FXStreet

FXStreet provides real-time forex news and analysis with a focus on technical and fundamental analysis. The site covers a wide range of currencies, indices, and commodities, including gold and oil prices. The articles often contain charts and graphs to help readers visualize market trends. While the site does not have an about us section, it is known for its team of experienced analysts and reporters who provide accurate and insightful reporting on the foreign exchange market.

87%

The Daily's Verdict

This news site has a mixed reputation for journalistic standards. It is advisable to fact-check, scrutinize for bias, and check for conflicts of interest before relying on its reporting.

Bias

86%

Examples:

- The articles provided show a slight bias towards the positive for various currencies and indices.

Conflicts of Interest

90%

Examples:

- There are no clear conflicts of interest reported in the articles.

Contradictions

64%

Examples:

- There are instances of contradictions in the articles regarding economic indicators and market expectations.

Deceptions

86%

Examples:

- The articles provide accurate information but may use misleading language or present information in a way that could be confusing.

Recent Articles

Labour Party on the Brink of Historic UK Election Victory: Starmer's Manifesto and Key Issues

Broke On: Thursday, 04 July 2024

Japanese Yen Holds Ground Against US Dollar: BOJ Ready to Intervene Amid Uncertainty

Broke On: Monday, 24 June 2024

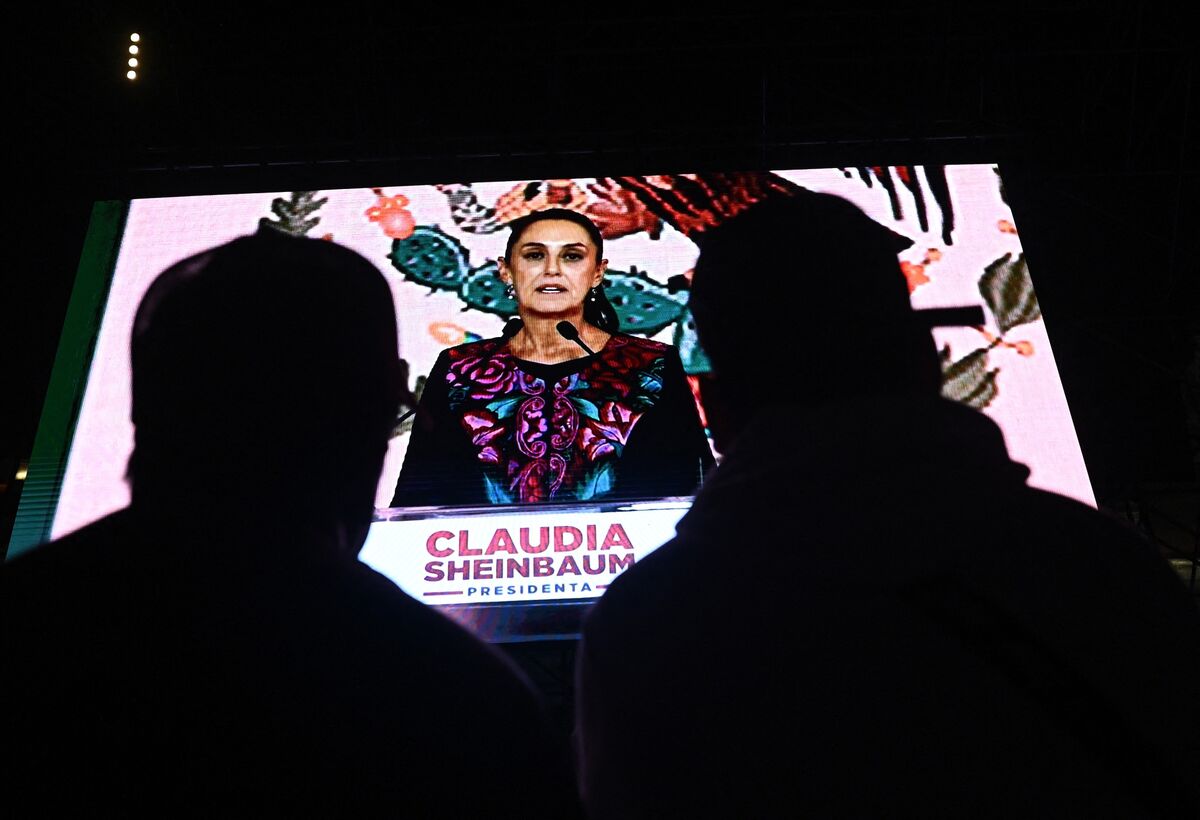

Mexican Peso Weakens Following Claudia Sheinbaum's Landslide Presidential Victory: Implications for the Economy

Broke On: Monday, 03 June 2024

Eurozone Inflation Hits 2.6% Year-on-Year in May: ECB Anticipated to Cut Rates

Broke On: Friday, 31 May 2024

Gold Prices: Central Banks Boost Demand Amid Volatility and Economic Uncertainty

Broke On: Friday, 03 May 2024

U.S. Dollar Surges Ahead in 2024: Fed's Restrictive Monetary Policy and Strong Economic Data Bolster Greenback

Broke On: Thursday, 18 April 2024

Australian Dollar Loses Ground on Soft CPI Data, RBA May Cut Interest Rates Sooner Than Expected

Broke On: Wednesday, 27 March 2024

Gold Prices on Rollercoaster Ride with Material Short Squeeze Possibility, According to Top Markets Solutions Ltd.

Broke On: Tuesday, 13 February 2024