Title: Intel and AMD's Expanding Roles in the AI Era: A Gradual Progress

The race for dominance in the Artificial Intelligence (AI) era is heating up, with Intel Corporation (NASDAQ: INTC) and Advanced Micro Devices (AMD) making significant strides to increase their roles in this burgeoning industry. Both companies have been investing heavily in AI chips and expanding their manufacturing capacities.

Intel's Gaudi 3 accelerator, which is more powerful and efficient than Nvidia's H100 according to the company, is a testament to its commitment to becoming a leading player in the foundry market. Intel dominates the x86 laptop CPUs market with a 75% market share, while AMD has gained ground with cheaper and more advanced CPUs.

AMD, on the other hand, is also making waves in the AI chip race. The company expects to release a new chip, MI350, in 2025 that will perform 35 times better in inference compared to its currently available MI300 series. AMD also unveiled the MI400 series, scheduled for 2026 and based on an architecture called 'Next'.

Despite their progress, both Intel and AMD face stiff competition from Nvidia Corporation (NVDA), which has had an early lead in the AI chip race. However, Intel's solid exposure to AI and data centers, as well as its larger R&D budget compared to Nvidia and AMD, position it well for gains in the accelerating spending on data centers and AI.

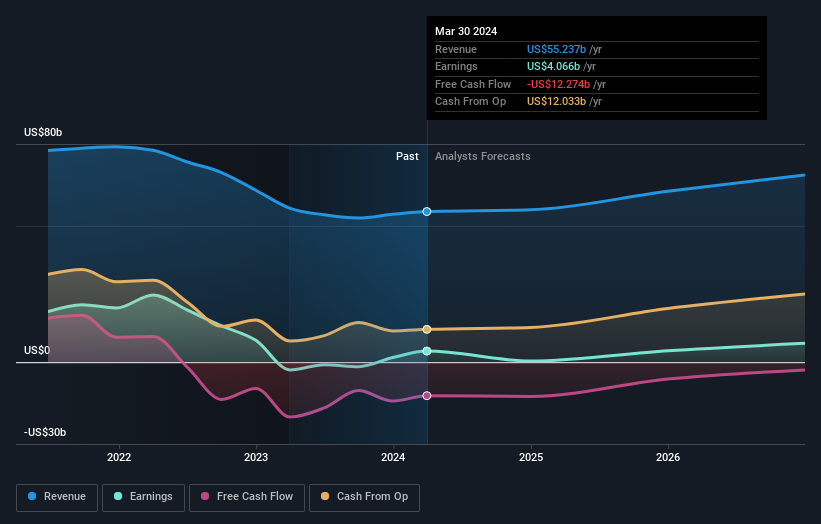

Price Considerations Intel Corporation's share price has seen significant movement in recent months, ranging from US$29.85 to US$44.52. Its price-to-earnings ratio is 32.7x, slightly above the industry average of 30.82x.

However, Intel's earnings are expected to increase by 81% in the next few years, making it an attractive investment opportunity for value investors.

Conclusion Both Intel and AMD are making significant strides in the AI era by expanding their roles and investing heavily in AI chips. Despite competition from Nvidia, their solid exposure to AI and data centers, as well as larger R&D budgets, position them well for gains in the accelerating spending on data centers and AI.