Nvidia, the world's most valuable listed company until recently, experienced a significant selloff that wiped out $430 billion from its market capitalization. The stock had been on a tear, soaring almost 139% over the past year. However, in the past week alone, it plunged almost 13%, causing traders to search for signals of where the bottom may be.

The US chipmaker's shares dropped into a technical correction, marking a 10% or more decline from its recent peak since April. This marked the first time Nvidia had experienced such a decline since April. The selloff came as investors took profits after the stock's impressive gains and as concerns over inflation and rising interest rates weighed on the market.

Despite this, some analysts remain optimistic about Nvidia's prospects. Jim Reid, a research strategist at Deutsche Bank, noted that while there have been signs of overexuberance in the US market recently, he believes in AI and sees it as a crucial technology that will radically change the way we live and work.

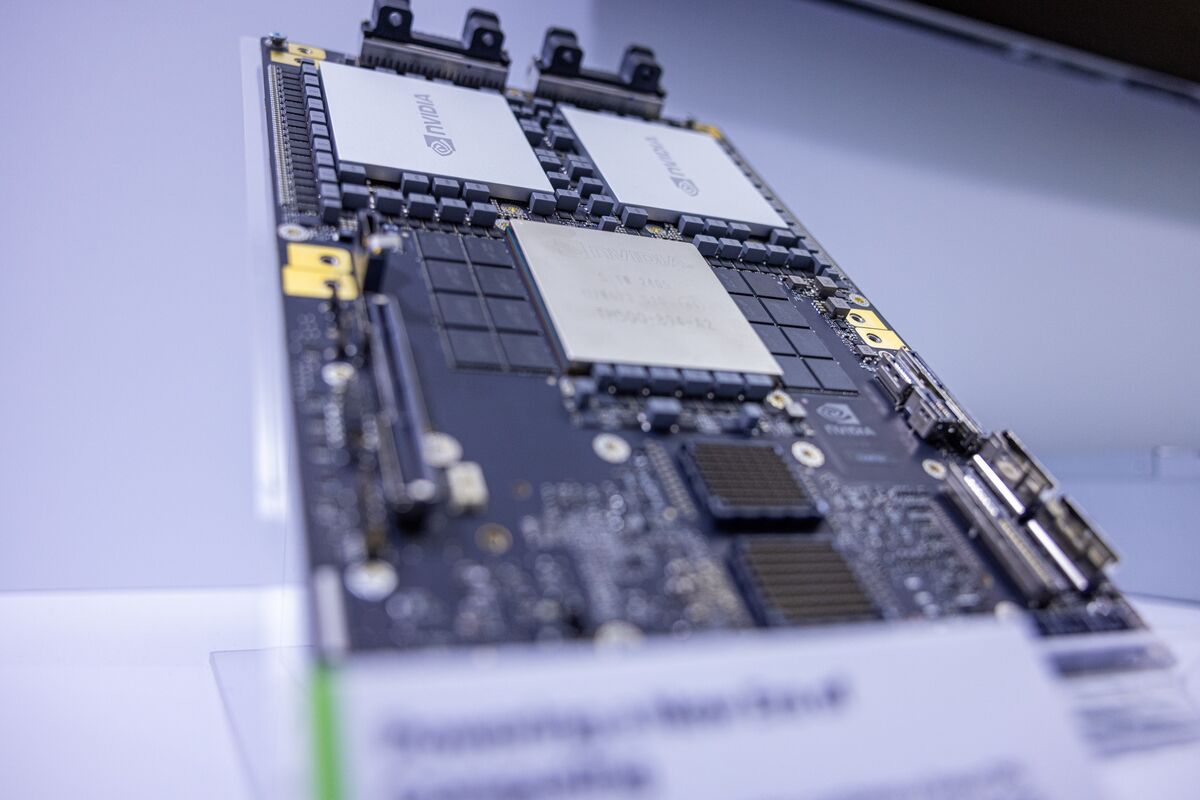

Nvidia's chips power AI systems, including generative AI, which is behind OpenAI's ChatGPT. The company has been a member of the so-called Magnificent Seven, mega-cap tech companies whose shares greatly outperformed the broader US stock market rally last year.

However, other billionaire investors have sold their shares of Nvidia in favor of other top stocks. For instance, Philippe Laffont's Coatue Management bought 10,027,552 shares of Taiwan Semiconductor Manufacturing (TSM), while Ken Griffin's Citadel Advisors bought 8,815,580 shares of Hess Corporation. Israel Englander's Millennium Management bought 4,021,500 shares of Merck & Co., and Stanley Druckenmiller purchased 2,525.070 shares of Coherent.

John Overdeck and David Siegel's Two Sigma Investments bought 8,419,014 shares of Pfizer, while David Tepper's Appaloosa Management bought 6,900,000 shares of Alibaba Group. These stocks offer investors exposure to different sectors and industries and may be seen as more stable or undervalued compared to Nvidia.

Despite the selloff in Nvidia's stock, some analysts remain bullish on the company's prospects. However, it is important for investors to consider diversifying their portfolios and not putting all their eggs in one basket.