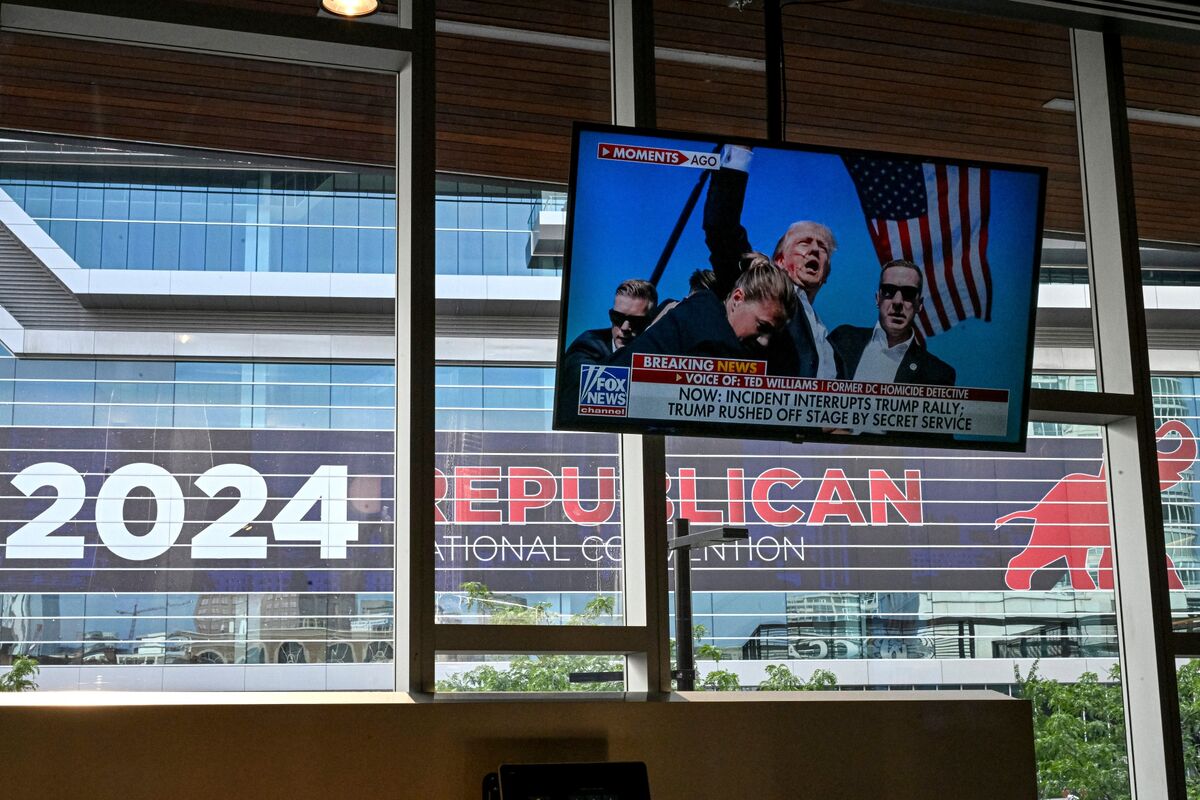

Former President Donald Trump was injured in a shooting incident at a presidential campaign rally in rural Pennsylvania on July 16, 2024. One person was killed and two others were seriously injured but reportedly in stable condition after the shooting. The suspected shooter, Thomas Matthew Crooks, is deceased and the investigation into his background and motives is ongoing.

The political turmoil following the shooting has led Wall Street to calculate its potential impact on financial markets. Historically, after ten prior assassination attempts of presidents and presidential candidates, the Dow Jones Industrial Average tended to be down an average of 1.1% in the first day of trading following such violent episodes.

Meanwhile, bond traders are closely watching the Federal Reserve for a potential rate cut that could give a boost to US Treasury yields. The Republican candidate's plans for tax cuts and higher tariffs have put pressure on long-term Treasury bonds, sending their yields higher. If the GOP gains control of Congress in a sweep, it may worsen US finances and ignite inflation.

Investors are also keeping an eye on potential mergers and acquisitions that could be approved under a second Trump presidency. The Trump administration is expected to be more lenient when it comes to such deals than the current Biden administration. JPMorgan, Goldman Sachs, Morgan Stanley, and Bank of America are among the investment banks that could benefit from this policy shift.

However, environment-related companies like Enphase, SolarEdge, Sunrun and Sunnova may see earnings decrease if government subsidies are taken away under a Trump administration. During his first term in office, the Trump administration rolled back over 100 environmental policies.