The Magnificent 7, a group of seven tech giants that accounted for 45% of the S&P 500 return in January, has been performing exceptionally well. The group includes Nvidia (NVDA), Tesla (TSLA), Meta Platforms (META) and others. Despite concerns about a potential recession or inflation, investors are penciling in a soft landing for the economy with 75% of them expecting one.

The Magnificent 7: Tech Giants Dominate S&P 500 Return in January and Expect Soft Landing for the Economy

San Francisco, California United States of AmericaDespite concerns about potential recession or inflation, investors expect a soft landing for the economy with 75% of them expecting one

Nvidia (NVDA), Tesla (TSLA), Meta Platforms (META) and others are included in this group

The Magnificent 7 is a group of seven tech giants that accounted for 45% of the S&P 500 return in January

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/C3BD5QQZTNEMBAM7D35YO7ZH6A.png)

Confidence

80%

Doubts

- It is not clear if there will be a recession or inflation, which could affect the performance of these tech giants and impact their ability to land softly for the economy.

Sources

70%

Why you must now be concerned about the hot 'Magnificent 7' trade

Yahoo Finance Brian Sozzi Monday, 05 February 2024 16:32Unique Points

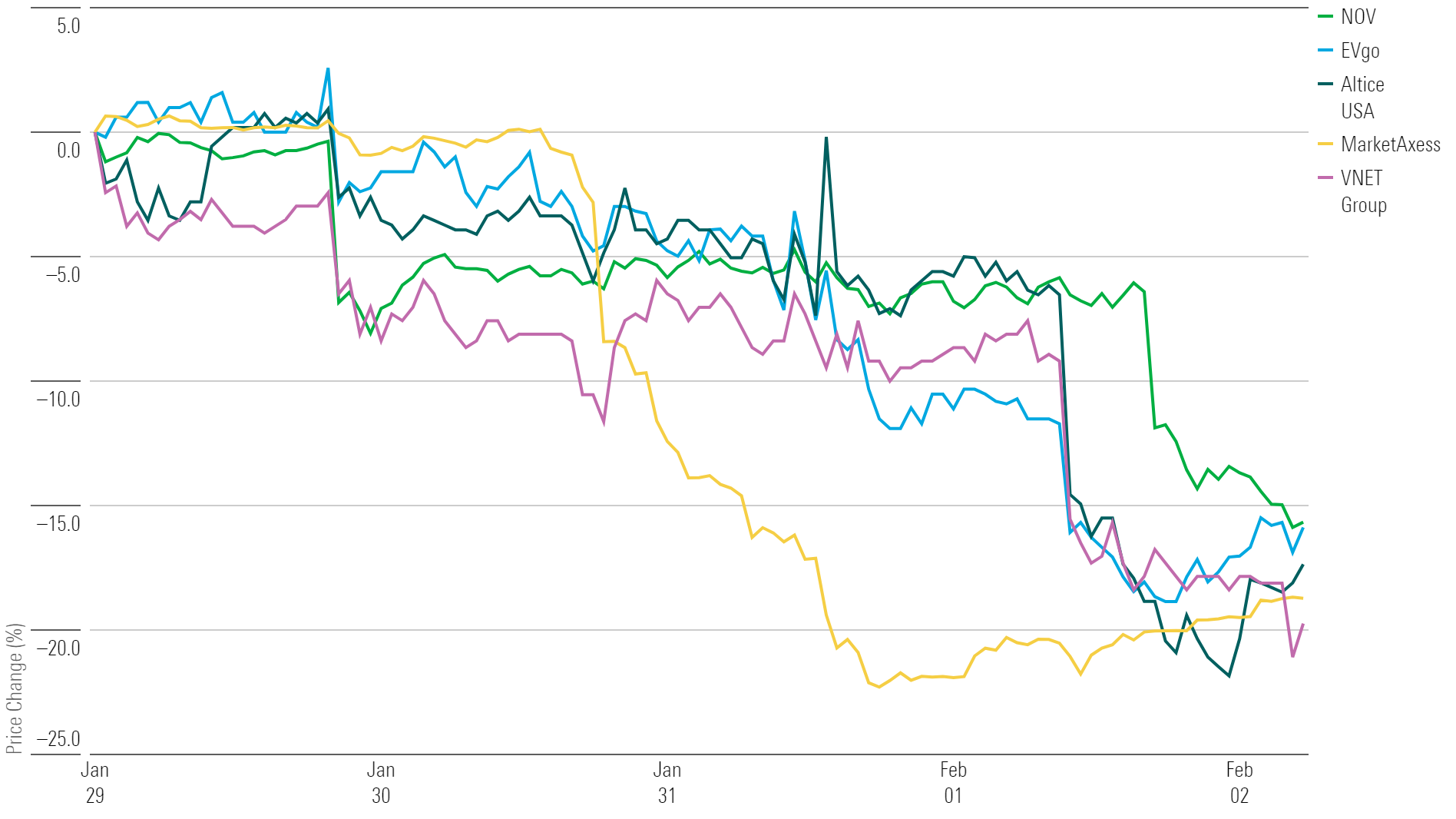

- The Magnificent Seven trade has brought immense paper profits the past year, but investors are overlooking new trends and information that warrant a short-term pause on this explosive trade.

- An updated market narrative suggests no rate cuts are imminent as removes a key tailwind that powered market psychology around Magnificent Seven stocks.

- Apple's performance in China was weak, the March quarter guidance was weak, and iPhone sales didn't wow.

- Alphabet missed on cloud sales. Tesla had red flags in its quarter and earnings call. Microsoft poked a hole in the narrative for now that all its new AI is going to lead to a massive reappraisal of its earnings estimates by the Street in 2024.

- Meta's quarter was reasonable but it also jacked up its 2024 capex a ton.

- Amazon had accelerating sales out of AWS, impressive operating margin expansion, and killer guidance.

Accuracy

- The Magnificent 7 trade has brought immense paper profits the past year, but investors are overlooking new trends and information that warrant a short-term pause on this explosive trade.

- Apple's performance in China was weak, the March quarter guidance was weak, and iPhone sales didn’t wow.

Deception (50%)

The article is deceptive in several ways. Firstly, the author uses emotional manipulation by stating that investors should be concerned about the Magnificent Seven trade and that they are overlooking new trends and information. This statement implies a sense of urgency and fear which could influence readers to make impulsive decisions without fully understanding the situation.- The first thing that is fresh to the scene is an updated market narrative.

Fallacies (85%)

The article contains several fallacies. Firstly, the author uses an appeal to authority by stating that investors have forgotten there are more ways to make money than hitting the buy button on seven tech stocks without providing any evidence or data to support this claim. Secondly, the author commits a false dilemma by presenting only two options for investors: either evolve their thinking around the Magnificent Seven trade or get their portfolio blown up in the not-too-distant future. This oversimplifies complex issues and ignores other potential outcomes. Thirdly, the author uses inflammatory rhetoric by stating that investors are overlooking new trends, news, and information that warrant a short-term pause on the explosive Magnificent Seven trade without providing any evidence or data to support this claim.- The first thing that is fresh to the scene is an updated market narrative. If late 2023 was all about interest rate cuts in an election year, then the first half of 2024 is shaping up to be about the potential for next to no rate cuts this year.

- I'm not sure about you, but I haven't been blown away by the results from Magnificent Seven stalwarts Apple, Alphabet, Microsoft and Tesla.

Bias (85%)

The article is biased towards the idea that investors should stop relying on the Magnificent Seven trade and start looking for new opportunities. The author uses language such as 'evolve or die' and 'crush it', which suggests a strong sense of urgency to change one's thinking. Additionally, the author mentions that there are anecdotal signs of tech layoffs and companies going for efficiency this year, but then contradicts himself by stating that the economy is producing hundreds of thousands of new jobs. This creates a mixed message and suggests a lack of objectivity in the author's analysis.- anecdotal signs of tech layoffs

- crush it

- evolve or die

Site Conflicts Of Interest (50%)

Brian Sozzi has a financial stake in the companies he reports on. He is an analyst at Bonnie Securities and provides investment advice to clients.Author Conflicts Of Interest (50%)

Brian Sozzi has conflicts of interest on the topics of Magnificent Seven trade and economy. He is a financial analyst who may have financial ties to companies or industries related to these topics.

77%

Markets Brief: Will the ‘Magnificent Seven’ Stocks Keep Carrying the Market After Earnings?

Morningstar Inc. Friday, 02 February 2024 22:47Unique Points

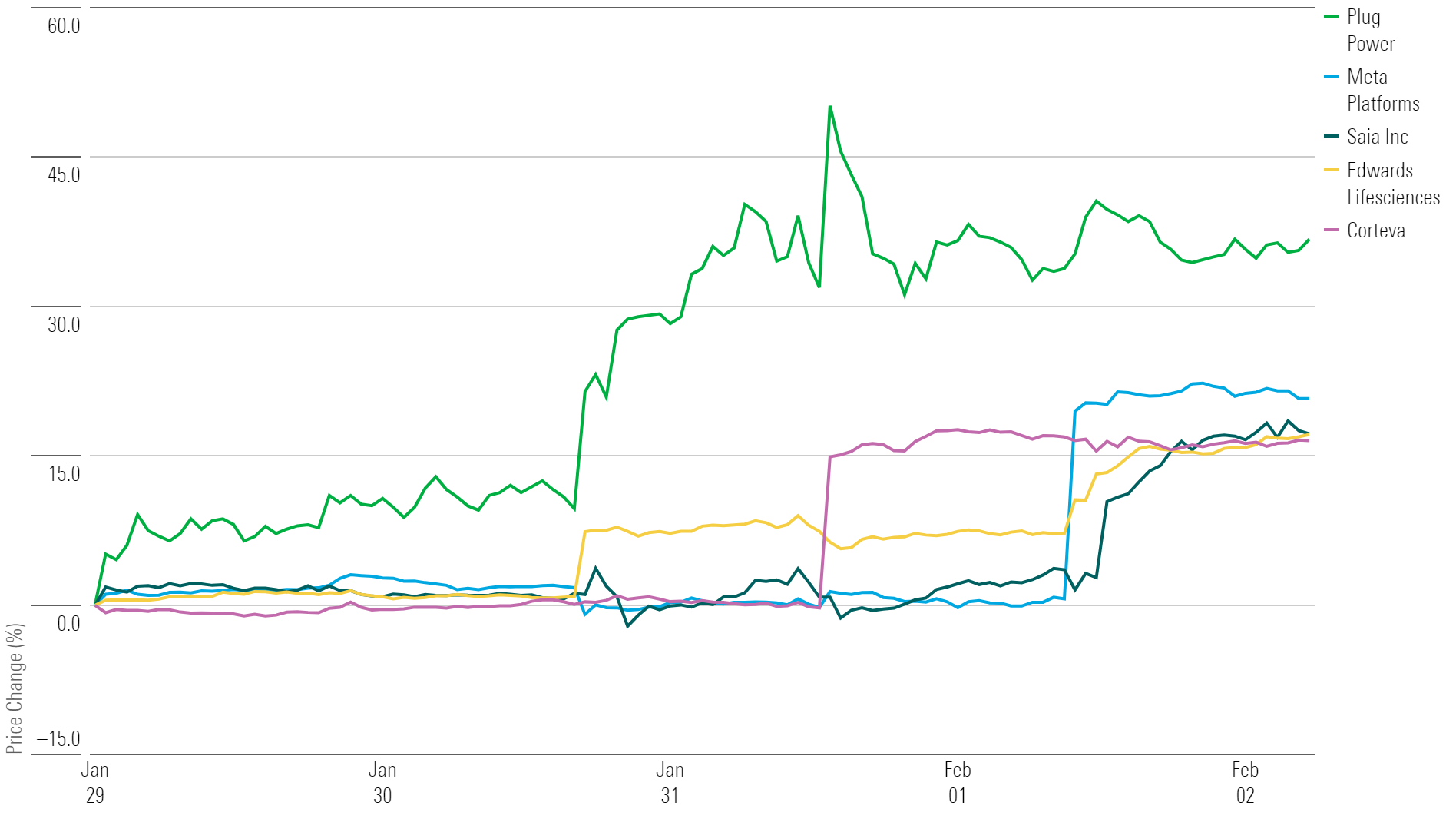

- The companies behind the 'Magnificent Seven' stocks mostly showed strong earnings in recent reports

- Together these stocks account for roughly one-quarter of the Morningstar US Market Index

- Five of these stocks were responsible for a staggering 98% of the index's gains in January

- Earnings and guidance from these companies have been better than expected as online advertising revenues and enterprise tech spending recover

- Revenue growth for these companies is accelerating while they continue to control costs, giving investors confidence

Accuracy

- The Magnificent Seven companies reported earnings last week with Amazon, Apple, Microsoft, Meta, and Alphabet reporting results

- `Revenue growth for these companies is accelerating` while they continue to control costs, giving investors confidence

Deception (30%)

The article is deceptive in several ways. Firstly, the author claims that all six companies reported better than expected earnings when only five of them did. Secondly, the author states that these companies account for roughly one-quarter of the Morningstar US Market Index but fails to disclose any sources or provide evidence to support this claim.- The author states that these companies account for roughly one-quarter of the Morningstar US Market Index but fails to disclose any sources or provide evidence to support this claim.

- The article incorrectly claims that all six companies reported better than expected earnings when only five of them did.

Fallacies (85%)

The article contains several fallacies. The first is an appeal to authority when it states that Steve Sosnick, chief strategist at Interactive Brokers, has stated that the lion's share of expected earnings growth for the entire stock market in the fourth quarter will be attributed to this group of companies.- Steve Sosnick, chief strategist at Interactive Brokers

- The lion's share of expected earnings growth for the entire stock market in the fourth quarter attributable to this group of companies.

Bias (85%)

The article is biased towards the Magnificent Seven stocks and their impact on the market. The author uses language that depicts these companies as powerhouses driving the stock market's rally, even though they only account for one-quarter of it. Additionally, there are examples of monetary bias in phrases such as 'the lion's share of expected earnings growth.' This creates a distorted view and implies that other sectors or stocks do not contribute to the overall performance of the market.- The Magnificent Seven comprises Nvidia NVDA, Tesla TSLA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT,

Site Conflicts Of Interest (100%)

None Found At Time Of Publication

Author Conflicts Of Interest (0%)

None Found At Time Of Publication

55%

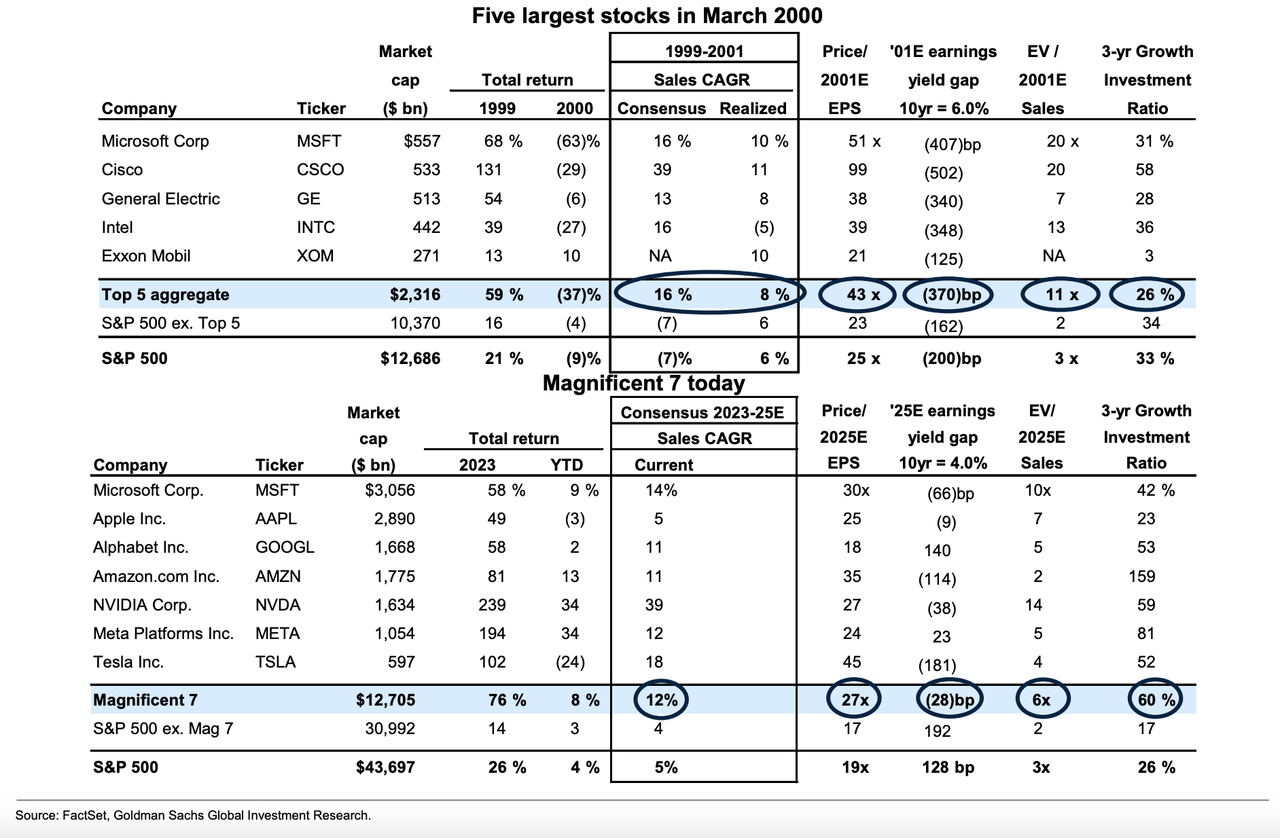

The Magnificent 7 vs. the Tech Bubble 5

Seeking Alpha Investment Community Kim Khan Sunday, 04 February 2024 18:06Unique Points

- The Magnificent 7 outperformed the S&P 493 with a return of 8% YTD compared to 3% for the index.

- Improving fundamentals have driven most of the group's performance since 2019, rather than valuation expansion.

- Looking forward, revenue growth will be key driver of returns for Magnificent 7 stocks with a consensus expectation of collective sales growth at a CAGR of 12% through 2026 compared to an expected CAGR of just 3% for the remaining S&P 500 companies.

- There is wide dispersion in consensus growth estimates across the group, with NVDA expected to grow sales at a blistering pace and TSLA's forecast slashed by 14%.

Accuracy

No Contradictions at Time Of Publication

Deception (30%)

The article is deceptive in several ways. Firstly, the author presents a comparison between the Magnificent 7 and Tech Bubble 5 without disclosing that these are two different groups of companies with different characteristics. Secondly, the author uses selective reporting to present only positive aspects of each group's performance while ignoring any negative or neutral data. Thirdly, the author presents a comparison between current megacaps and five largest stocks in March 2000 without disclosing that these are two different groups of companies with different characteristics. Fourthly, the author uses emotional manipulation by stating that investors believe consensus estimates at their own risk while not providing any evidence to support this claim.- The author uses selective reporting to present only positive aspects of each group's performance while ignoring any negative or neutral data. For example, the author states 'Looking forward, we expect revenue growth will be the key driver of returns for the Magnificent 7 stocks,' but does not mention that some companies in this group may face challenges such as increased competition or regulatory hurdles.

- The author uses emotional manipulation by stating that investors believe consensus estimates at their own risk while not providing any evidence to support this claim. For example, the author states 'In March 2000, MSFT, CSCO, GE, INTC and XOM were the largest S&P 500 companies,' but does not provide any evidence to support this statement.

- The article presents a comparison between current megacaps and five largest stocks in March 2000 without disclosing that these are two different groups of companies with different characteristics. For example, the author states 'Importantly, the Tech Bubble shows that investors believe consensus estimates at their own risk,' but does not mention that this is a comparison between two different groups of companies.

- The article presents a comparison between the Magnificent 7 and Tech Bubble 5 without disclosing that these are two different groups of companies with different characteristics. For example, the author states 'Outperformance by the group - Apple (AAPL), Amazon (AMZN), Alphabet (GOOG) (GOOGL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), Tesla(TSLA) - has persisted with the group returning 8% YTD compared with 3% for the S&P 493,' but does not disclose that these are two different groups of companies.

Fallacies (70%)

The article contains several fallacies. The author uses a dichotomous depiction of the Magnificent 7 and Tech Bubble 5 by comparing their performance to each other without providing any context or explanation for why these two groups are being compared. This creates an appeal to authority as it implies that Goldman Sachs is an expert on this topic, but there is no evidence provided in the article to support this claim. The author also uses inflammatory rhetoric by stating that continued outperformance requires stocks to exceed a high bar set by consensus, which could be seen as fear-mongering or sensationalism. Additionally, the author quotes an analyst who used formal fallacies such asBias (85%)

The article contains examples of religious bias and monetary bias. The author uses language that depicts one side as extreme or unreasonable by referring to the Magnificent 7's outperformance as a 'Dot Com boom'. Additionally, the author compares current megacaps with five largest stocks in March 2000, right at the peak of the dotcom bubble. This comparison is used to show that investors believe consensus estimates at their own risk and highlights how difficult it can be to predict future performance accurately.- The author compares current megacaps with five largest stocks in March 2000, right at the peak of the dotcom bubble. This comparison is used to show that investors believe consensus estimates at their own risk and highlights how difficult it can be to predict future performance accurately.

- The author uses language that depicts one side as extreme or unreasonable by referring to the Magnificent 7's outperformance as a 'Dot Com boom'.

Site Conflicts Of Interest (0%)

Kim Khan has conflicts of interest on the topics Goldman Sachs and Meta (Facebook).Author Conflicts Of Interest (0%)

Kim Khan has conflicts of interest on the topics Goldman Sachs and Meta (Facebook).- <https://seekingalpha.com/news/4062392-the-magnificent-7-vs-the-tech>

- The article mentions that Kim Khan is a former employee of Goldman Sachs.

77%

Markets are behaving like past bubble as Magnificent 7 keep surging

Business Insider Yuheng Zhan Monday, 05 February 2024 16:37Unique Points

- The Magnificent Seven accounted for 45% of January’s S&P 500 return and has surpassed the GDP of major cities like New York and Tokyo.

- Excluding Tesla, which has seen a sharp drop in share price this year, the group has actually accounted for 71% of the gains in the benchmark index.

- Roughly 75% of investors are penciling in a soft landing, with 20% anticipating no landing and 5% eyeing a hard landing.

- Investors looking to navigate the frothiness should keep an eye on high-growth stocks and distressed assets.

Accuracy

No Contradictions at Time Of Publication

Deception (80%)

The article is deceptive in several ways. Firstly, the author uses sensationalist language such as 'markets are behaving like past bubbles' and 'the continued outperformance of the Magnificent Seven underscores bubble-era behavior'. This creates a false sense of urgency for readers to take action based on this supposed impending doom. Secondly, the author uses selective reporting by only focusing on the positive performance of the Magnificent Seven and ignoring any negative aspects or potential risks associated with their investments. Thirdly, there is no evidence presented in the article to support these claims of bubble-like behavior or a soft landing scenario.- The author only focuses on the positive performance of the Magnificent Seven and ignores any negative aspects or potential risks associated with their investments

- There is no evidence presented in the article to support these claims of bubble-like behavior or a soft landing scenario

- The author uses sensationalist language such as 'markets are behaving like past bubbles'

Fallacies (85%)

The article contains several fallacies. The author uses an appeal to authority by citing the opinions of other experts without providing any evidence or reasoning for their own beliefs. This is evident in statements such as 'BofA's Michael Hartnett says markets are behaving like they have in past bubbles.' and 'Roughly 75% of investors are penciling in a soft landing, with 20% anticipating no landing, and 5% eyeing a hard landing,'. The author also uses inflammatory rhetoric by stating that the continued outperformance of the Magnificent Seven underscores bubble-era behavior in the market similar to what was seen during the tech rally of the late 1990s. This is an example of a dichotomous depiction, as it presents two extreme views without providing any evidence or reasoning for why one view is correct and the other incorrect.- BofA's Michael Hartnett says markets are behaving like they have in past bubbles.

Bias (85%)

The article contains several examples of monetary bias. The author uses the phrase 'markets are behaving like past bubbles' to suggest that there is a bubble in the market. This statement implies that markets will eventually crash and this could be seen as an attempt to influence readers' perception of the market.- The continued outperformance of the Magnificent Seven underscores bubble-era behavior in the market similar to what was seen during the tech rally of the late 1990s, Bank of America said in a note on Friday.

Site Conflicts Of Interest (50%)

The article by Yuheng Zhan has several examples of conflicts of interest. The author is an employee at Bank of America (BofA), which may have a financial stake in the companies and industries discussed in the article.Author Conflicts Of Interest (50%)

The author has a conflict of interest on the topic of markets and bubble behavior as they are reporting on companies that have surged in value. The article also mentions Michael Hartnett who is an analyst at Bank of America (BofA) which could create a potential conflict.