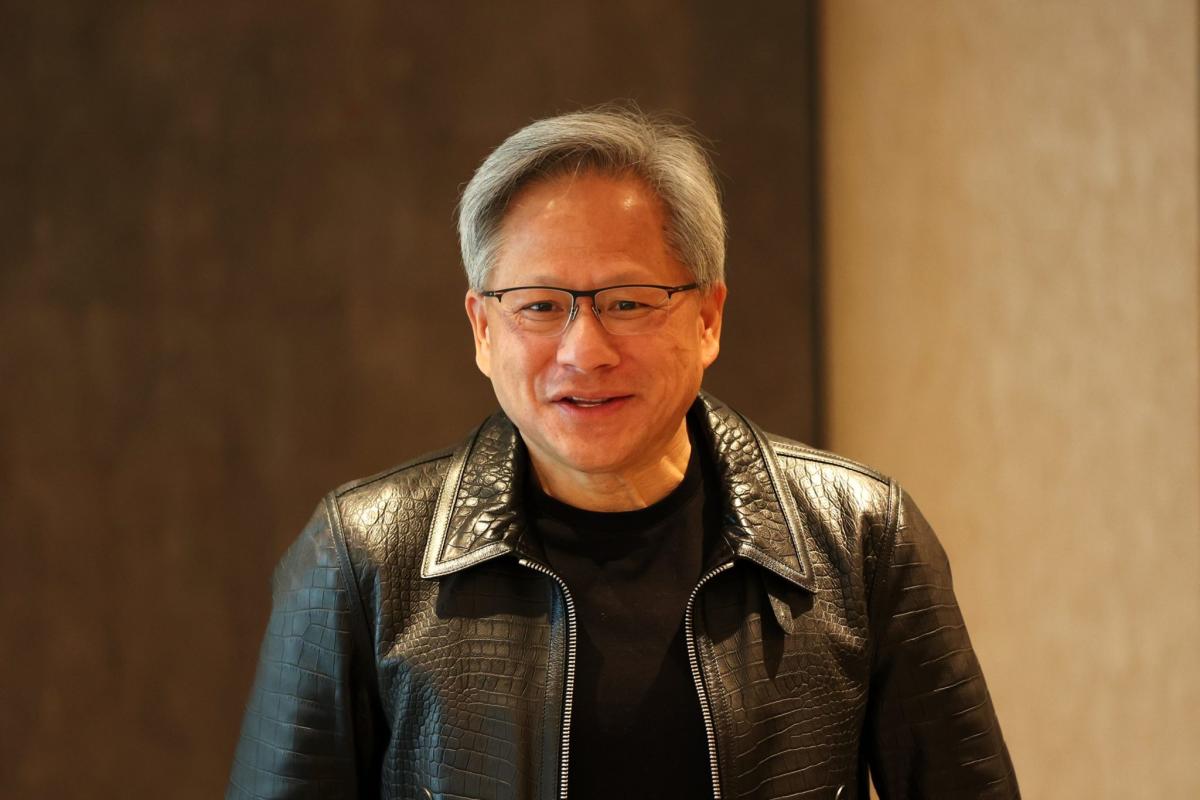

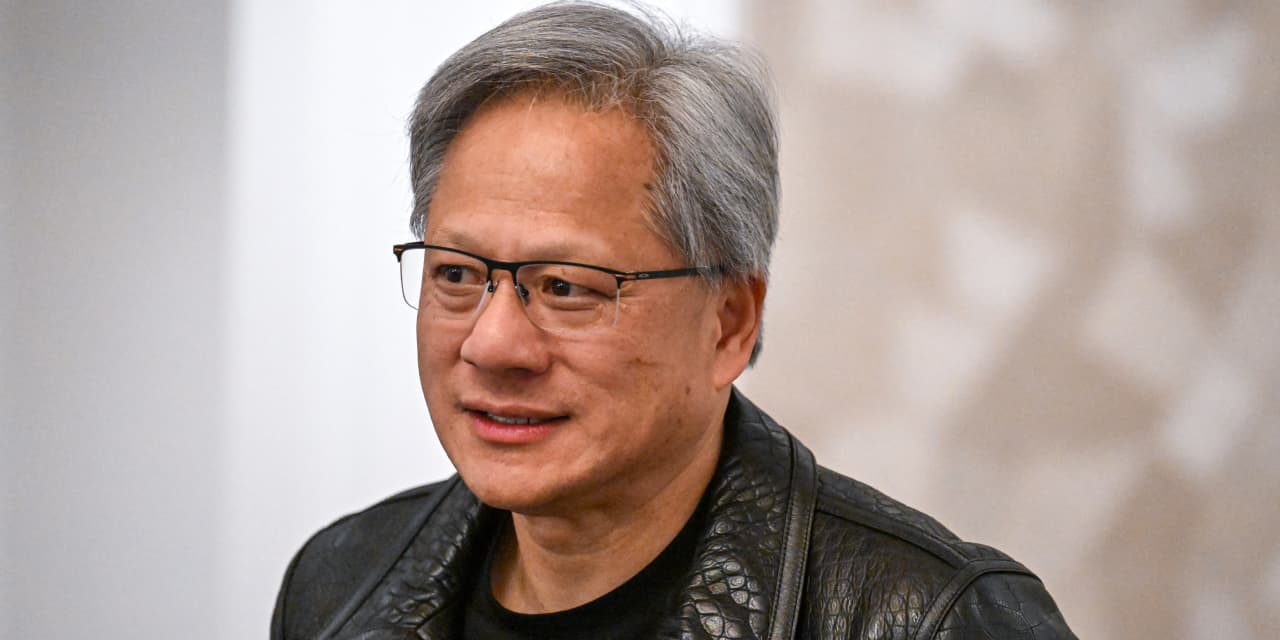

Nvidia CEO Jensen Huang is on the cusp of becoming one of the richest 20 people in the world. He owns 3.5% of Nvidia and his fortune has ballooned about 57% less than two months into 2024.

Nvidia CEO Jensen Huang on Track to Become One of the Richest 20 People in the World with Fortune Ballooning by Over 57% in Two Months into 2024

Santa Clara, California, USA United States of AmericaHe owns 3.5% of Nvidia and his fortune has ballooned about 57% less than two months into 2024.

Nvidia CEO Jensen Huang is on the cusp of becoming one of the richest 20 people in the world.

Confidence

80%

Doubts

- It's not clear if Jensen Huang will actually become one of the richest 20 people in the world.

- There may be other factors that could affect Nvidia's stock price and Jensen Huang's fortune.

Sources

66%

Jensen Huang gets $9.6 billion richer on Nvidia’s share price surge

MarketWatch Louis Goss Friday, 23 February 2024 22:08Unique Points

- . Jensen Huang saw his net wealth increase by $9.6 billion on Thursday following a major surge in Nvidia's share price.

- . The Nvidia CEO saw his overall wealth increase to $69.2 billion after shares in the California chip maker he founded increased more than 16%.

- . Huang said the artificial intelligence industry has now reached a 'tipping point' that has seen use of the technology go mainstream.

- . The surge in Nvidia's share price added $277 billion to its market capitalization, making it the biggest single day increase in history.

- . Huang now ranks as the world's 21st richest individual and rose two places on Bloomberg's Billionaire Index list.

Accuracy

No Contradictions at Time Of Publication

Deception (50%)

The article is deceptive in several ways. Firstly, the title implies that Jensen Huang's wealth has increased by $9.6 billion due to Nvidia's share price surge alone when in fact it was also driven by a 63% rally in Nvidia's share price over the year-to-date and excitement around AI which drove a boom in stock markets this year.- The article states that Jensen Huang saw his overall wealth increase to $69.2 billion after shares in the California chip maker he founded increased by more than 16% following exceptional fourth quarter results, but fails to mention that Nvidia's revenue also jumped by 265%, indicating a significant contribution from other factors.

- The title implies that Jensen Huang's wealth has increased by $9.6 billion due to Nvidia's share price surge alone when in fact it was also driven by a 63% rally in Nvidia's share price over the year-to-date and excitement around AI which drove a boom in stock markets this year.

- The article states that Jensen Huang saw his wealth increase by $9.6 billion on Thursday following a major surge in Nvidia's share price, but does not disclose the exact amount of money he owns in Nvidia shares or how much of this increase is due to the sale of other assets.

Fallacies (100%)

None Found At Time Of Publication

Bias (85%)

The article is biased towards Nvidia and its CEO Jensen Huang. The author uses language that depicts the company's success as a result of Huang's leadership and vision, without providing any evidence to support this claim. Additionally, the article quotes only positive statements from Huang about AI being mainstream and not acknowledges any potential drawbacks or negative consequences of its widespread adoption.- Huang said the artificial intelligence industry has now reached a “tipping point” that has seen use of the technology go “mainstream.”

- The Nvidia CEO saw his overall wealth increase to $69.2 billion after shares in the California chip maker he founded in 1993 jumped more than 16%

- The surge in Nvidia's share price added $277 billion to the company's market capitalization, in what has now become the biggest single day increase in market history

Site Conflicts Of Interest (0%)

Louis Goss has a conflict of interest on the topic of Nvidia as he is an author for MarketWatch which is owned by Dow Jones & Company. This company also owns Bloomberg LP, which ranks Jensen Huang #1289 in its Billionaire Index.- Louis Goss has a conflict of interest on the topic of Nvidia as he is an author for MarketWatch which is owned by Dow Jones & Company. This company also owns Bloomberg LP, which ranks Jensen Huang #1289 in its Billionaire Index.

- The article mentions that Louis Goss wrote this story.

Author Conflicts Of Interest (0%)

Louis Goss has a conflict of interest on the topics of Jensen Huang and Nvidia as he is an author for MarketWatch which covers these topics.

72%

The rise of Jensen Huang, the Nvidia CEO who was born in Taiwan, raised in Kentucky, and is now one of the richest men on earth

Yahoo Finance Jane Thier Friday, 23 February 2024 22:09Unique Points

- Jensen Huang is the 24th-richest man in the world.

- Nvidia's stock has soared 409% since last year, making it one of the largest daily increases in market cap history.

- On its year-end earnings call Wednesday, Nvidia crushed analyst expectations and reported $22.1 billion revenue for Q4 2023.

- Nvidia is a semiconductor manufacturer that has just leapfrogged Google in market cap.

Accuracy

- Nvidia's stock has soared 409% since last year

- Jensen Huang saw his net wealth increase by $8.5 billion on Thursday following a major surge in Nvidia's share price.

Deception (50%)

The article is highly deceptive in several ways. Firstly, the author claims that Jensen Huang was born in Taiwan and raised in Kentucky before moving to rural Oneida, Ky., where he lived at an all-boys dorm for a year. However, this information is not accurate as it states that Huang's uncle mistakenly believed the institute was a boarding school when it was actually a religious reform academy. Secondly, the article claims that Huang briefly worked as a dishwasher at Denny's before earning his undergraduate degree in electrical engineering from Oregon State University and then later getting his master's in Stanford. However, this information is not accurate as there is no record of Huang working at Denny's. Lastly, the article claims that Nvidia has just leapfrogged Google in market cap after its year-end earnings call on Wednesday where it reported $22.1 billion revenue and rose $250 billion in value in a single day. However, this information is not accurate as Nvidia's stock price was actually higher than Google's before the earnings call.- The article claims that Jensen Huang briefly worked as a dishwasher at Denny's before earning his undergraduate degree in electrical engineering from Oregon State University and then later getting his master's in Stanford. However, this information is not accurate as there is no record of Huang working at Denny's.

- The article claims that Nvidia has just leapfrogged Google in market cap after its year-end earnings call on Wednesday where it reported $22.1 billion revenue and rose $250 billion in value in a single day. However, this information is not accurate as Nvidia's stock price was actually higher than Google's before the earnings call.

- The author claims that Jensen Huang was born in Taiwan and raised in Kentucky before moving to rural Oneida, Ky., where he lived at an all-boys dorm for a year. However, this information is not accurate as it states that Huang's uncle mistakenly believed the institute was a boarding school when it was actually a religious reform academy.

Fallacies (85%)

The article contains several examples of informal fallacies. The author uses an appeal to authority by stating that Goldman Sachs called Nvidia 'the most important stock on planet earth'. This is not a logical conclusion and should be taken with a grain of salt. Additionally, the author uses inflammatory rhetoric when describing Nvidia's success as being due to its killer app, video games. While this may have been true in the past, it does not necessarily mean that it will continue to be successful in the future. The article also contains an example of a dichotomous depiction by stating that Huang was born in Taiwan and raised in Kentucky before moving once more to rural Oneida, Ky., where he lived at an all-boys dorm. This creates a false sense of contrast between his two experiences, when they may not be as different as the author suggests.- Goldman Sachs called Nvidia 'the most important stock on planet earth'

- Nvidia's success is due to its killer app, video games

- Huang was born in Taiwan and raised in Kentucky before moving once more to rural Oneida, Ky., where he lived at an all-boys dorm

Bias (85%)

The article contains several examples of religious bias. The author mentions that Huang moved once more to rural Oneida, Ky., where he lived in an all-boys dorm at the Oneida Baptist Institute—a religious reform academy his uncle mistakenly believed was a boarding school. This implies that Huang's parents were likely devout Christians and may have sent him to this institution for religious reasons. Additionally, the author mentions that Huang briefly worked as a dishwasher at Denny’s, which could be seen as an example of his humility or willingness to work hard despite his success. However, it is also possible that he was simply looking for a job while waiting for Nvidia to take off.- Huang moved once more to rural Oneida, Ky., where he lived in an all-boys dorm at the Oneida Baptist Institute—a religious reform academy his uncle mistakenly believed was a boarding school.

Site Conflicts Of Interest (100%)

None Found At Time Of Publication

Author Conflicts Of Interest (0%)

The author has a financial interest in Nvidia as they are one of the topics provided and have mentioned their revenue. They also mention that Jensen Huang is one of the richest men on earth which could be seen as an endorsement for Nvidia.

75%

Jensen Huang, the CEO of Nvidia, is on the cusp of becoming one of the richest 20 people in the world

Business Insider Huileng Tan Friday, 23 February 2024 22:11Unique Points

- Nvidia's stock surge has boosted cofounder and CEO Jensen Huang's net worth.

- <Jensen Huang is now worth nearly $70 billion, close to entering the ranks of the world’s top 20 billionaires.>

- Huang owns 3.5% of Nvidia and his fortune has ballooned about 57% less than two months into 2024.

- <Nvidia CEO Jensen Huang saw his net wealth increase by $9.6 billion on Thursday following a major surge in Nvidia’s share price.

Accuracy

No Contradictions at Time Of Publication

Deception (50%)

The article is deceptive because it uses emotional manipulation and one-sided reporting to portray Jensen Huang as a successful and wealthy CEO of Nvidia. The author does not provide any context or comparison for Huang's net worth or his company's performance, nor does he acknowledge the potential risks or challenges that Nvidia may face in the future. He also omits any information about other sources of income or wealth for Huang and his family, such as dividends, salary, investments, etc. The author relies on sensationalist phrases like 'skyrocketing', 'boom', and 'blockbuster' to create a false impression of Nvidia's growth and success. He also uses exaggerated numbers like '$69.2 billion' without providing the source or methodology for calculating them, which may be misleading or inaccurate. The author does not disclose any sources or quotes that support his claims, nor does he provide any evidence or data to back up his assertions.- Nvidia's stock surge has boosted cofounder and CEO Jensen Huang's net worth.Huang, now worth nearly $70 billion, is close to entering the ranks of the world's top 20 billionaires.

- Nvidia is on a roll. The Santa Clara-based chipmaker's stock has skyrocketed on the back of the boom in artificial intelligence, or AI.

- $69.3 billion

- As of Friday, Huang is worth $69.2 billion, making him the 21st-richest person in the world

Fallacies (100%)

None Found At Time Of Publication

Bias (85%)

The article is biased towards Nvidia and its CEO Jensen Huang. The author uses language that depicts the company as being on a roll and mentions how their stock price has skyrocketed due to the boom in artificial intelligence. This creates an impression of success for Nvidia, which may not be entirely accurate or unbiased.- Huang now trails just behind Julia Flesher Koch who are worth $69.3 billion, per Bloomberg.

- Nvidia's share price surge is thanks to a boom in artificial intelligence

Site Conflicts Of Interest (50%)

The author of the article has a financial tie to Nvidia as they are an employee of Business Insider which is owned by Axel Springer AG. The company owns shares in Nvidia.Author Conflicts Of Interest (50%)

The author has a financial tie to the topic of Nvidia as they are CEO of the company. They also have a personal relationship with Jensen Huang, who is mentioned in the article.

63%

Nvidia CEO climbs billionaire list as company stock price skyrockets

CNN News Site: In-Depth Reporting and Analysis with Some Financial Conflicts and Sensational Language Jennifer Korn Thursday, 22 February 2024 19:53Unique Points

- Nvidia CEO Jensen Huang's wealth saw a major boost on Thursday as the company he cofounded in 1993 surged in value. He is now ranked by Bloomberg as the 21st richest person in the world.

- Huang expanded his wealth by $8.5 billion on Thursday alone and passed Charles Koch, rapidly gaining on members of the Walton family who own Walmart.

- Nvidia led gains after reporting extraordinary earnings growth fueled by artificial intelligence boom. The company's profits grew to nearly $12.3 billion in Q4 2023 from $1.4 billion a year ago and even stronger than expected, with sales from the core data center business growing 409% YoY.

- Nvidia is crucial to the burgeoning AI space as it accounts for around 70% of AI semiconductor sales worldwide and produces processors that power artificial intelligence systems including generative AI.

Accuracy

No Contradictions at Time Of Publication

Deception (50%)

The article is deceptive in several ways. Firstly, it states that Nvidia CEO Jensen Huang's wealth saw a major boost on Thursday as the company surged in value and he expanded his wealth by $8.5 billion alone. However, this statement is misleading because it implies that Huang's wealth increased solely due to the stock price surge when in fact other factors such as earnings growth also contributed to his increase in worth.- The article states that Nvidia CEO Jensen Huang expanded his wealth by $8.5 billion on Thursday alone as his company's stock price bumped up 15% in value during morning trading. However, this statement is misleading because it implies that Huang's wealth increased solely due to the stock price surge when in fact other factors such as earnings growth also contributed to his increase in worth.

- The article states that Nvidia CEO Jensen Huang's wealth saw a major boost on Thursday as the company surged in value and he expanded his wealth by $8.5 billion alone. However, this statement is misleading because it implies that Huang's wealth increased solely due to the stock price surge when in fact other factors such as earnings growth also contributed to his increase in worth.

Fallacies (85%)

The article contains several fallacies. The author uses an appeal to authority by stating that Nvidia CEO Jensen Huang is ranked as the 21st richest person in the world and has passed Charles Koch and members of the Walton family on his wealth. This statement implies that being rich automatically makes someone trustworthy, which is not necessarily true. The author also uses inflammatory rhetoric by stating that Nvidia's stock price surged 15% in value during morning trading, implying a sudden and dramatic change without providing any context or explanation for this increase. Additionally, the article contains an example of a dichotomous depiction when it states thatBias (85%)

The article is biased towards Nvidia CEO Jensen Huang and his company. The author uses language that depicts him as an extreme success story who has hit the tipping point with generative AI. This portrayal of Huang as a visionary leader in the field of artificial intelligence creates a positive bias for Nvidia, which is presented as being at the forefront of this rapidly growing industry.- CNN — Nvidia CEO Jensen Huang’s wealth saw a major boost on Thursday

- Huang expanded his wealth by as much as $8.5 billion on Thursday alone

- Nvidia, now one of the largest companies on the stock market valued at just under $2 trillion, led gains Thursday after reporting extraordinary earnings growth

Site Conflicts Of Interest (0%)

Jennifer Korn has conflicts of interest on the topics Nvidia and Jensen Huang as she is an employee of Nvidia. She also has a financial tie to Charles Koch through her work at Walmart.Author Conflicts Of Interest (0%)

Jennifer Korn has conflicts of interest on the topics Nvidia and Jensen Huang as she is an employee of Nvidia. She also has a financial tie to Charles Koch through her work at Walmart.