In recent weeks, the stock market has seen significant gains, with some companies experiencing remarkable growth. Among them are Nvidia (NVDA), Alphabet Inc. (GOOGL), and Apple (AAPL). However, a closer look at the data reveals that these gains may not be as sustainable as they seem.

Nvidia's stock price has gained 53% since April 15, 2024. According to technical analysis, the company's relative strength index (RSI) is at 80, suggesting the stock is overbought and could take a dive soon. This trend is not unique to Nvidia; Eli Lilly (LLY), Apple, Costco Wholesale, and Arm Holdings also have RSIs above 78.

Meanwhile, Alphabet Inc. reached new all-time highs at the end of April 2024. Google is a dominant player in the digital ad market, accounting for approximately 26% of market share. Digital ad sales for Google hit $61.66 billion in Q1 2024, up from $54.55 billion in the same quarter last year.

However, these gains come amidst broader economic concerns. The unemployment rate ticked up to 4% and the labor force shrank by 250k in May. The number of full-time employees shrunk by 625k while part-time workers increased by 286k in the past year.

Despite these concerns, some market observers remain optimistic about the continued growth of tech giants like Nvidia, Alphabet, and Apple. However, it is important to remember that stock prices can be influenced by a variety of factors beyond fundamental business performance. As such, investors should approach these stocks with caution and consider diversifying their portfolios.

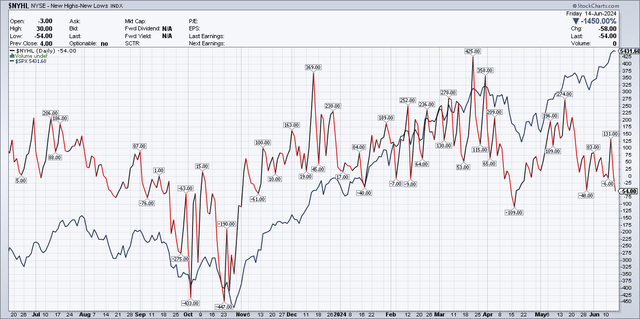

It is also worth noting that the market as a whole has been experiencing unusual volatility in recent months. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all seen significant swings in value. This volatility can make it difficult for investors to make informed decisions based on short-term trends alone.

In conclusion, while the recent gains in tech stocks like Nvidia, Alphabet, and Apple are impressive, they come amidst broader economic concerns and unusual market volatility. Investors should approach these stocks with caution and consider diversifying their portfolios to mitigate risk.