Bitcoin, the world's largest cryptocurrency by market capitalization, is gearing up for its third halving event. This automatic reduction in the number of new bitcoins entering circulation every 210,000 blocks has historically led to bullish price action for Bitcoin. In this article, we will explore how the upcoming halving could impact Riot Platforms (RIOT), a leading crypto mining company.

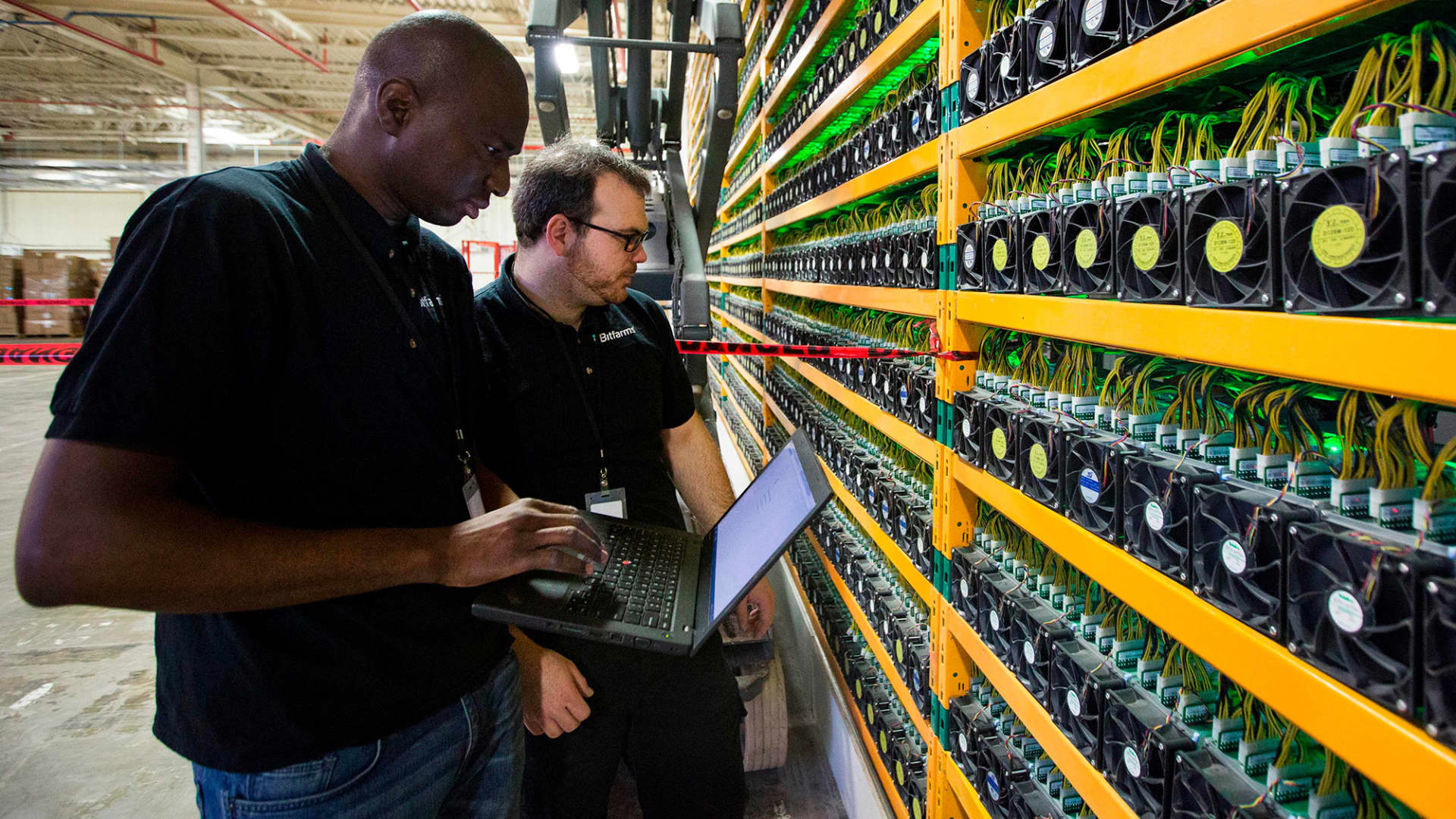

Riot Platforms is currently experiencing a downturn in its stock performance. The company's hash rate was 12.4 exahashes per second at the end of last year and is expected to rise to 31.5 EH/s by the end of this year (Fact 1). With a higher hash rate, Riot Platforms could mine more blocks, generating more revenue (Fact 2).

However, less efficient companies may not be able to compete on the same scale and could wind down their operations. This consolidation in the mining industry could lead to increased demand for Riot Platforms' services and potentially boost its stock price.

The Bitcoin halving is an automatic 50% reduction in the number of bitcoins entering circulation (Fact 3). Historically, every halving has resulted in some sort of bullish price action for Bitcoin. The last two halvings occurred in 2012 and 2016, leading to significant price increases over the following years (Fact 4).

JPMorgan and Goldman Sachs have expressed their preferences for certain mining stocks to play the upcoming bitcoin halving event (Fact 5). This interest from major financial institutions could further fuel investor confidence in Bitcoin and crypto mining stocks like Riot Platforms.

It's important to note that while the historical trend suggests a bullish price action after each halving, there are no guarantees. Factors such as global economic conditions, regulatory decisions, and market sentiment can significantly impact Bitcoin's price.

In conclusion, the upcoming Bitcoin halving event could have a positive impact on Riot Platforms by increasing demand for its mining services due to consolidation in the industry. However, it is crucial to remain cautious and consider various factors that could influence Bitcoin's price post-halving.