In the realm of technology, Nvidia Corporation has been a standout performer in recent years. The company's stock has seen an incredible surge, increasing from $4 to $140.76 in less than 2 years. This impressive growth has made Nvidia one of the best-performing stocks not only within its industry but also outperforming the S&P 500 index by more than 35 times over the past five years.

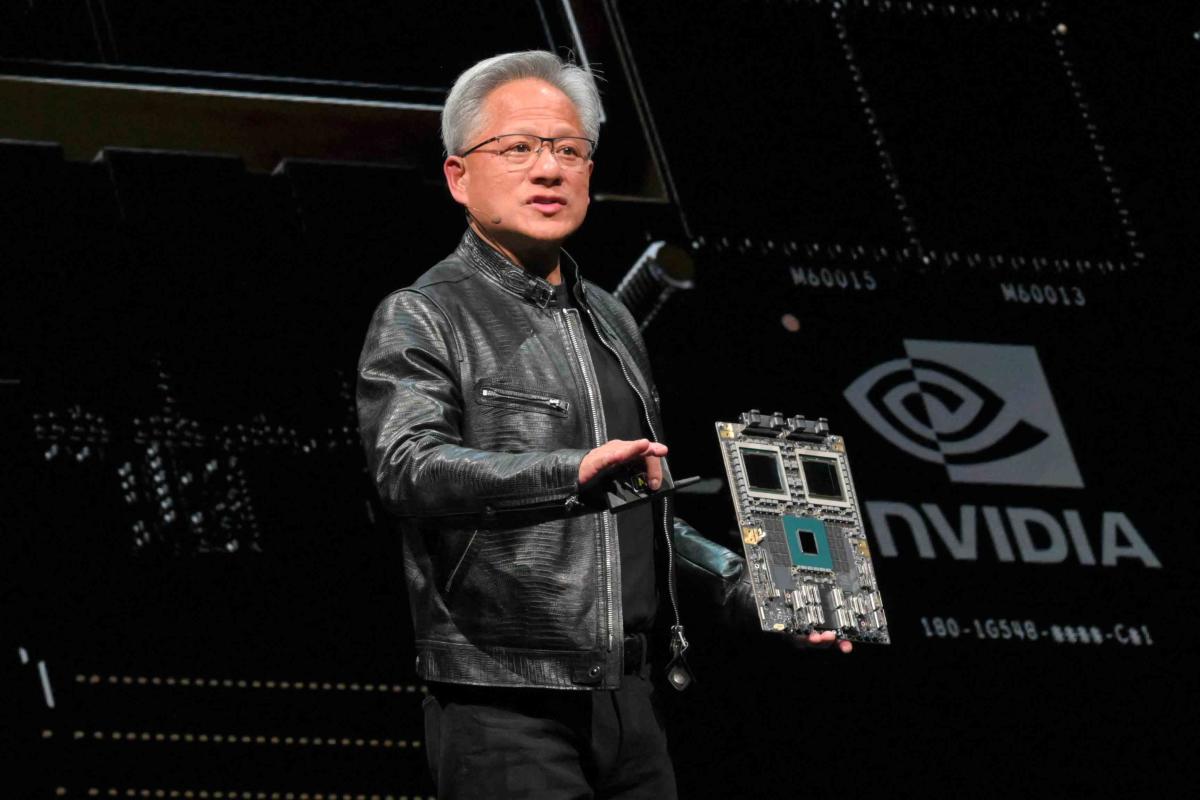

Nvidia's success can be attributed to its strong presence in the artificial intelligence (AI) market. The company's chips and other AI-related technologies have seen a significant increase in demand, driving up shares of Nvidia. In fact, Nvidia is one of the key players in the rapidly growing AI chip market.

The company has also benefited from its partnerships with major tech giants such as Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Meta Platforms (META). These partnerships have allowed Nvidia to expand its reach and further solidify its position in the AI market.

Despite a temporary dip in shares following the market downturn, Nvidia's stock has since rebounded strongly. The company's impressive financial results, including a 265% year-over-year revenue growth in the fourth quarter of fiscal year 2024, have contributed to this resurgence.

In conclusion, Nvidia Corporation has been a standout performer in the technology sector. Its strong presence in the AI market and partnerships with major tech giants have driven its stock to incredible heights. Despite a temporary dip, Nvidia's stock has since rebounded strongly, and the company continues to be a key player in the rapidly growing AI chip market.

Sources:

- https://finance.yahoo.com/news/nvidia-blackwell-launch-could-lift-210117570.html

- https://www.fool.com/investing/2024/07/10/nvda-stock-gain-2024-%E3%86%9Ai%E3%86%95s-stocks-ai-chip-%E3%86%9Ai-%E3