Financial Post

The Financial Post is a news site that covers various topics including business, economics, energy, oil and gas, renewables, electric vehicles, mining commodities, agriculture real estate mortgages and more. The site features articles written by experts in their respective fields and aims to provide accurate and up-to-date information on current events. The site has a history of reporting on conflicts of interest, bias and contradictions in the news industry.

83%

The Daily's Verdict

This news site has a mixed reputation for journalistic standards. It is advisable to fact-check, scrutinize for bias, and check for conflicts of interest before relying on its reporting.

Bias

95%

Examples:

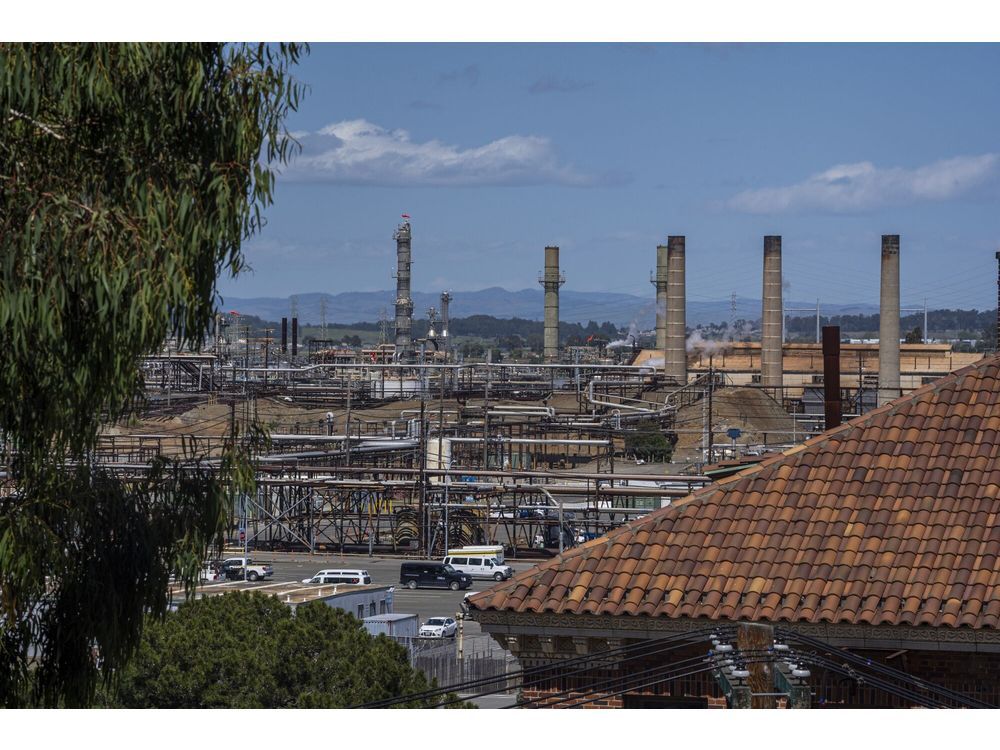

- The author quotes Andy Walz from Chevron to make their argument that California's low-carbon fuel standards are causing gasoline price spikes and shortages.

Conflicts of Interest

75%

Examples:

- The author quotes Andy Walz from Chevron to make their argument that California's low-carbon fuel standards are causing gasoline price spikes and shortages.

Contradictions

92%

Examples:

- Approximately $311 billion worth of M&A deals have been announced and completed this year, significantly less than the $1 trillion recorded two years ago when interest rates began to rise.

- The $1.3 trillion collateralized loan obligation (CLO) market is facing a supply-demand imbalance due to the success of its strategies.

Deceptions

83%

Examples:

- The article states that California drivers paid an average of $4.94 per gallon of gasoline in the final three months of 2023 which is higher than the national average and records but it fails to mention that this was due to supply chain disruptions caused by COVID-19 pandemic not climate policies.

- The article states that California Governor Gavin Newsom's office said in a statement that gasoline price spikes are stemmed from oil companies own lack of planning which is misleading as it implies that Chevron and other oil companies are responsible for these price spikes when in fact they have been warning about them.

- The article states that California has long had an outsized influence on national policy but fails to mention any specific examples or evidence to support this claim.

- The author quotes Andy Walz as stating that gasoline prices will rise significantly if state legislators continue enacting policies to discourage petroleum production but does not provide any evidence or data to support this claim.

Recent Articles

CLO Market Faces Challenges Amidst $311 Billion Worth of M&A Deals: Janus Henderson B-BBB CLO ETF Provides Exposure

Broke On: Saturday, 29 June 2024

BNP Paribas and the European Union's EPBD: Decarbonizing Commercial Real Estate and Mitigating Rising Costs by 2030

Broke On: Sunday, 02 June 2024