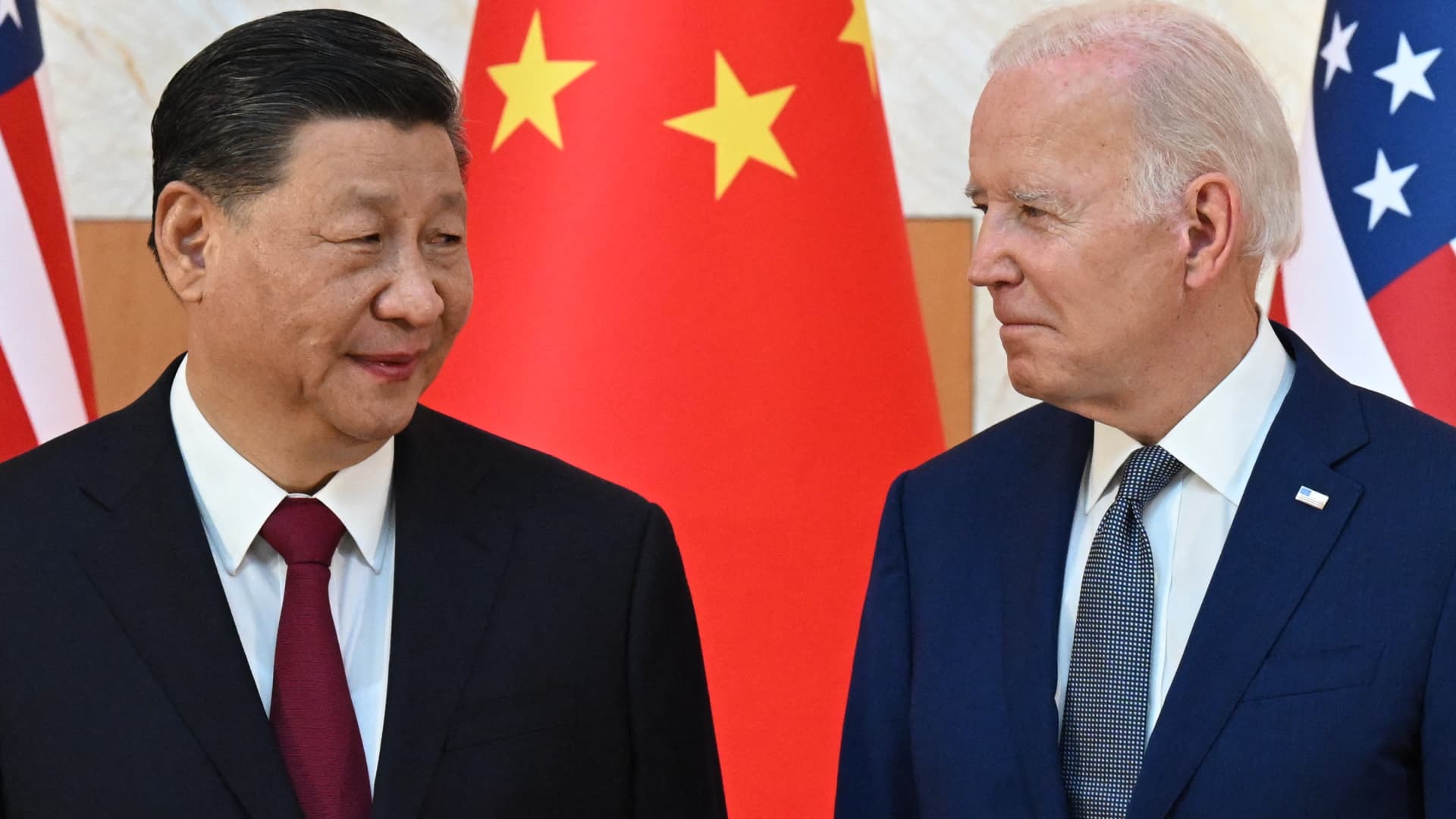

Global chip stocks experienced significant declines on July 17, 2024, with ASML, Nvidia, TSMC, and Tokyo Electron among those posting drops due to reports of tighter US export restrictions and geopolitical tensions. The Biden administration is reportedly considering a rule to clamp down on companies exporting critical chipmaking equipment to China under the US foreign direct product rule (FDPR). This regulation allows controls on foreign-made products even with minimal American technology involvement, potentially affecting non-US companies. President Joe Biden and Chinese counterpart Xi Jinping are expected to meet at the APEC summit in November. Meanwhile, former US President Donald Trump's comments have raised doubts about US commitment to defend Taiwan if he becomes president and during a potential attack by China.

TSMC is expected to report a 30% rise in second-quarter profit on July 18, 2024, thanks to soaring demand for advanced chips used in artificial intelligence applications. The company has benefited from the surge towards AI and has spent billions building new factories overseas. However, ASML's Q3 revenue guidance was light despite its strong earnings report and surging bookings.

The geopolitical tensions and Trump's comments weighed on chip stocks in the US as well, with the VanEck Semiconductor ETF down 3.5% in premarket trading, Nvidia falling 4%, and Arm and Applied Materials among other laggards.

The Biden administration's potential export restrictions could impact not only Taiwanese companies but also Dutch-based ASML and others. The US FDPR allows controls on foreign-made products even if they use the smallest amount of American technology, potentially affecting non-US companies. This move comes as tensions between the US and China continue to escalate over various issues, including trade disputes and territorial claims.

The geopolitical tensions also raise concerns about Taiwan's defense if Trump becomes president again. In a Bloomberg Businessweek interview published late on July 16, 2024, Trump claimed that Taiwan should pay the US for defense and questioned its value as an ally. This comment has raised doubts about the US commitment to defend Taiwan from a Chinese attack if Trump returns to power.

TSMC's second-quarter earnings are due on July 18, 2024, and investors will be closely watching for any updates on the company's outlook for the current quarter and full year. The chipmaker has maintained its guidance for capital spending this year at $28 billion to $32 billion but could potentially raise it given the strong demand for advanced chips.