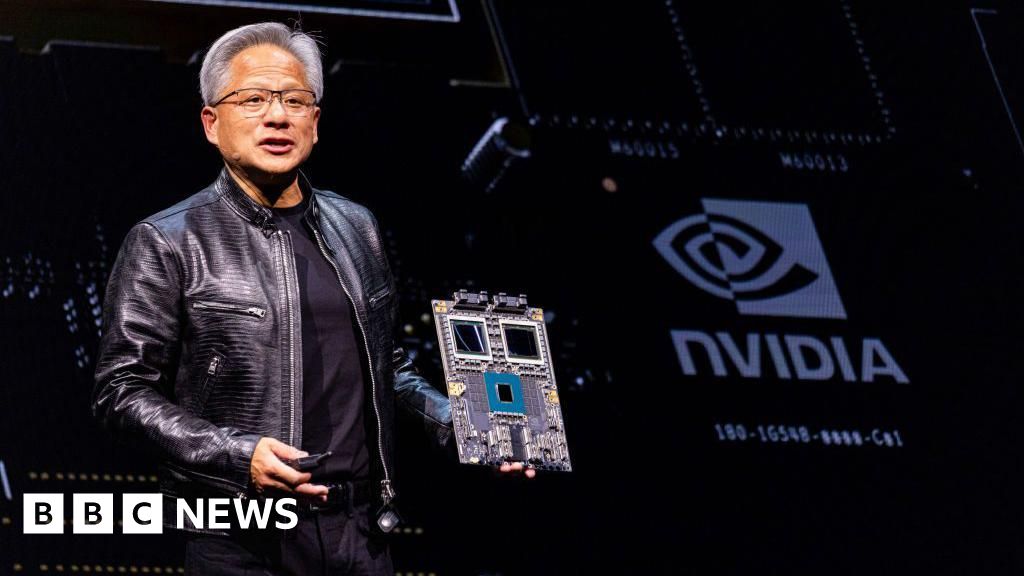

Nvidia, an American technology company specializing in graphics processing units (GPUs) and system on a chip units (SoCs), surpassed Apple to become the second-most valuable publicly traded company in the US with a market capitalization of $3.019 trillion on June 5, 2024. This achievement was driven by Nvidia's significant growth in its data center business, which accounts for approximately 86% of the company's overall sales.

The data center business saw a revenue increase of 427% year-over-year in the most recent quarter, primarily due to strong demand from cloud vendors. Nvidia's GPUs are widely used in artificial intelligence (AI) applications and have an estimated 80% market share in this sector.

Apple, on the other hand, faced challenges with its sales growth stalling and strategic questions regarding demand in China, manufacturing issues, and mixed reactions to its new virtual reality headset, Vision Pro. Apple's market capitalization stood at $2.99 trillion as of June 5.

Microsoft remains the most valuable publicly traded company in the US with a market capitalization of $3.15 trillion.

Nvidia's stock price has been on a tear since last year, rising more than 3,290% over the past five years. The company announced a 10-for-1 stock split in May to make shares more affordable for small investors.

Founded in 1993, Nvidia initially focused on gaming and sold hardware for playing 3D computer games. However, it has since expanded its offerings to include cryptocurrency mining chips and cloud subscription services.

Apple was the first company to reach a $1 trillion and $2 trillion market capitalization but was passed by Microsoft earlier this year. Both Microsoft and Nvidia have benefited from investor demand for AI infrastructure.

Nvidia's explosive growth has contributed to the broader market rally over the last year, pushing the S&P 500 and Nasdaq in the US to new records on June 5.