Seeking Alpha Investment Community

Seeking Alpha Investment Community is a platform that provides independent and balanced stock research, fundamental analysis tools, crowdsourced debate, reliable news, and actionable market data to empower investors to make the absolute best investing decisions. The site's news enables investors to understand why the market and stocks in their portfolio are moving or are about to move. The site's data places professional-caliber tools in the hands of every investor. The community includes everyone from new investors to fund managers.

90%

The Daily's Verdict

This news site has a mixed reputation for journalistic standards. It is advisable to fact-check, scrutinize for bias, and check for conflicts of interest before relying on its reporting.

Bias

95%

Examples:

- The source provides a balanced view of the news and market events without any clear signs of editorial slant or favoritism.

Conflicts of Interest

95%

Examples:

- The site does not appear to have any significant conflicts of interest or financial ties that would influence their reporting.

Contradictions

88%

Examples:

- There are instances where contradictory information is presented in the articles, such as conflicting data on deliveries for Tesla and discrepancies in reported earnings for certain companies.

Deceptions

80%

Examples:

- Some articles may contain misleading information or present a one-sided view of certain topics, but these instances are relatively rare.

Recent Articles

SIGGRAPH 2024: Immersive Mixed Reality Experiences and Revolutionizing Digital Art Creation

Broke On: Sunday, 28 July 2024

Loews Corp.: Q2 Earnings Surge as Insurance and Energy Businesses Thrive, Tisch Family Set to Maintain Leadership

Broke On: Monday, 29 July 2024Asian Stocks Surge on Anticipation of Central Bank Policy Meetings and Tech Earnings

Broke On: Monday, 29 July 2024:max_bytes(150000):strip_icc()/GettyImages-2163067200-c158e8b703a04360aa442ed34890b083.jpg)

McDonald's Beats Inflation with Successful Value Promotions: Second-Quarter Earnings Report

Broke On: Monday, 29 July 2024

Woodside Energy Acquires Tellurian Inc. for $900 Million: A New Player in the Global LNG Market

Broke On: Monday, 22 July 2024

Google Parent Company Alphabet in Advanced Talks to Acquire Cybersecurity Startup Wiz for $23 Billion: Largest Acquisition to Date

Broke On: Monday, 15 July 2024

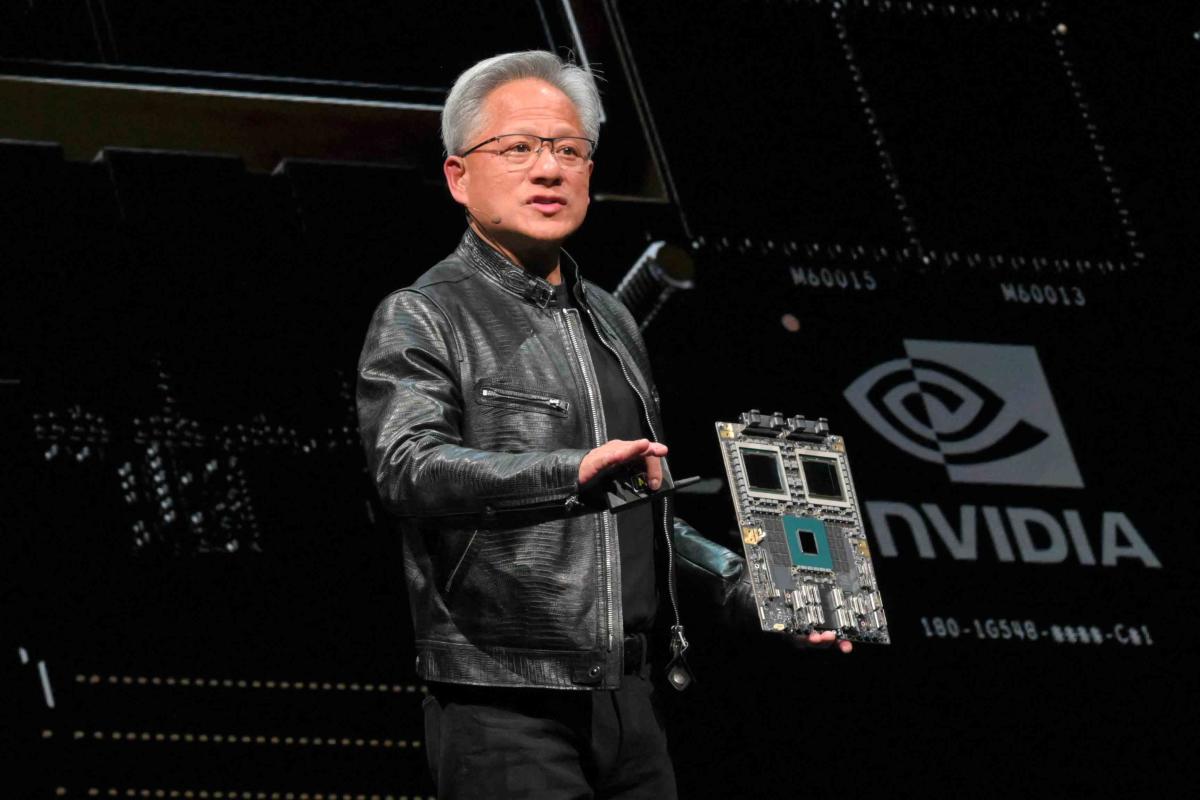

Nvidia's Stock Surges: A Key Player in the Rapidly Growing AI Chip Market

Broke On: Saturday, 13 July 2024

Record-Breaking Home Inventory in the Southern US: Is a Housing Market Crash on the Horizon?

Broke On: Monday, 08 July 2024

New Echo Spot: Amazon's Upgraded Alarm Clock with Improved Visuals and Audio for $44.99

Broke On: Monday, 08 July 2024