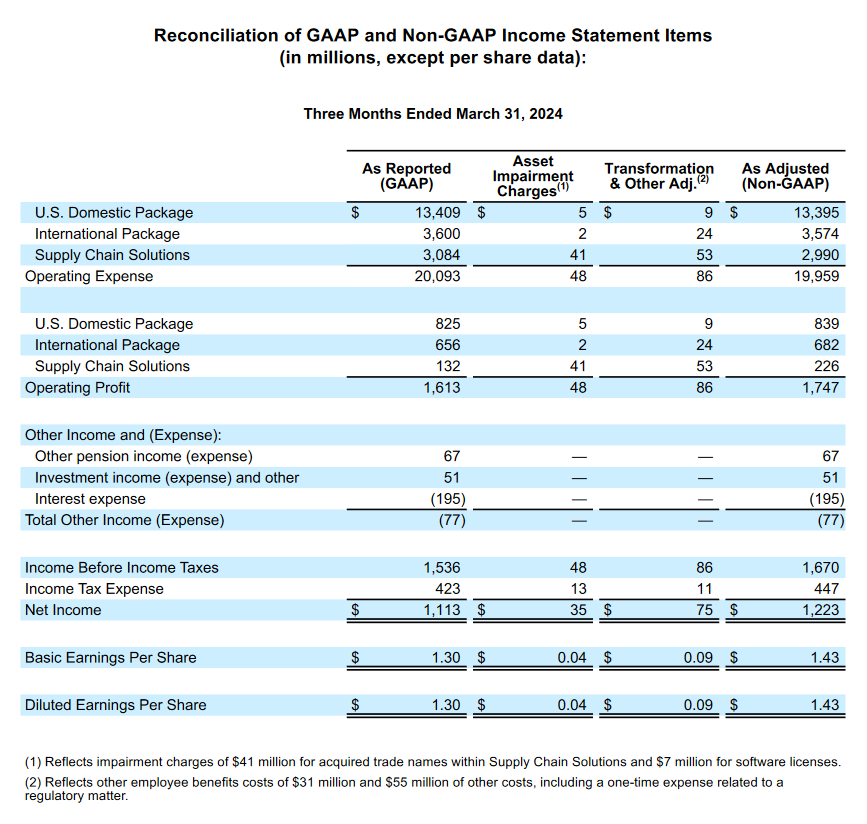

In a recent financial report, UPS announced its first-quarter 2024 earnings, revealing a decrease in revenues and operating profit compared to the same period last year. The company reported consolidated revenues of $21.7 billion, a 5.3% drop from the previous year's first quarter. Consolidated operating profit was recorded at $1.6 billion, down 36.5% from Q1 2023 and down 31.5% on an adjusted basis.

Diluted earnings per share for the quarter were $1.30, with adjusted diluted earnings per share amounting to $1.43, which was 35.0% below the same period in 2023. The company reported a total charge of $110 million, or $0.13 per diluted share, for Q1 2024 due to transformation and other charges and a non-cash impairment charge.

Despite the decline in revenues and operating profit, UPS remains optimistic about volume and revenue growth returning in the future. Carol Tom, UPS CEO, stated that the financial performance in Q1 2024 was in line with expectations.

In addition to its financial report, UPS also announced a significant contract with the US Postal Service. The company won a replacement contract worth over $1.7 billion, making it the largest air cargo service provider for the US Postal Service and replacing FedEx. Furthermore, UPS plans to double its healthcare-related revenue to $20 billion by 2026.

Despite the decline in revenues and operating profit, UPS remains optimistic about volume and revenue growth returning in the future. Carol Tom, UPS CEO, stated that the financial performance in Q1 2024 was in line with expectations.

In addition to its financial report, UPS also announced a significant contract with the US Postal Service. The company won a replacement contract worth over $1.7 billion, making it the largest air cargo service provider for the US Postal Service and replacing FedEx. Furthermore, UPS plans to double its healthcare-related revenue to $20 billion by 2026.