Next week, the focus of the investment world will be on Nvidia as it prepares to release its Q1 earnings. With high investor expectations and a strong track record of surpassing earnings estimates, Nvidia's report could significantly impact the broader market indexes which are currently printing fresh highs. Let's take a closer look at what investors can expect from Nvidia's Q1 earnings.

According to multiple sources, including Zacks Investment Research and CNBC, Q1 earnings for Nvidia are anticipated next week with EPS projected to soar over 400% to $5.52 versus $1.09 a share in the comparative quarter. Furthermore, sales are expected to increase by 237% to $24.27 billion versus $7.19 billion a year ago.

Nvidia has consistently surpassed earnings and sales estimates for five straight quarters, posting an average earnings surprise of 20.18% in its last four quarterly reports. This trend is expected to continue with Q1, as the Most Accurate Estimate indicates Nvidia could once again beat expectations with a projected EPS of $5.68 and 3% above the current Zacks Consensus.

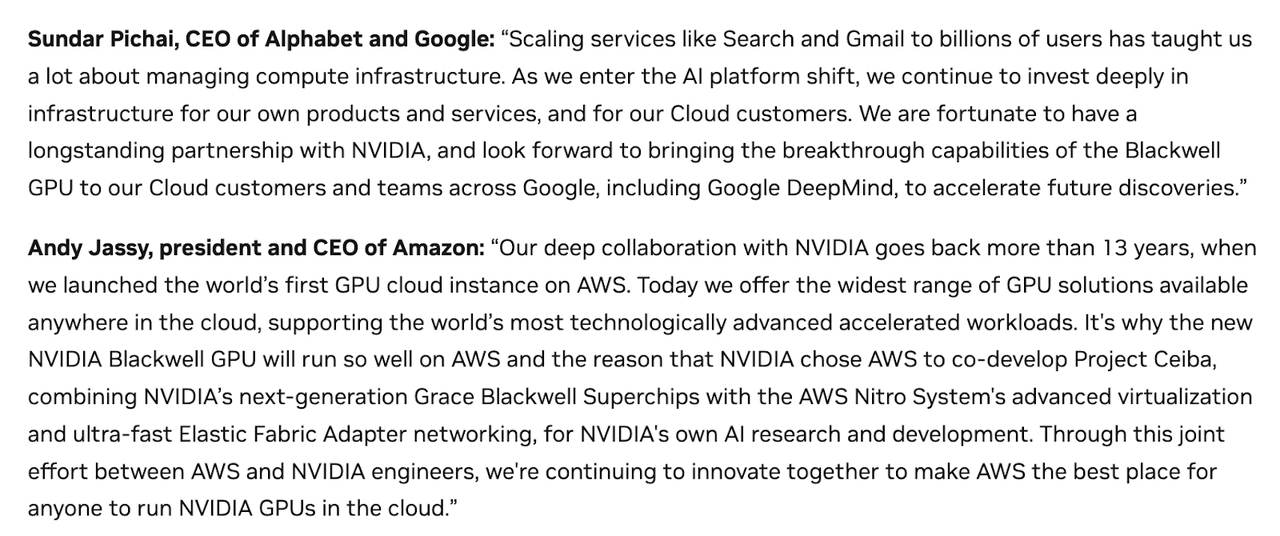

Wallstreet will also be looking for updates on Nvidia's upcoming Blackwell series of GPUs, which are expected to arrive during Q4 in October or November and projected to have a price tag of $30,000-$40,000 for a single GPU. These high-performance AI chips are anticipated to cement projections of high double-digit top and bottom-line growth for Nvidia in its current fiscal 21 and FY26.

Despite the strong earnings expectations, Nvidia's stock currently trades at a more reasonable valuation with a forward earnings multiple of 39.4X, which is well below its five-year high of 122.1X and a 29% discount to the median of 55.6X.

However, competition from tech giants like Alphabet Inc., Meta Platforms, Intel Corporation, and Advanced Micro Devices is building up as companies look to diversify their chip providers. Nvidia now faces real competition in the market and investors will be closely watching for any updates on this front during the earnings report.

In conclusion, with high investor expectations and a strong track record of surpassing earnings estimates, Nvidia's Q1 earnings report next week could significantly impact the broader market indexes. Investors will be looking for updates on Nvidia's upcoming Blackwell series of GPUs and any potential competition from other tech giants.