Nvidia, a leading AI chip company, is predicted to have an abundance of financial success in the coming years. With its unique 'full stack' approach that combines hardware and software, Nvidia has gained a significant advantage in the booming AI space. Tech analyst Ben Reitzes of Melius Research believes that Nvidia will generate $270 billion in cash over the next three years, potentially leading to huge returns for shareholders.

Despite not being eager to discuss potential stock buybacks, Reitzes suggests that Nvidia's cash surplus will have nowhere else to go but towards shareholders as it cannot invest heavily in R&D or make large purchases. Nvidia has already returned capital to shareholders through a $25 billion repurchase program and a boosted quarterly cash dividend.

Nvidia's annual cadence of innovating new products allows developers and customers to anticipate upgrades and budget accordingly, giving the company an edge over rivals. The recent financials show that Nvidia's ability to generate cash is accelerating, with net cash provided by operating activities soaring to $28.1 billion in the fiscal year that ended in January from $5.6 billion in the prior year.

Despite ongoing selloffs and concerns about competitors building custom AI chips, history suggests they will need a comparable software ecosystem to displace Nvidia. Nvidia remains one of the best ways for investors to expose their portfolios to AI, a market forecasted to grow by 36% annually through 2030.

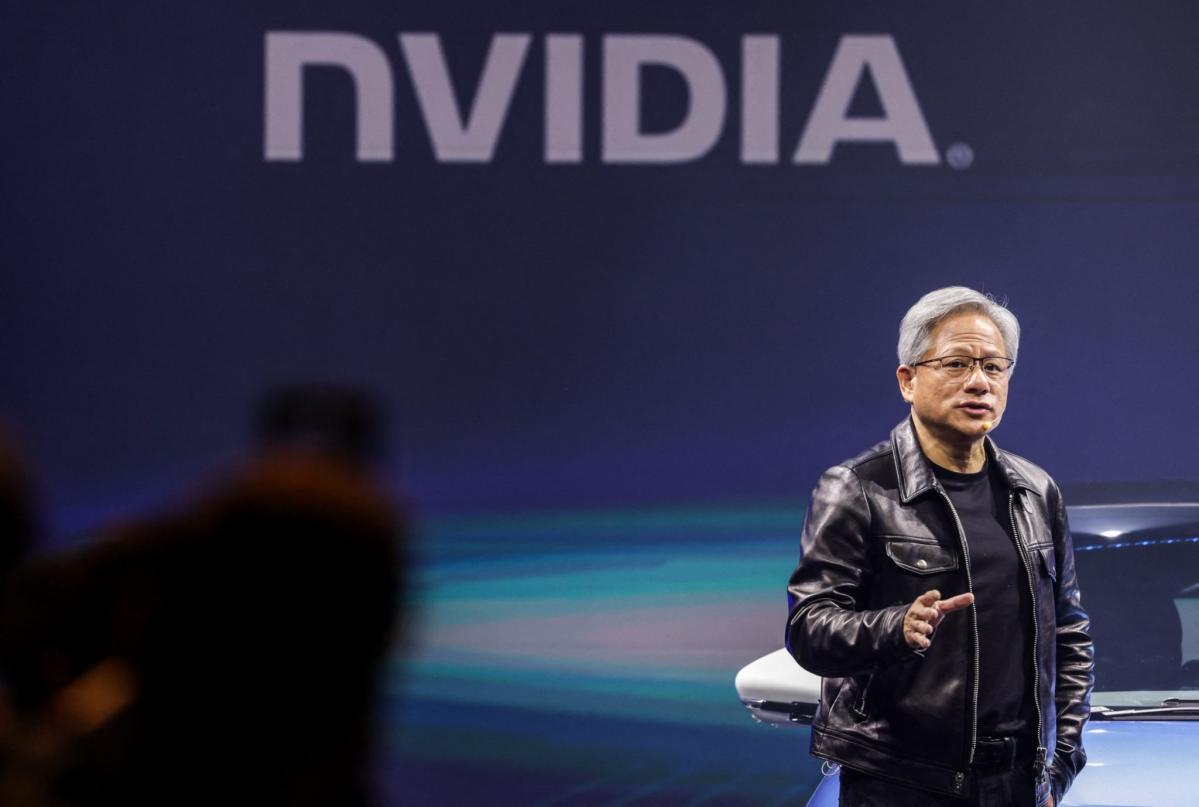

Nvidia's CEO, Jensen Huang, has also expressed confidence in the company's continued success. At the annual shareholder meeting on Wednesday, he stated that Nvidia will remain the gold standard for AI training chips amid concerns about rivals cutting into his market share. The rollout of Nvidia's Blackwell system later this year is expected to cement its lead.

Reitzes has set a price target of $160 on Nvidia stock, implying a 30% gain from Friday's closing price.