Nike Faces Challenging Times: Sales Decline Amidst Growing Competition and Consumer Shift

Lead: Nike, the world's largest sportswear brand, is experiencing a sales decline as it grapples with growing competition and changing consumer behavior. The company reported flat sales for the last quarter of 2024 and projected a 10% drop in sales for the upcoming quarter.

Background: Nike has faced challenges on multiple fronts. Consumers have become more choosy with their purchases due to financial constraints, leading to a decline in demand for discretionary goods like expensive sneakers and athletic clothing. Additionally, Nike's efforts to refresh its existing brands through innovation have not been successful enough to counteract this trend.

Competition: Newcomers in the market like Hoka and On have gained market share by emphasizing comfort over traditional style in running shoes. These upstart brands have capitalized on consumer preferences and Nike's missteps, leaving the company struggling to keep up.

Strategy Missteps: Nike's distribution strategy has also contributed to its sales decline. The company had initially aimed to sell more directly through its own channels, but this move alienated traditional retailers who then partnered closely with competitors. Nike has since reversed course and reinstated some of these partnerships.

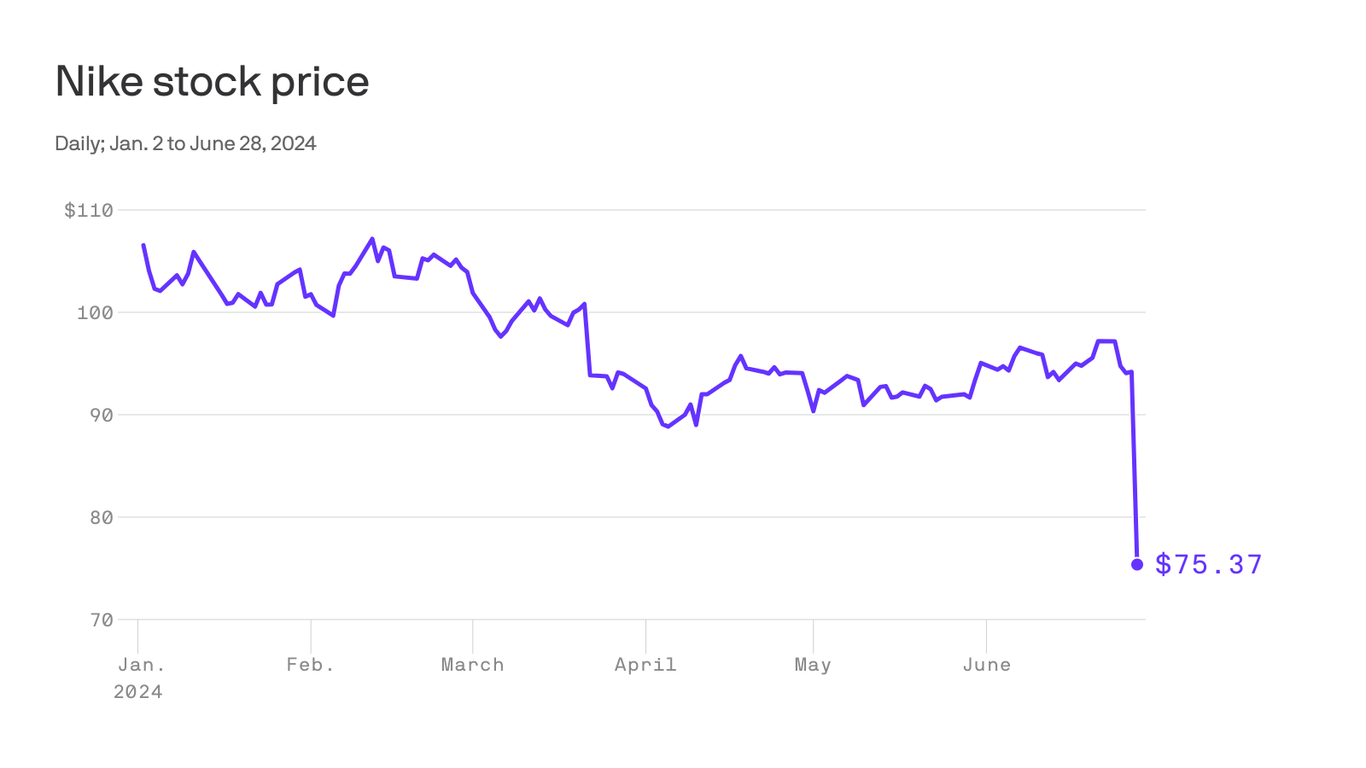

Impact on Stock: Nike's stock price plummeted following the earnings report, with shares down 20% in a single day and 29% year-to-date. Analysts have questioned whether the right leadership is in place to turn things around for the company.

Conclusion: Nike's sales decline is a sign of larger macroeconomic issues affecting consumer behavior and retail strategies. The company will need to adapt quickly to remain competitive and regain consumer trust.

/2024/06/28/1719597670897.gif?w=1920)