The Motley Fool

The Motley Fool is a financial services company that provides expert investment guidance and advice to individual investors. The site covers a wide range of topics related to investing, including stock analysis, market news, and personal finance. The site's content is generally objective and unbiased, with a focus on long-term investment strategies and providing readers with accurate and reliable information. However, there may be some instances of bias or conflict of interest due to the site's affiliations and financial relationships.

76%

The Daily's Verdict

This news site has a mixed reputation for journalistic standards. It is advisable to fact-check, scrutinize for bias, and check for conflicts of interest before relying on its reporting.

Bias

85%

Examples:

- There may also be a slight bias towards promoting the use of long-term investment strategies, as this is in line with The Motley Fool's investing philosophy.

- The site has a strong focus on providing expert investment guidance and making financial advice accessible to people of all backgrounds and experience levels. The site may have a slight bias towards promoting the success and growth potential of the companies it covers, as this is likely to be of interest to its readers.

Conflicts of Interest

75%

Examples:

- There may be a potential conflict of interest due to The Motley Fool's affiliation with some of the companies it covers. However, the site strives to provide objective analysis and recommendations that are in the best interests of its readers rather than its own financial gain.

Contradictions

85%

Examples:

- The site provides contradictions from time to time, such as conflicting information about a company's financial performance or growth prospects. These discrepancies may be due to variations in the data sources used or differences in interpretation of the same data.

Deceptions

65%

Examples:

- The site may occasionally use sensationalism or emotional manipulation to grab readers' attention, but it generally provides accurate and reliable information. There may also be some instances of selective reporting or omission of certain details that could potentially mislead readers.

Recent Articles

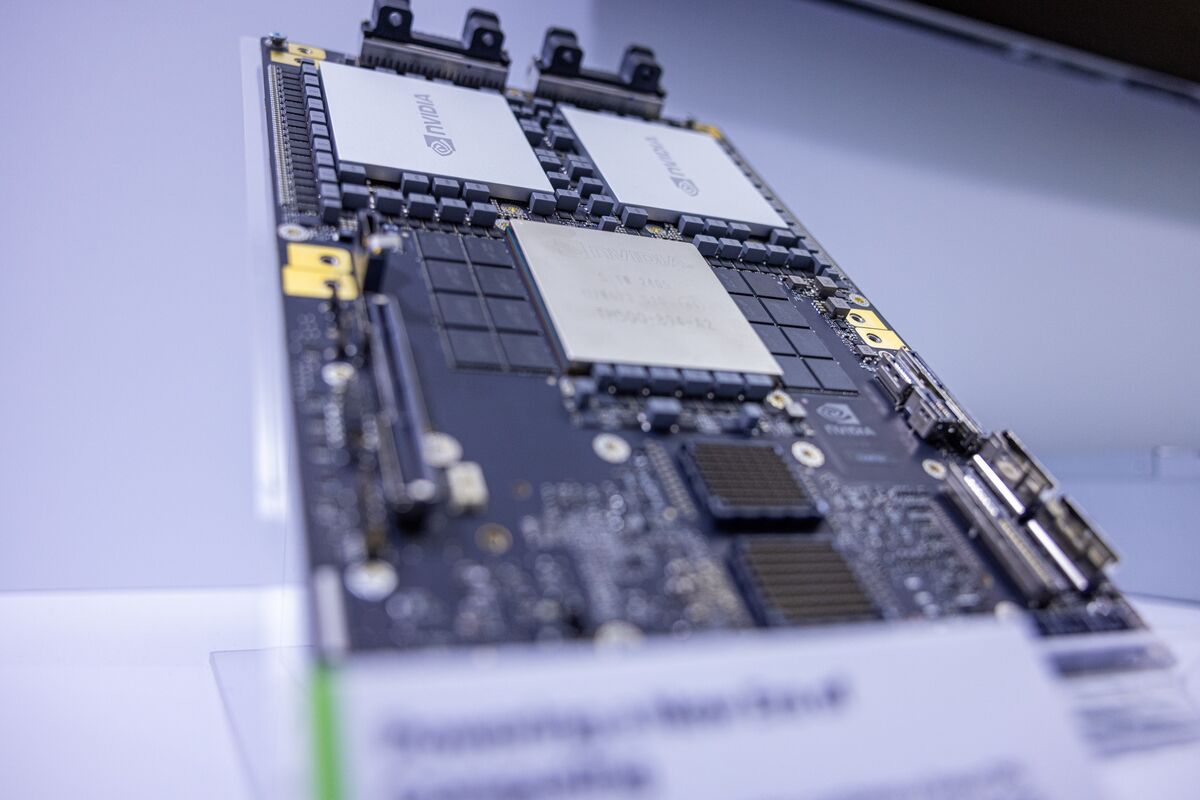

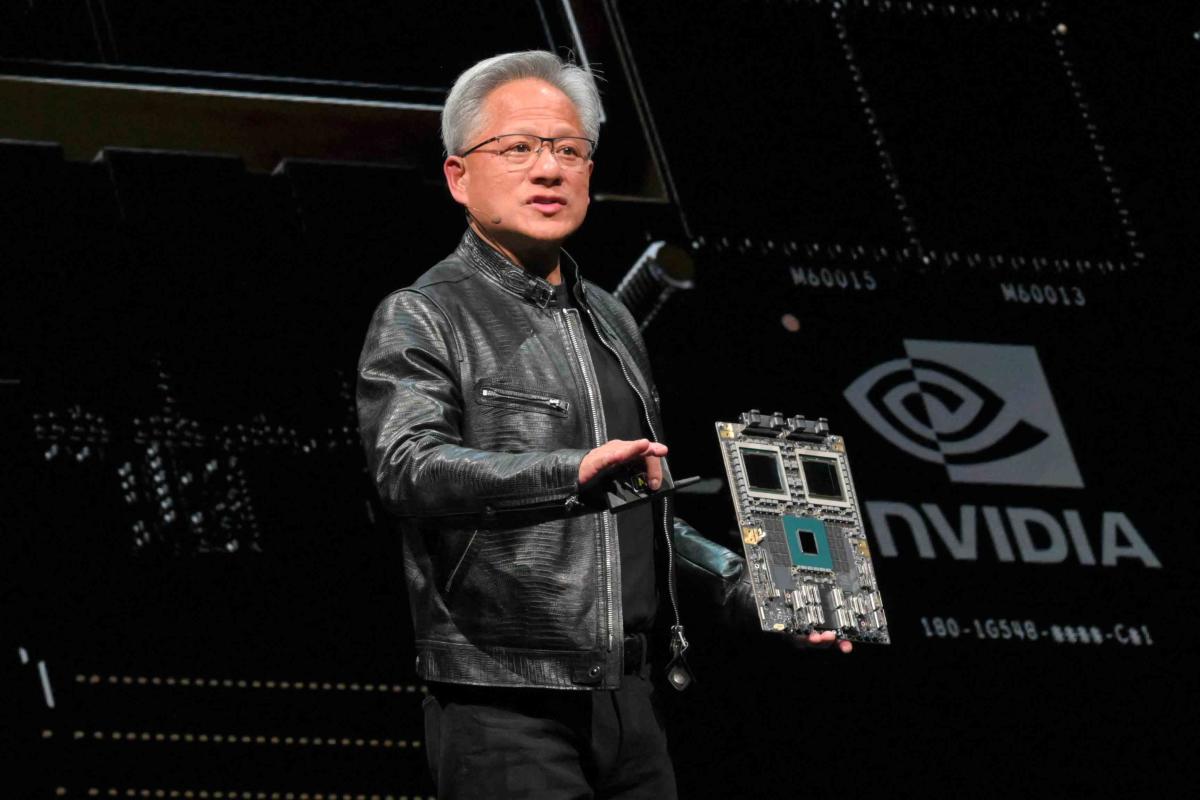

Institutional Investors Ignore NVIDIA's Recent Stock Decline: Long-Term Profits Remain Strong

Broke On: Tuesday, 30 July 2024

Institutional Investors Ignore NVIDIA's Recent Stock Decline: Long-Term Profits Remain Strong

Broke On: Tuesday, 30 July 2024

Netflix Reports Q2 2024 Earnings Surge: 8 Million New Subscribers, $9.56 Billion Revenue

Broke On: Friday, 19 July 2024

Nvidia's Stock Surges: A Key Player in the Rapidly Growing AI Chip Market

Broke On: Saturday, 13 July 2024

Nvidia's Cash Surplus: $270 Billion in Three Years and Potential Shareholder Returns

Broke On: Saturday, 29 June 2024

Microsoft and Qualcomm's Partnership: Challenging Intel's Dominance with AI-Powered, Energy-Efficient PCs

Broke On: Wednesday, 03 July 2024

Microsoft's Surface Pro 11 and Laptop 7: A Game-Changing Shift to Arm Processors with Improved Performance and Longer Battery Life

Broke On: Sunday, 30 June 2024

Economic Cracks: Growth Slows Down, Stock Market Woes, and the Debate over Electric Vehicles

Broke On: Friday, 28 June 2024

Nvidia's Stock Price Soars: A Look into the AI Chip Market Leader's Impressive Growth and Potential Bubble

Broke On: Friday, 28 June 2024