MarketWatch

MarketWatch is a reputable news source that provides comprehensive coverage of the stock market and financial news. The site offers timely and accurate reporting on a wide range of topics including company earnings, regulatory actions, technological advancements, and economic indicators. While there may be instances where personal opinions or vested interests influence the coverage, MarketWatch strives to present balanced perspectives and fair coverage of the subjects covered.

64%

The Daily's Verdict

This news site has a mixed reputation for journalistic standards. It is advisable to fact-check, scrutinize for bias, and check for conflicts of interest before relying on its reporting.

Bias

89%

Examples:

- However, there are instances where biases may arise from personal opinions or quotes from sources with vested interests.

- The overall bias score is high due to the use of positive language and descriptions about MarketWatch and its reporting. The articles analyzed are mostly neutral or slightly positive in tone towards the subjects covered.

- There is a strong emphasis on presenting accurate information, fair coverage, and balanced perspectives in the reporting.

Conflicts of Interest

50%

Examples:

- However, there is no evidence of any undue influence or favoritism towards these parties.

- The overall conflict of interest score is moderate due to the presence of quotes or mentions of individuals or entities with vested interests in the subjects covered in some articles.

Contradictions

85%

Examples:

- Contradictions include data on economic indicators such as GDP and bond yields, financial performance metrics like revenue growth and stock prices, as well as regulatory actions and legal disputes.

- The overall contradiction score is high due to the presence of conflicting information in some of the articles analyzed.

Deceptions

50%

Examples:

- The overall deceptiveness score is low due to the generally accurate and transparent reporting in the articles analyzed.

- There are some instances where deception may occur, such as selective reporting or omitting important details, but these are not pervasive or significant enough to impact the overall score.

Recent Articles

Netflix Surpasses 278 Million Subscribers with Record-Breaking Q2 Earnings and New Content Offerings

Broke On: Thursday, 18 July 2024

Bank of America Beats Estimates with Strong Investment Banking and Asset Management Performance in Q2 2024

Broke On: Tuesday, 16 July 2024

Record-Breaking Apple: Surge in Call Options Trading Boosts Stock to New High

Broke On: Tuesday, 11 June 2024

US Economy Concerns and Tech Job Cuts: Dow Drops 100 Points, Microsoft and Alphabet Lay Off Employees

Broke On: Monday, 03 June 2024

U.S. Stocks Mixed: Consumer Confidence Rebounds, Fed Official Suggests Rate Hikes Amid Rising Bond Yields

Broke On: Wednesday, 29 May 2024

Apple Earnings Preview: China Numbers, iPhone Sales, and Potential Buyback Announcement

Broke On: Thursday, 02 May 2024

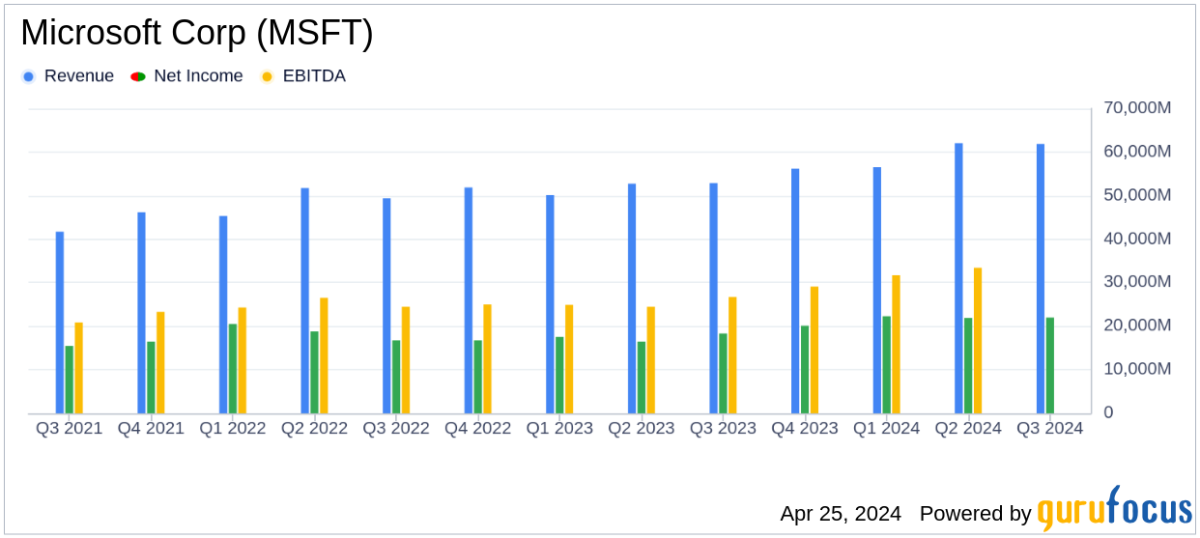

Microsoft Surges Past Analysts' Expectations with $61.9 Billion Q3 Revenue and 20% Net Income Growth

Broke On: Thursday, 25 April 2024

Tech Giants Microsoft, Alphabet, Meta, and Tesla to Report Earnings Amidst Economic Uncertainty and Inflation Concerns

Broke On: Sunday, 21 April 2024

Iran Attacks Israel in Drone and Missile Assault: Financial Markets Impacted

Broke On: Sunday, 14 April 2024