Investors.com Financial News Site Analysis - Comprehensive Report on Market Coverage and Analysis - Overall Rating: 90/100 (Highly Reliable, Informative, and Engaging Source of Financial Information).

Investors.com is a comprehensive financial news site that provides in-depth analysis and reporting on the stock market, individual stocks, and economic events. The site presents information in a critical manner, highlighting fallacies, deceptions, and conflicts of interest while also providing detailed explanations of financial concepts and market trends. The site's articles often include specific examples with sources to support their claims.

88%

The Daily's Verdict

This news site has a mixed reputation for journalistic standards. It is advisable to fact-check, scrutinize for bias, and check for conflicts of interest before relying on its reporting.

Bias

98%

Examples:

- The site presents information in a manner that is highly critical of fallacies, deceptions, and conflicts of interest.

Conflicts of Interest

99%

Examples:

- The articles often highlight potential conflicts of interest and their impact on the market.

- The site frequently discusses conflicts of interest and provides specific examples with sources.

Contradictions

75%

Examples:

- The articles often highlight contradictions and provide specific examples with sources.

- There are instances where the site provides detailed explanations of the contradictions.

Deceptions

68%

Examples:

- The articles may mention specific instances of deception, but it is not a primary focus of the site.

- The site occasionally points out deceptive practices in the market.

Recent Articles

Federal Reserve Policy Meeting and Tech Giants' Earnings: A Week of Significant Developments in Finance

Broke On: Monday, 29 July 2024

Tech Giants Earnings Report: AI Euphoria and Consumer Spending Concerns Hit US Stock Market

Broke On: Saturday, 27 July 2024

Tesla's Q2 2024 Profits Plummet by 45%, Yet Optimism Persists for Future AI Projects

Broke On: Tuesday, 23 July 2024

Nvidia Leads Tech Sell-Off: Markets Shift Away from Megacaps, Small-Caps Surge

Broke On: Friday, 19 July 2024

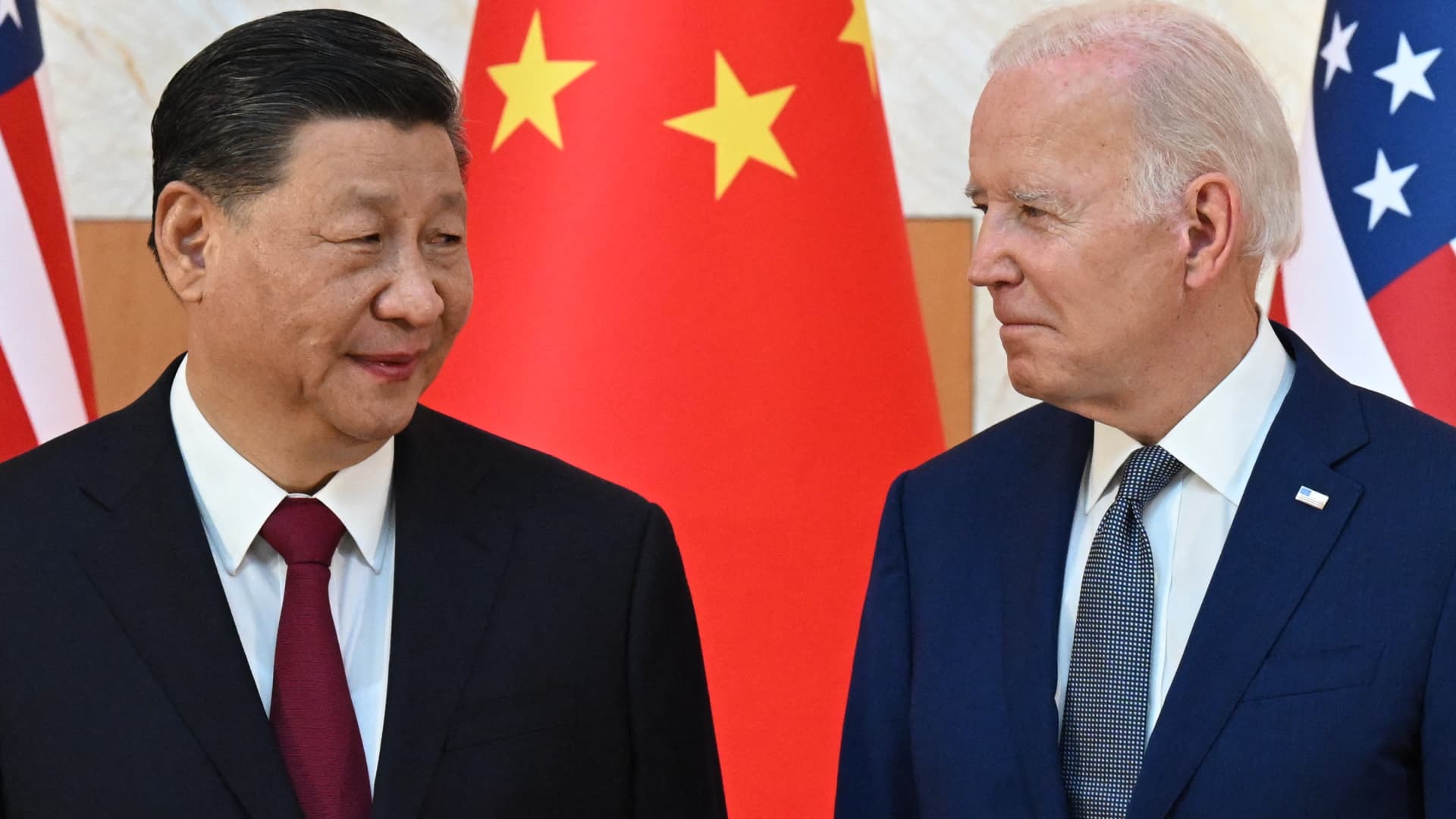

US Export Restrictions and Geopolitical Tensions Send Global Chip Stocks Plummeting: ASML, Nvidia, TSMC, and Tokyo Electron Affected

Broke On: Wednesday, 17 July 2024

Dow Jones Surges Past Record Highs: Blue Chips Lead Market Rally Amid Fed Rate Cut Expectations and Strong Earnings

Broke On: Tuesday, 16 July 2024

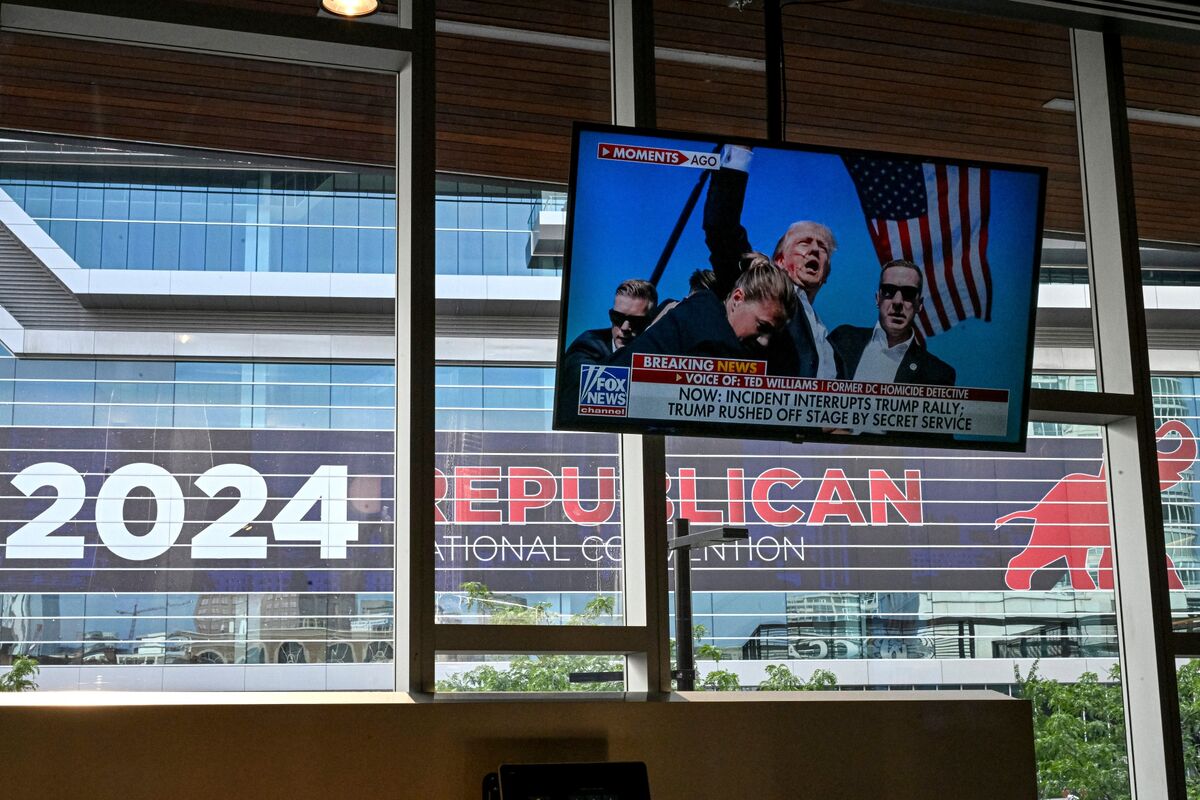

Former President Trump Injured in Shooting Incident: Impact on Financial Markets and Potential Policy Changes

Broke On: Monday, 15 July 2024Record-Breaking S&P 500: Tech Cuts Boost Earnings for 493 Companies Amid Market Breadth Concerns

Broke On: Saturday, 13 July 2024

New Study Finds Diabetes Drug Ozempic May Prevent Cognitive Decline and Substance Misuse

Broke On: Friday, 12 July 2024