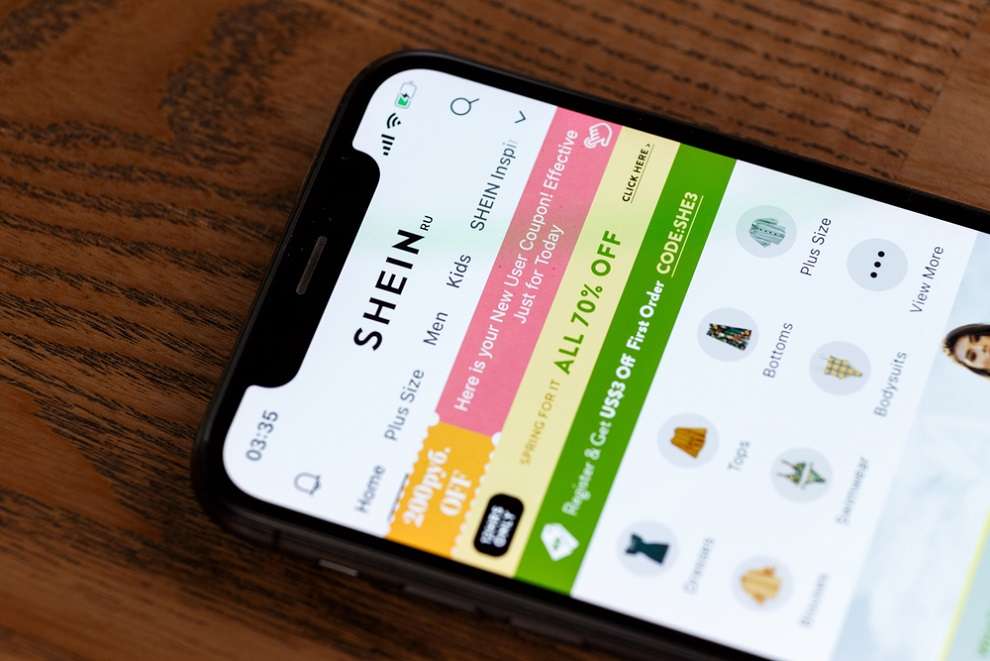

Fast fashion retailer Shein, known for its affordable prices, has confidentially filed for a public listing in London after facing backlash and opposition in the US due to concerns about forced labor and tax exemptions. The company had previously sought approval from China's securities regulator to go public in the US but failed to win support.

Shein's decision to list in London comes as it faces criticism for its supply chain practices, with reports of long working hours and low wages for factory workers. In 2022, a Channel 4 undercover investigation showed that Shein factory workers were working up to 18 hours a day with one day off per month and were paid just 3p per garment.

Despite these concerns, Shein's potential IPO could value the company at around £50 billion ($63.3 billion), making it one of the biggest London listings in over a decade.

The retailer had initially filed for an IPO with the US Securities and Exchange Commission in November 2023 and approached China's securities regulator for approval at the same time. However, opposition from US lawmakers led to a collapse of Shein's original plan to list in New York.

Shein is not the first company to turn to London as an alternative listing venue due to geopolitical tensions and regulatory challenges in other markets. In recent years, Chinese tech giants like Alibaba and Ant Group have also chosen London for their IPOs.

Former Chancellor Sajid Javid was reportedly in discussions about a potential advisory role to Shein, but it is not clear if he will take on the position.

Shein's move to London comes as the retail industry faces significant challenges, including rising costs and changing consumer behavior. The company will need to address these issues and provide transparency around its supply chain practices in order to win over investors and maintain public trust.